Australia's Giant Battery Supplier Faces Collapse

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Australia's Giant Battery Supplier, Redflow, Faces Collapse Amidst Financial Troubles

Australia's renewable energy sector is facing a potential blow as Redflow, a significant supplier of zinc-bromine flow batteries, teeters on the brink of collapse. The company, once lauded for its innovative battery technology and potential to contribute significantly to Australia's ambitious renewable energy targets, is now grappling with severe financial difficulties, raising concerns about the future of its operations and the broader impact on the energy storage market.

The news comes as a shock to many, particularly given Redflow's prominent position in the Australian energy landscape. The company's zinc-bromine flow batteries have been touted as a viable alternative to lithium-ion batteries, offering longer lifespans and potentially greater safety. However, despite technological advancements and significant government support for renewable energy initiatives in Australia, Redflow has struggled to achieve profitability.

Redflow's Financial Woes: A Closer Look

Redflow's recent financial reports paint a grim picture. The company has reported substantial losses, dwindling cash reserves, and a significant decline in sales. These struggles have led to a sharp drop in its share price, leaving investors deeply concerned about the company's viability. Analysts point to several factors contributing to Redflow's predicament:

- Intense Competition: The energy storage market is becoming increasingly competitive, with established players and new entrants vying for market share. Redflow has faced challenges competing against larger, more established companies with greater resources and brand recognition.

- High Manufacturing Costs: The production costs associated with Redflow's zinc-bromine flow batteries have reportedly been higher than anticipated, impacting profitability and hindering market penetration.

- Supply Chain Issues: Like many businesses globally, Redflow has experienced disruptions to its supply chain, leading to delays and increased costs.

- Slow Market Adoption: While the demand for energy storage solutions is growing, the market adoption rate for zinc-bromine flow batteries has been slower than anticipated, limiting Redflow's revenue growth.

Implications for Australia's Renewable Energy Transition

Redflow's potential collapse has significant implications for Australia's ambitious renewable energy targets. The country is heavily reliant on renewable energy sources, and reliable energy storage is crucial for managing the intermittent nature of solar and wind power. The loss of a significant player like Redflow could disrupt the supply chain, potentially delaying the deployment of renewable energy projects and impacting the country's ability to meet its climate goals.

This situation highlights the challenges faced by innovative companies in the renewable energy sector. While technological advancements are crucial, ensuring financial stability and achieving market penetration are equally important for long-term success.

What's Next for Redflow?

Redflow is currently exploring various options to address its financial challenges, including potential mergers, acquisitions, or restructuring. The outcome remains uncertain, and the future of the company hangs in the balance. The situation underscores the need for continued government support and investment in the renewable energy sector to foster innovation and ensure the long-term viability of Australian businesses involved in this crucial industry. This will be a developing story, so stay tuned for further updates.

Keywords: Redflow, Australia, battery, energy storage, renewable energy, zinc-bromine flow battery, financial crisis, collapse, renewable energy transition, Australian energy market, energy storage solutions, supply chain issues.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Australia's Giant Battery Supplier Faces Collapse. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

