Average Mortgage Rate Dips To Lowest Point Since Early April

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Average Mortgage Rate Dips to Lowest Point Since Early April: A Sign of Relief for Homebuyers?

The average mortgage rate has experienced a welcome dip, reaching its lowest point since early April, offering a potential glimmer of hope for prospective homebuyers grappling with persistently high borrowing costs. This significant shift in the market could reignite interest in the housing sector, though experts caution against premature celebrations.

What Caused the Dip?

Several factors contributed to this recent decline in average mortgage rates. The most significant influence is the ongoing uncertainty surrounding the economy. Concerns about a potential recession have led some investors to seek safer havens, increasing demand for government bonds. This increased demand pushes bond yields down, and mortgage rates, which are closely tied to bond yields, tend to follow suit. Furthermore, recent data indicating a slight cooling in inflation may have also contributed to this downward trend. The Federal Reserve's (Fed) monetary policy decisions, while still focused on combating inflation, are being closely scrutinized, with any hint of a pause or slowdown in rate hikes immediately impacting mortgage rates.

How Low Did Rates Go?

While the precise numbers vary slightly depending on the source and the type of mortgage (e.g., 30-year fixed-rate, 15-year fixed-rate), industry reports show that average mortgage rates have fallen below [Insert Specific Percentage Here]% – the lowest point since the beginning of April. This represents a notable decrease compared to the peak rates seen earlier this year. For context, [Insert Link to a reputable source showing historical mortgage rate data]. This drop is particularly significant for potential homebuyers who have been sidelined by the high cost of borrowing.

Is This a Sustainable Trend?

While the recent decline is encouraging, it’s crucial to approach it with a degree of caution. The economic outlook remains complex, with inflation still a major concern. Any unexpected economic shifts, particularly renewed inflationary pressures or shifts in Fed policy, could easily reverse this downward trend. Moreover, the availability of mortgages and the associated lending criteria remain factors influencing overall affordability.

What This Means for Homebuyers and Sellers:

- Homebuyers: This dip in rates offers a potentially more favorable borrowing environment. It may allow more potential buyers to enter the market or enable existing buyers to afford a larger mortgage. However, it's vital to shop around and compare rates from different lenders to secure the best possible deal.

- Home Sellers: While lower rates might increase buyer demand, the overall market remains competitive. Pricing strategies and market conditions in specific geographic locations will continue to significantly influence sale success.

Looking Ahead:

The future direction of mortgage rates remains uncertain. Closely monitoring economic indicators, inflation reports, and Federal Reserve announcements is crucial for anyone considering a mortgage in the coming months. Consulting with a qualified financial advisor and a mortgage broker can help navigate the complexities of the current market.

Call to Action: Stay informed about market trends by regularly checking reputable financial news sources and consulting with financial professionals to make informed decisions about your home financing.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Average Mortgage Rate Dips To Lowest Point Since Early April. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Inundaciones Devastadoras En Texas Reportes En Tiempo Real Y Zonas Afectadas

