AVGO Stock: Analyst And Trader Outlook Following Q[Quarter] Earnings Report

![AVGO Stock: Analyst And Trader Outlook Following Q[Quarter] Earnings Report AVGO Stock: Analyst And Trader Outlook Following Q[Quarter] Earnings Report](https://vtrandafir.com/image/avgo-stock-analyst-and-trader-outlook-following-q-quarter-earnings-report.jpeg)

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

AVGO Stock: Analyst and Trader Outlook Following Q3 Earnings Report

Broadcom (AVGO) stock experienced significant movement following its Q3 2023 earnings report, leaving investors wondering about the future trajectory. The results, released [insert date], sparked a flurry of analyst predictions and trader reactions, painting a mixed, yet intriguing, picture for the semiconductor giant. This article delves into the key takeaways from the report and analyzes the resulting expert opinions, offering insights for both seasoned investors and those new to the AVGO story.

Q3 Earnings Report: Key Highlights and Market Reaction

Broadcom's Q3 earnings report showcased [insert key figures: revenue, EPS, guidance]. While [mention positive aspects, e.g., exceeding revenue expectations], [mention negative aspects, e.g., lower-than-anticipated guidance for the next quarter] caused a degree of market uncertainty. This led to an initial [describe market reaction – e.g., dip in stock price] followed by a [describe subsequent movement – e.g., gradual recovery].

Analyst Opinions: A Divergence of Views

The post-earnings reaction from analysts has been far from uniform. Some firms, such as [mention analyst firm and their rating/price target], maintained a bullish outlook, citing [reasons for bullish outlook – e.g., strong long-term growth prospects in the semiconductor industry, AVGO's market leadership]. They emphasized [specific aspects supporting their bullish view – e.g., the company's robust free cash flow, successful integration of previous acquisitions].

However, other analysts, including [mention analyst firm and their rating/price target], expressed a more cautious stance. Their concerns centered on [reasons for cautious outlook – e.g., potential macroeconomic headwinds, increasing competition]. They highlighted [specific concerns – e.g., the impact of weakening demand in certain market segments].

Trader Sentiment: Short-Term Volatility and Long-Term Potential

Trader sentiment reflects this analyst division. Short-term trading activity has seen increased volatility, with some traders taking advantage of the price fluctuations for quick profits. However, many long-term investors remain confident in AVGO's future, viewing the recent dip as a potential buying opportunity. The stock's [mention relevant technical indicators, e.g., support levels, resistance levels] are being closely monitored.

What's Next for AVGO Stock?

Predicting the future performance of any stock is inherently challenging, and AVGO is no exception. The coming months will be crucial in determining whether the post-earnings optimism or pessimism prevails. Key factors to watch include:

- Macroeconomic conditions: Global economic growth and any potential recessionary pressures will significantly impact demand for semiconductors.

- Industry competition: The competitive landscape within the semiconductor industry remains fierce, and AVGO's ability to maintain its market share will be critical.

- Future guidance: Broadcom's future earnings guidance will be closely scrutinized by investors as a key indicator of its future performance.

- Technological advancements: AVGO's continued investment in research and development and its ability to innovate will be essential for long-term growth.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. Investing in the stock market involves inherent risks, and you should conduct your own thorough research before making any investment decisions.

Call to Action: Stay informed about the latest developments in the semiconductor industry and Broadcom's performance by subscribing to our newsletter [link to newsletter signup if applicable] or following us on social media [links to social media]. Learn more about investing in technology stocks by exploring resources like [link to reputable financial education resource].

![AVGO Stock: Analyst And Trader Outlook Following Q[Quarter] Earnings Report AVGO Stock: Analyst And Trader Outlook Following Q[Quarter] Earnings Report](https://vtrandafir.com/image/avgo-stock-analyst-and-trader-outlook-following-q-quarter-earnings-report.jpeg)

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on AVGO Stock: Analyst And Trader Outlook Following Q[Quarter] Earnings Report. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

