Average Mortgage Length: First-Timers Face 31-Year Loan Terms

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Average Mortgage Length: First-Timers Face 31-Year Loan Terms – A Growing Trend?

The dream of homeownership is becoming increasingly distant for many first-time buyers, burdened by longer mortgage terms and rising interest rates. A recent study reveals a stark reality: the average mortgage length for first-time homebuyers is now a staggering 31 years. This significant increase compared to previous generations raises serious concerns about financial burden and long-term implications for borrowers. Is this the new normal, and what does it mean for the future of the housing market?

Record-High Loan Terms and Their Impact

The 31-year mortgage term isn't just a statistic; it's a reflection of the challenges facing today's aspiring homeowners. Several factors contribute to this trend:

- Soaring House Prices: The relentless rise in house prices across many regions makes saving for a substantial down payment increasingly difficult. This necessitates larger loans and, consequently, longer repayment periods.

- Rising Interest Rates: Higher interest rates directly translate to increased monthly payments. To manage affordability, borrowers often opt for longer loan terms, even if it means paying significantly more interest over the life of the loan.

- Increased Competition: A competitive housing market forces buyers to stretch their budgets, often leading to larger mortgages and longer repayment plans.

The Long-Term Financial Implications

While a longer mortgage term might seem appealing initially by lowering monthly payments, it comes with significant long-term costs:

- Increased Interest Payments: The longer the loan term, the more interest you'll pay over the life of the mortgage. This can significantly increase the total cost of your home. A simple (replace with a real link to a reputable calculator) can help you understand this impact.

- Delayed Financial Freedom: A 31-year mortgage ties up a substantial portion of your income for a significant period, potentially delaying major life goals like retirement planning or investing.

- Potential for Increased Risk: Unforeseen circumstances like job loss or medical emergencies can become more challenging to manage with a longer-term mortgage.

Strategies for First-Time Homebuyers

Despite the challenges, there are strategies first-time homebuyers can utilize to navigate the current market:

- Improve Credit Score: A strong credit score can qualify you for better interest rates and potentially shorter loan terms.

- Save Aggressively for a Down Payment: Even a small increase in your down payment can significantly reduce the loan amount and the overall interest paid.

- Explore Government Assistance Programs: Many government programs offer assistance to first-time homebuyers, including down payment assistance and reduced interest rates. Research local and federal programs to see if you qualify.

- Consider Alternative Housing Options: Explore options like condos or townhouses which might be more affordable than single-family homes in desirable areas.

The Future of Mortgage Lending

The trend of longer mortgage terms raises questions about the long-term sustainability of the housing market. Experts are closely watching this development and its implications for both borrowers and lenders. Future changes in interest rates and government policies could significantly impact the average mortgage length.

Conclusion:

The 31-year average mortgage length for first-time homebuyers is a concerning trend reflecting the challenges of today's housing market. Understanding the long-term implications and employing strategic planning is crucial for aspiring homeowners to navigate this complex landscape and achieve their dream of homeownership. Staying informed about market changes and exploring available resources is essential to making informed decisions and securing a sustainable financial future.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Average Mortgage Length: First-Timers Face 31-Year Loan Terms. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

High School Athletics Transgender Students Competition Marked By Political Division

Jun 03, 2025

High School Athletics Transgender Students Competition Marked By Political Division