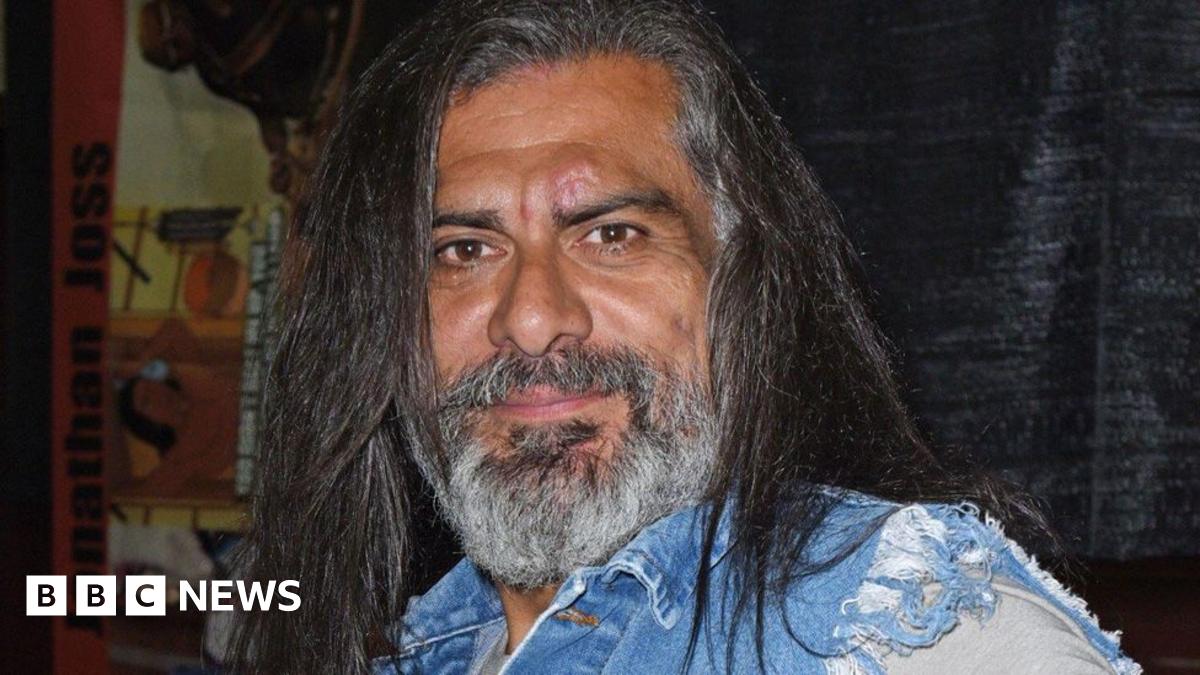

Confirmed Jonathan Joss King Of The Hills John Redcorn Victim Of Fatal Shooting

Jun 05, 2025

Confirmed Jonathan Joss King Of The Hills John Redcorn Victim Of Fatal Shooting

Jun 05, 2025 -

Investigation Underway Police Examine Deaths After Cardiac Surgery At Nhs Trust

Jun 05, 2025

Investigation Underway Police Examine Deaths After Cardiac Surgery At Nhs Trust

Jun 05, 2025 -

Political Crisis In Netherlands Wilders Departure Ends Coalition Rule

Jun 05, 2025

Political Crisis In Netherlands Wilders Departure Ends Coalition Rule

Jun 05, 2025 -

Daily Grooming Abuse The Untold Stories Of Survivors

Jun 05, 2025

Daily Grooming Abuse The Untold Stories Of Survivors

Jun 05, 2025 -

The Reality Of Grooming Survivors Share Their Experiences Of Daily Abuse

Jun 05, 2025

The Reality Of Grooming Survivors Share Their Experiences Of Daily Abuse

Jun 05, 2025

Latest Posts

-

Premier League Racism Antoine Semenyo Details Abuse During Liverpool Game

Aug 17, 2025

Premier League Racism Antoine Semenyo Details Abuse During Liverpool Game

Aug 17, 2025 -

The Untold Story Of A Wwii Veteran A Vj Day Memory That Moved Queen Camilla

Aug 17, 2025

The Untold Story Of A Wwii Veteran A Vj Day Memory That Moved Queen Camilla

Aug 17, 2025 -

Battlefield 6 Map Size Controversy Players React To Latest Mini Map

Aug 17, 2025

Battlefield 6 Map Size Controversy Players React To Latest Mini Map

Aug 17, 2025 -

Smaller Maps Spark Outrage In Battlefield 6s Rush Mode

Aug 17, 2025

Smaller Maps Spark Outrage In Battlefield 6s Rush Mode

Aug 17, 2025 -

League Of Legends Exploring The Lore And Abilities Of Zaahen

Aug 17, 2025

League Of Legends Exploring The Lore And Abilities Of Zaahen

Aug 17, 2025