AVGO Stock Price Prediction: Assessing Broadcom's Future Following Earnings

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

AVGO Stock Price Prediction: Assessing Broadcom's Future Following Earnings

Broadcom (AVGO) recently released its earnings report, sending ripples through the tech sector. Investors are now scrambling to understand what the results mean for the future and, crucially, what the AVGO stock price prediction should be. This article delves into the key takeaways from the report, analyzes the current market sentiment, and offers a balanced perspective on the potential trajectory of Broadcom's stock price.

Q2 2024 Earnings: A Mixed Bag

Broadcom's Q2 2024 earnings report presented a mixed picture. While the company beat revenue expectations, profit margins came in slightly below analyst projections. This discrepancy is largely attributed to [mention specific reasons cited in the earnings report, e.g., increased competition in a specific market segment, supply chain challenges, or unexpected expenses]. The company's guidance for the next quarter also played a significant role in shaping investor reactions. [Mention specific details from the guidance, e.g., lower-than-expected revenue projections or adjustments to anticipated growth rates].

Analyzing the Market Reaction and Sentiment

The immediate market reaction to the earnings report was a [describe the market reaction – e.g., slight dip, significant drop, or modest increase] in AVGO's stock price. This reflects the inherent volatility of the tech sector and the complexities of interpreting financial reports. Several factors influenced this reaction, including:

- Overall Market Conditions: The broader macroeconomic environment, including interest rate hikes and inflation concerns, undoubtedly played a role in shaping investor sentiment towards AVGO.

- Analyst Ratings: Post-earnings, several analysts revised their ratings and price targets for AVGO. [Mention specific examples of analyst actions and their reasoning]. It's crucial to note that analyst predictions are not guarantees and should be considered alongside other factors.

- Competitive Landscape: Broadcom operates in a highly competitive market. The performance of its competitors and any emerging technological disruptions could significantly impact its future growth.

Factors Affecting AVGO Stock Price Prediction

Several key factors will influence the future trajectory of AVGO's stock price:

- The Semiconductor Industry Cycle: The cyclical nature of the semiconductor industry means that AVGO's performance is intrinsically linked to broader market trends. Understanding the predicted cycle is vital for any accurate AVGO stock price prediction.

- Innovation and R&D: Broadcom's commitment to research and development and its ability to innovate in key areas like 5G, AI, and cloud computing will be pivotal for long-term growth.

- Acquisition Strategy: Broadcom has a history of strategic acquisitions. Future acquisitions could significantly impact its revenue streams and overall valuation.

- Geopolitical Risks: Global geopolitical instability and trade tensions could create uncertainty and influence investor confidence.

AVGO Stock Price Prediction: A Cautious Outlook

Predicting stock prices with certainty is impossible. However, based on the Q2 earnings report, market sentiment, and the factors outlined above, a cautious outlook seems appropriate. While Broadcom remains a strong player in the semiconductor industry, the near-term outlook may be somewhat volatile. [Mention a range of potential price predictions from reputable analysts or financial sources, citing your sources]. It's crucial to remember that this is not financial advice, and investors should conduct their own thorough research before making any investment decisions.

Disclaimer: This article provides general information and analysis and should not be considered financial advice. Investing in the stock market involves risk, and you could lose money. Consult with a qualified financial advisor before making any investment decisions.

Further Research: For deeper insights, consult resources like [link to reputable financial news sources, e.g., Yahoo Finance, Bloomberg, MarketWatch]. Staying updated on industry news and Broadcom's announcements is vital for informed decision-making.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on AVGO Stock Price Prediction: Assessing Broadcom's Future Following Earnings. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Lilibets Fourth Birthday Meghan Shares Adorable New Portraits