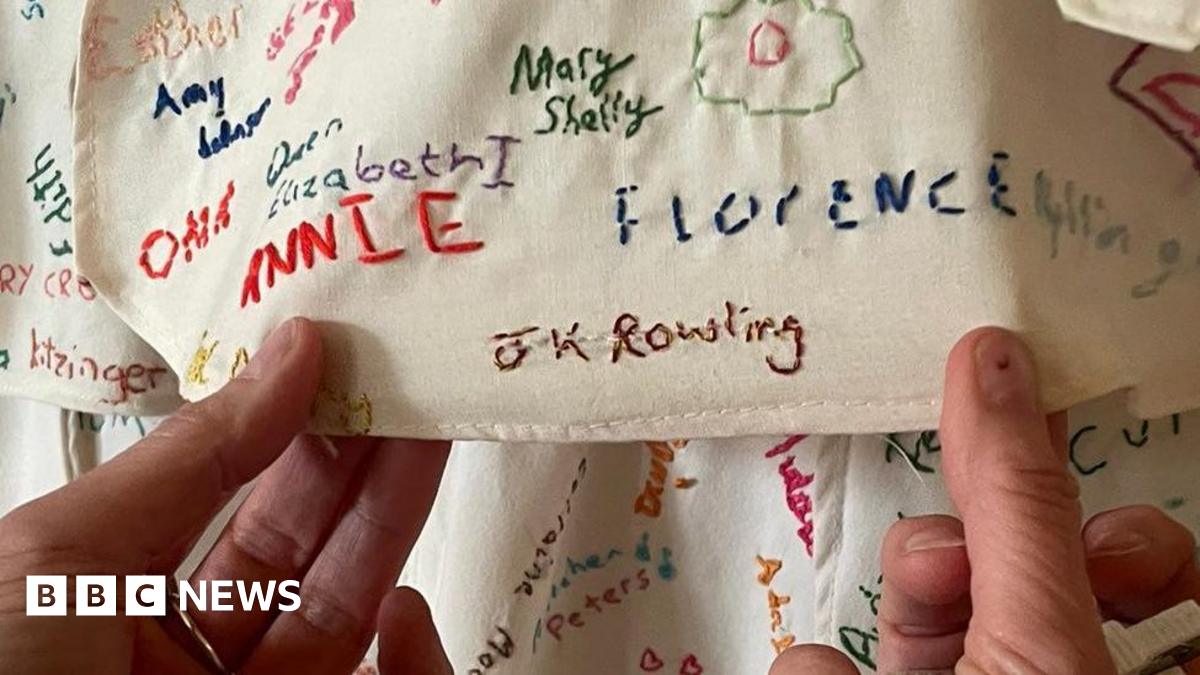

National Trust Addresses Damage To J K Rowling Related Artwork In Derbyshire

Jun 06, 2025

National Trust Addresses Damage To J K Rowling Related Artwork In Derbyshire

Jun 06, 2025 -

Lgbtq Activist Harvey Milk Navy Ship Name Change Sparks Debate

Jun 06, 2025

Lgbtq Activist Harvey Milk Navy Ship Name Change Sparks Debate

Jun 06, 2025 -

Confirmed David Quinn Returns To Rangers As Part Of Mike Sullivans Team

Jun 06, 2025

Confirmed David Quinn Returns To Rangers As Part Of Mike Sullivans Team

Jun 06, 2025 -

Cnn Analyst Harry Enten Examines The My Pillow Ceos Rise And Fall

Jun 06, 2025

Cnn Analyst Harry Enten Examines The My Pillow Ceos Rise And Fall

Jun 06, 2025 -

De Sorbos Summer House Exit Whats Next For The Reality Star

Jun 06, 2025

De Sorbos Summer House Exit Whats Next For The Reality Star

Jun 06, 2025

Latest Posts

-

Aplds Hyperscale Expansion A 5 Billion Commitment

Jun 06, 2025

Aplds Hyperscale Expansion A 5 Billion Commitment

Jun 06, 2025 -

Massive Ai Lease Agreement Fuels 48 Rise In Applied Digital Shares

Jun 06, 2025

Massive Ai Lease Agreement Fuels 48 Rise In Applied Digital Shares

Jun 06, 2025 -

Southern Syria Israeli Raid Leads To Bbc Crews Gunpoint Detention

Jun 06, 2025

Southern Syria Israeli Raid Leads To Bbc Crews Gunpoint Detention

Jun 06, 2025 -

Playoff Debacle Costs Peter De Boer His Job With San Jose Sharks

Jun 06, 2025

Playoff Debacle Costs Peter De Boer His Job With San Jose Sharks

Jun 06, 2025 -

My Retired Police Dog Should Heroes Get Pensions

Jun 06, 2025

My Retired Police Dog Should Heroes Get Pensions

Jun 06, 2025