Australian Mortgage Holders: Expecting Further Interest Rate Reductions

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Australian Mortgage Holders: Hoping for Further Interest Rate Reductions

Are falling inflation rates a sign of relief for Aussie homeowners? The Reserve Bank of Australia (RBA) has recently hinted at potential further interest rate reductions, sending ripples of hope through the nation's mortgage-holding population. After a period of aggressive rate hikes to combat soaring inflation, the possibility of easing monetary policy is a welcome prospect for many struggling with rising repayments. But what does this actually mean for Australian homeowners, and what should they expect?

Inflation Cooling: A Catalyst for Rate Cuts?

The recent slowdown in inflation provides a strong argument for further interest rate cuts. The Consumer Price Index (CPI) has shown signs of easing, suggesting the RBA's previous tightening measures are starting to have the desired effect. This positive trend has fueled speculation that the central bank might be ready to shift its focus from combating inflation to supporting economic growth, a move that would likely involve lower interest rates. This is great news for those facing financial pressure from high mortgage repayments. However, it's not a guaranteed win.

What Factors Influence the RBA's Decisions?

The RBA's decisions are never simple, influenced by a complex interplay of economic indicators. While falling inflation is encouraging, the central bank will also carefully consider other factors, including:

- Employment rates: Sustained low unemployment could put upward pressure on wages, potentially reigniting inflationary pressures.

- Global economic conditions: International events and economic shifts can significantly impact the Australian economy and the RBA's policy decisions.

- Wage growth: A rapid increase in wages can fuel inflation, making the RBA hesitant to cut rates too aggressively.

What Should Mortgage Holders Do Now?

While the prospect of lower interest rates is positive, it's crucial for mortgage holders to remain proactive:

- Review your budget: Analyze your current spending and identify areas where you can potentially save.

- Consider refinancing: Explore options to refinance your mortgage with a lender offering more favorable rates. This could lead to significant long-term savings, even before any potential RBA cuts. Check out resources like for guidance.

- Communicate with your lender: If you're experiencing financial difficulties, reach out to your lender to discuss potential hardship options. Open communication is key.

- Stay informed: Keep up-to-date on economic news and RBA announcements to understand the latest developments and their potential impact on your mortgage.

Looking Ahead: Cautious Optimism

The possibility of further interest rate reductions offers a glimmer of hope for Australian mortgage holders burdened by high repayments. However, it's crucial to approach this with cautious optimism. The RBA's decisions will depend on a variety of economic factors, and the timing and magnitude of any rate cuts remain uncertain. By staying informed, managing their finances effectively, and proactively engaging with their lenders, Australian homeowners can best navigate this evolving economic landscape.

Keywords: Australian mortgage rates, RBA interest rates, interest rate cuts Australia, Australian inflation, mortgage repayments Australia, refinancing mortgage Australia, Australian economy, RBA monetary policy.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Australian Mortgage Holders: Expecting Further Interest Rate Reductions. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Get The New Spirit Empress Legendary Card A Clash Royale Giveaway Guide

Jul 09, 2025

Get The New Spirit Empress Legendary Card A Clash Royale Giveaway Guide

Jul 09, 2025 -

Us Flyers Exploring The Benefits Of Air Canadas Aeroplan Program

Jul 09, 2025

Us Flyers Exploring The Benefits Of Air Canadas Aeroplan Program

Jul 09, 2025 -

Trumps New Oval Office Approach Reactions From World Leaders

Jul 09, 2025

Trumps New Oval Office Approach Reactions From World Leaders

Jul 09, 2025 -

Texas Facing Catastrophic Flooding 78 Fatalities Dozens Unaccounted For Further Rain Expected

Jul 09, 2025

Texas Facing Catastrophic Flooding 78 Fatalities Dozens Unaccounted For Further Rain Expected