Jun 06, 2025

Lilibets Fourth Birthday Meghan Shares Adorable New Portraits

Jun 06, 2025 -

Burning Car Carrier In North Pacific Lifeboat Rescue Of 22 Crew

Jun 06, 2025

Burning Car Carrier In North Pacific Lifeboat Rescue Of 22 Crew

Jun 06, 2025 -

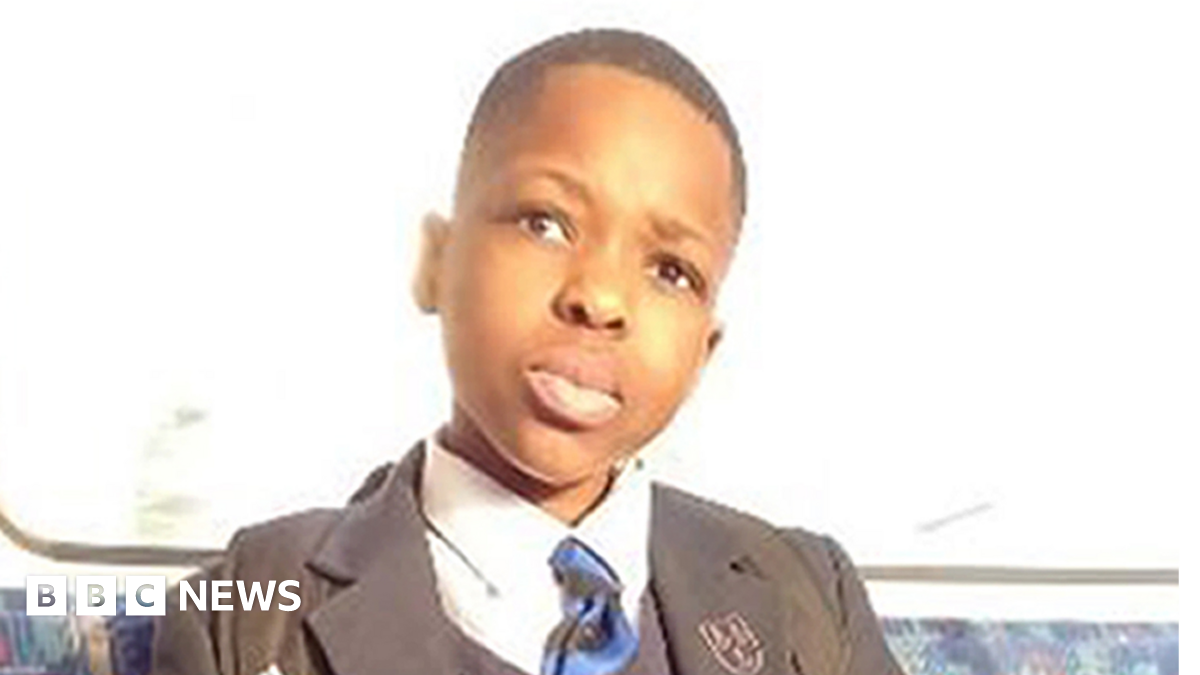

Anjorin Murder Case Prosecution Presents Evidence Of Monzos Intent

Jun 06, 2025

Anjorin Murder Case Prosecution Presents Evidence Of Monzos Intent

Jun 06, 2025 -

Tax Evasion Allegations Lead To Directorship Ban For Rob Cross

Jun 06, 2025

Tax Evasion Allegations Lead To Directorship Ban For Rob Cross

Jun 06, 2025 -

Major Wwii Bomb Found In Cologne Thousands Evacuated

Jun 06, 2025

Major Wwii Bomb Found In Cologne Thousands Evacuated

Jun 06, 2025

Latest Posts

-

Hyperscale Growth Apld Announces 5 Billion Expansion Plan

Jun 06, 2025

Hyperscale Growth Apld Announces 5 Billion Expansion Plan

Jun 06, 2025 -

Infant Microbiome And Its Effect On Future Health

Jun 06, 2025

Infant Microbiome And Its Effect On Future Health

Jun 06, 2025 -

Analyzing The Impact Were Ukraines Airfield Strikes A Turning Point

Jun 06, 2025

Analyzing The Impact Were Ukraines Airfield Strikes A Turning Point

Jun 06, 2025 -

Aplds Hyperscale Expansion A 5 Billion Commitment

Jun 06, 2025

Aplds Hyperscale Expansion A 5 Billion Commitment

Jun 06, 2025 -

Massive Ai Lease Agreement Fuels 48 Rise In Applied Digital Shares

Jun 06, 2025

Massive Ai Lease Agreement Fuels 48 Rise In Applied Digital Shares

Jun 06, 2025