Jul 07, 2025

Inundaciones Devastadoras En Texas Reportes En Tiempo Real Y Zonas Afectadas

Jul 07, 2025 -

Twitch Streamers Tone Brand Launches In Target A New Era In Beauty

Jul 07, 2025

Twitch Streamers Tone Brand Launches In Target A New Era In Beauty

Jul 07, 2025 -

July 2025 Nta Backing Confirmed By Perpetual Equity Investment Co Ltd

Jul 07, 2025

July 2025 Nta Backing Confirmed By Perpetual Equity Investment Co Ltd

Jul 07, 2025 -

Israeli Forces Confirm Strikes On Yemeni Ports And Galaxy Leader Ship

Jul 07, 2025

Israeli Forces Confirm Strikes On Yemeni Ports And Galaxy Leader Ship

Jul 07, 2025 -

Lakers 2020 Championship Dwight Howard On The Criticism And Le Bron James

Jul 07, 2025

Lakers 2020 Championship Dwight Howard On The Criticism And Le Bron James

Jul 07, 2025

Latest Posts

-

Tragedy Strikes Poynton Police Discover Bodies Of Two Teenagers

Jul 07, 2025

Tragedy Strikes Poynton Police Discover Bodies Of Two Teenagers

Jul 07, 2025 -

Severe Tick Season Increased Risk And Essential Prevention Strategies

Jul 07, 2025

Severe Tick Season Increased Risk And Essential Prevention Strategies

Jul 07, 2025 -

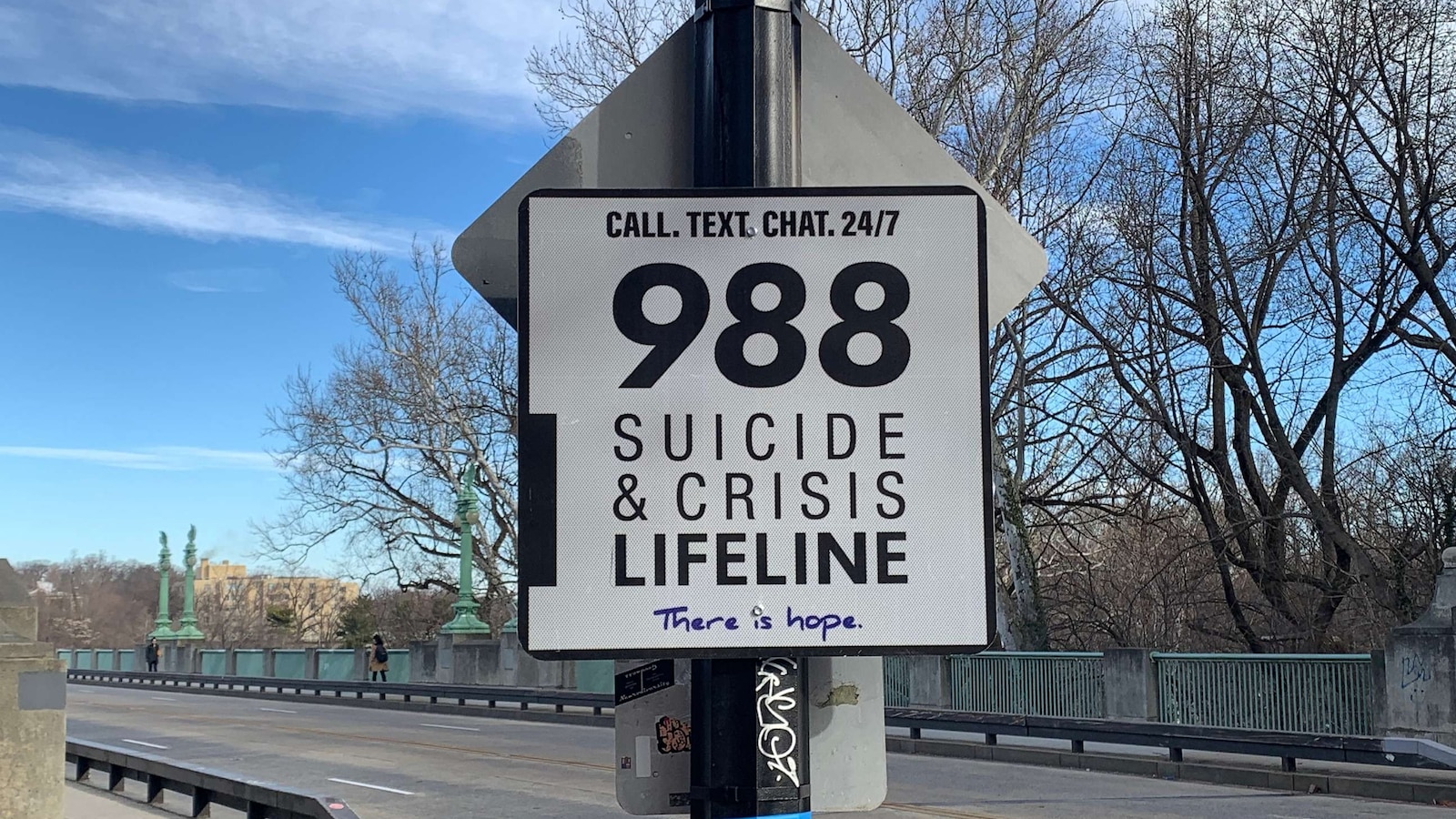

988 Lifeline Call Volume Rises Yet Funding Cuts Impact Lgbtq Youth Support

Jul 07, 2025

988 Lifeline Call Volume Rises Yet Funding Cuts Impact Lgbtq Youth Support

Jul 07, 2025 -

Perpetual Equity Net Tangible Asset Backing Reported

Jul 07, 2025

Perpetual Equity Net Tangible Asset Backing Reported

Jul 07, 2025 -

Texas Flood Death Toll Rises To 32 Frantic Search For Survivors

Jul 07, 2025

Texas Flood Death Toll Rises To 32 Frantic Search For Survivors

Jul 07, 2025