Jul 09, 2025 -

Dame Un Grrr Reel Assams Babydoll Archis Unexpected Rise To Fame

Jul 09, 2025

Dame Un Grrr Reel Assams Babydoll Archis Unexpected Rise To Fame

Jul 09, 2025

Latest Posts

-

A Students Guide To Personal Injury Law Challenges And Rewards Of The Legal Profession

Jul 16, 2025

A Students Guide To Personal Injury Law Challenges And Rewards Of The Legal Profession

Jul 16, 2025 -

Putin And Trump A Continuing Conflict Despite Trumps Disappointment

Jul 16, 2025

Putin And Trump A Continuing Conflict Despite Trumps Disappointment

Jul 16, 2025 -

The Shocking Details Of The Marten And Gordon Case A Nations Disbelief

Jul 16, 2025

The Shocking Details Of The Marten And Gordon Case A Nations Disbelief

Jul 16, 2025 -

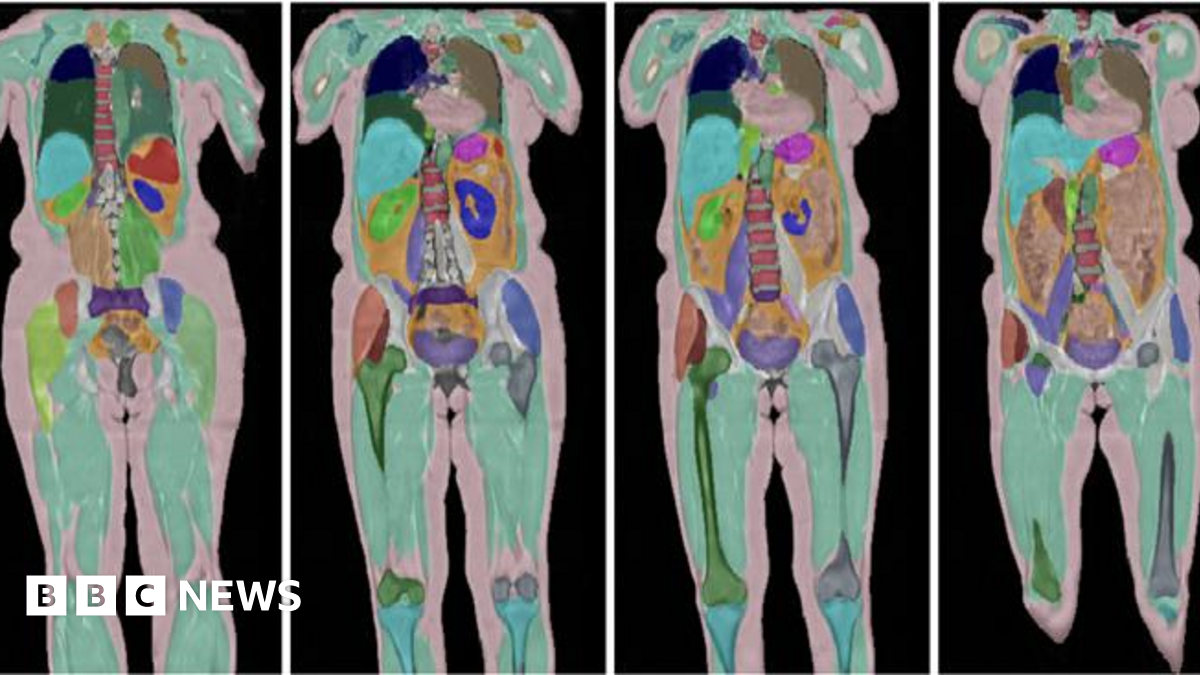

100 000 Uk Volunteers Contribute To Massive Human Imaging Study

Jul 16, 2025

100 000 Uk Volunteers Contribute To Massive Human Imaging Study

Jul 16, 2025 -

Laid Off King Employees Replaced By Ai They Helped Create

Jul 16, 2025

Laid Off King Employees Replaced By Ai They Helped Create

Jul 16, 2025