Jun 03, 2025 -

Late Start No Problem 9 Actionable College Savings Tips

Jun 03, 2025

Late Start No Problem 9 Actionable College Savings Tips

Jun 03, 2025 -

9 Proven Ways To Fund Your Childs Higher Education

Jun 03, 2025

9 Proven Ways To Fund Your Childs Higher Education

Jun 03, 2025 -

Millions Of Bees Cause Traffic Chaos After Truck Accident In Washington

Jun 03, 2025

Millions Of Bees Cause Traffic Chaos After Truck Accident In Washington

Jun 03, 2025 -

Analysis The Strategic Significance Of Ukraines Recent Drone Operations

Jun 03, 2025

Analysis The Strategic Significance Of Ukraines Recent Drone Operations

Jun 03, 2025

Latest Posts

-

How A Crypto Attack Compromised An Only Fans Streamer A Cnn Investigation

Aug 03, 2025

How A Crypto Attack Compromised An Only Fans Streamer A Cnn Investigation

Aug 03, 2025 -

Uk Government Mandates Working Class Background For Civil Service Interns

Aug 03, 2025

Uk Government Mandates Working Class Background For Civil Service Interns

Aug 03, 2025 -

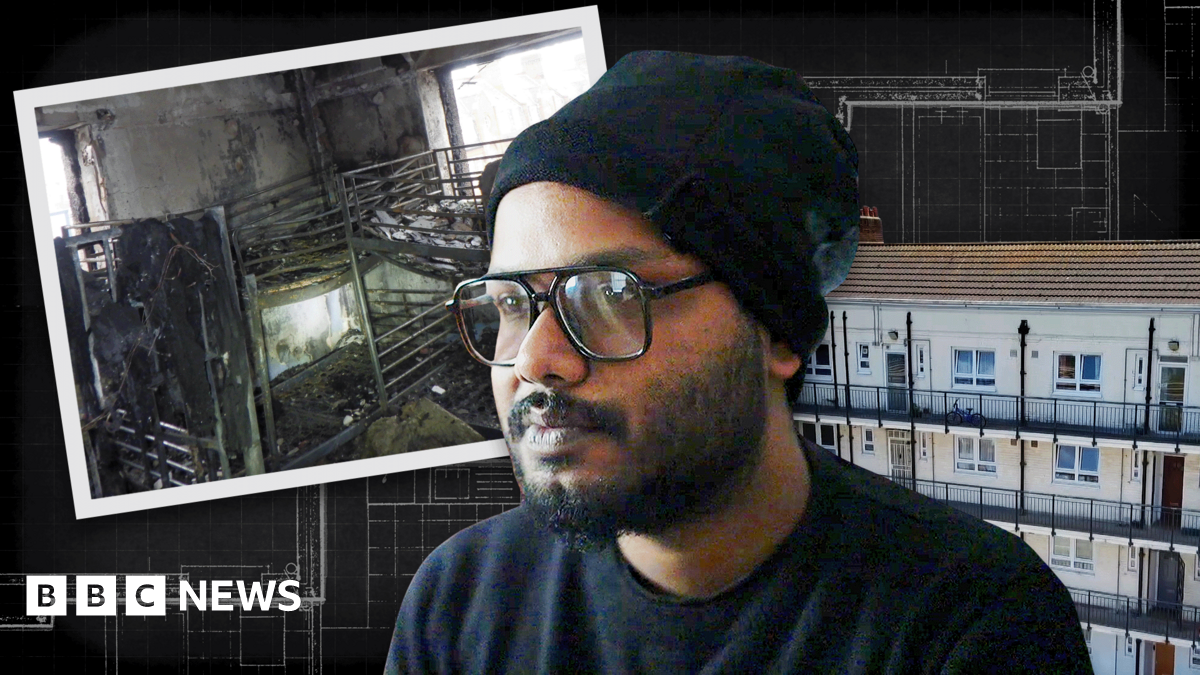

Rat Infestation Mold And Overcrowding Plague Illegal House Shares

Aug 03, 2025

Rat Infestation Mold And Overcrowding Plague Illegal House Shares

Aug 03, 2025 -

September Start Date Announced For Trumps 200 Million White House Ballroom

Aug 03, 2025

September Start Date Announced For Trumps 200 Million White House Ballroom

Aug 03, 2025 -

Pattinson Out James Gunn Clarifies Dcu Batman Casting Speculation

Aug 03, 2025

Pattinson Out James Gunn Clarifies Dcu Batman Casting Speculation

Aug 03, 2025