Australian Mortgage Holders: Expecting Further Interest Rate Cuts

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Australian Mortgage Holders: Expecting Further Interest Rate Cuts

Could relief be on the horizon for Aussie homeowners? The whispers are growing louder: further interest rate cuts may be on the cards for Australia. With inflation showing signs of cooling and economic growth slowing, many experts believe the Reserve Bank of Australia (RBA) could ease monetary policy in the coming months. This news offers a glimmer of hope for millions of Australian mortgage holders struggling under the weight of rising interest rates.

This article delves into the current economic climate, examines the likelihood of further rate cuts, and explores what this could mean for Australian homeowners.

Inflation Cooling: A Key Factor

The RBA's primary mandate is to maintain price stability. Recent data suggests inflation, while still elevated, is finally starting to ease. [Link to relevant ABS data on inflation]. This decline, albeit gradual, provides the RBA with more flexibility in its monetary policy decisions. The lessening inflationary pressure reduces the urgency for aggressive interest rate hikes, opening the door for potential cuts.

Economic Growth Slowdown: Another Contributing Factor

Beyond inflation, the Australian economy is showing signs of a slowdown. [Link to relevant news article on economic slowdown]. Concerns about a potential recession are contributing to the expectation of further rate cuts. The RBA aims to stimulate economic activity and prevent a sharp downturn, and rate cuts are a powerful tool to achieve this.

What this Means for Australian Mortgage Holders

For many Australians, the prospect of lower interest rates is a welcome relief. The past year has seen significant increases in mortgage repayments, placing a strain on household budgets. Further rate cuts would translate to:

- Lower monthly repayments: This immediate benefit would provide significant financial breathing room for many homeowners.

- Increased borrowing capacity: For those looking to refinance or take out a new loan, lower rates mean increased borrowing power.

- Improved consumer confidence: Lower interest rates can boost consumer confidence, encouraging spending and investment.

The Uncertainty Remains

While the possibility of further rate cuts is encouraging, it's crucial to remember that the RBA's decisions are complex and depend on numerous economic factors. There are still significant uncertainties:

- Global economic conditions: International events and global inflation will continue to influence the RBA's decisions.

- Labor market dynamics: The strength of the Australian labor market will be a key consideration. High employment levels might lessen the pressure for rate cuts.

- Unexpected economic shocks: Unforeseen events can significantly impact the RBA's outlook and policy decisions.

What Should Mortgage Holders Do?

While waiting for the RBA's announcement, homeowners should:

- Review their budget: Analyze their current financial situation and identify areas for potential savings.

- Explore refinancing options: Research different lenders and compare interest rates to ensure you're getting the best deal.

- Consult a financial advisor: Seek professional advice tailored to your individual circumstances.

In conclusion, the possibility of further interest rate cuts in Australia is a significant development for mortgage holders. While uncertainty remains, the cooling inflation and economic slowdown suggest that relief may be on the horizon. Staying informed and proactively managing your finances are crucial steps during this period of economic transition. Keep an eye on the RBA's announcements and consult with financial professionals for personalized guidance.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Australian Mortgage Holders: Expecting Further Interest Rate Cuts. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Understanding The Dame Un Grrr Trend Babydoll Archi And Internet Fame

Jul 09, 2025

Understanding The Dame Un Grrr Trend Babydoll Archi And Internet Fame

Jul 09, 2025 -

Viral Sensation Assams Babydoll Archis Collaboration With Kendra Lust

Jul 09, 2025

Viral Sensation Assams Babydoll Archis Collaboration With Kendra Lust

Jul 09, 2025 -

Inglourious Basterds Exploring Themes Of Revenge And War

Jul 09, 2025

Inglourious Basterds Exploring Themes Of Revenge And War

Jul 09, 2025 -

Clark County Court Neillsville Woman Sentenced For Lottery Ticket Forgery

Jul 09, 2025

Clark County Court Neillsville Woman Sentenced For Lottery Ticket Forgery

Jul 09, 2025 -

Trumps New Oval Office Approach Reactions From World Leaders

Jul 09, 2025

Trumps New Oval Office Approach Reactions From World Leaders

Jul 09, 2025

Latest Posts

-

A Students Guide To Personal Injury Law Challenges And Rewards Of The Legal Profession

Jul 16, 2025

A Students Guide To Personal Injury Law Challenges And Rewards Of The Legal Profession

Jul 16, 2025 -

Putin And Trump A Continuing Conflict Despite Trumps Disappointment

Jul 16, 2025

Putin And Trump A Continuing Conflict Despite Trumps Disappointment

Jul 16, 2025 -

The Shocking Details Of The Marten And Gordon Case A Nations Disbelief

Jul 16, 2025

The Shocking Details Of The Marten And Gordon Case A Nations Disbelief

Jul 16, 2025 -

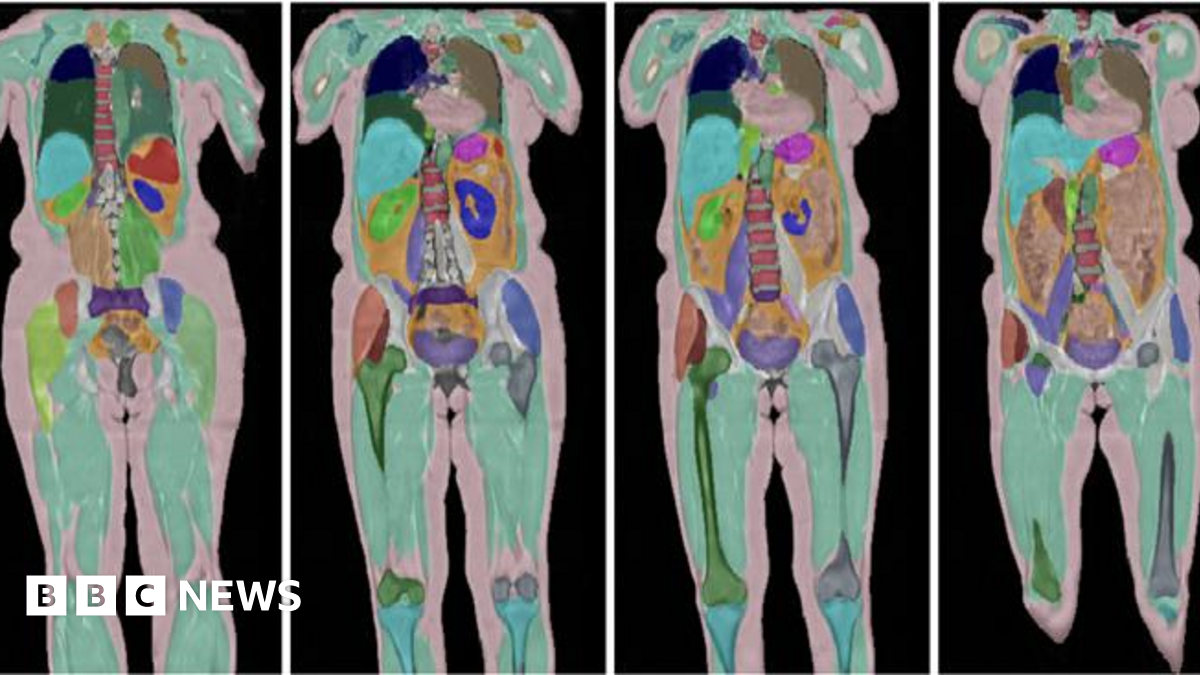

100 000 Uk Volunteers Contribute To Massive Human Imaging Study

Jul 16, 2025

100 000 Uk Volunteers Contribute To Massive Human Imaging Study

Jul 16, 2025 -

Laid Off King Employees Replaced By Ai They Helped Create

Jul 16, 2025

Laid Off King Employees Replaced By Ai They Helped Create

Jul 16, 2025