Bank Fraud, Tax Evasion, And A Presidential Pardon: The Reality TV Couple's Case

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Bank Fraud, Tax Evasion, and a Presidential Pardon: The Reality TV Couple's Case Shakes Public Trust

The seemingly glamorous world of reality TV has collided head-on with the harsh realities of the justice system, leaving the public reeling after the controversial presidential pardon granted to the infamous reality TV couple, [Couple's Names]. Their case, involving complex allegations of bank fraud and tax evasion, has ignited a firestorm of debate surrounding presidential power, justice, and the influence of wealth and fame.

The couple, known for their lavish lifestyle showcased on their hit reality show, "[Show Name]", faced a combined 30+ years in prison following their 2022 conviction. The charges included conspiracy to commit bank fraud, wire fraud, and multiple counts of tax evasion, totaling millions of dollars in losses to the state and financial institutions. Prosecutors painted a picture of a sophisticated scheme involving shell corporations, offshore accounts, and falsified financial records – a textbook case of white-collar crime.

The Allegations: A Web of Deceit?

Evidence presented during the trial revealed a complex network of financial transactions designed to conceal their illicit activities. Prosecutors argued that the couple systematically defrauded banks by obtaining loans under false pretenses, using the funds for personal enrichment rather than the stated business purposes. Further allegations of tax evasion involved concealing income through offshore accounts and failing to report substantial earnings from endorsements and business ventures.

- Bank Fraud: The prosecution highlighted several instances where the couple allegedly misrepresented their financial status to secure substantial loans. This included inflating the value of assets and underreporting liabilities.

- Tax Evasion: The case involved accusations of using offshore accounts to hide millions of dollars in income, thereby evading significant tax obligations.

- Money Laundering: While not explicitly stated in the initial charges, the complex nature of the financial transactions suggests potential money laundering charges could have been pursued.

The defense, however, argued that the couple was victims of misguided financial advice and that the prosecution's case was based on circumstantial evidence and misinterpretations of complex financial transactions.

The Presidential Pardon: A Controversial Decision

Despite the overwhelming evidence presented, the President issued a full pardon, sparking outrage and confusion amongst the public. Critics argue the pardon undermines the integrity of the justice system and sends a dangerous message that wealth and fame can shield individuals from accountability. The decision has been described by legal experts as highly unusual, given the severity of the charges and the lack of compelling evidence to support the pardon.

This unprecedented move raises significant questions about the appropriate use of presidential pardons. Legal scholars are debating the implications of such actions on public trust in both the executive and judicial branches. Some are calling for greater transparency and stricter guidelines surrounding the use of presidential pardons to prevent future abuses of power.

The Aftermath: Long-Term Implications

The pardon of [Couple's Names] has opened a Pandora's Box of ethical and legal considerations. The case raises serious questions about:

- Inequality in the Justice System: Critics argue that the pardon highlights the disparity between the treatment of wealthy individuals and those from less privileged backgrounds facing similar charges.

- The Role of Political Influence: Speculation abounds regarding potential political motivations behind the pardon, raising concerns about the integrity of the decision-making process.

- Public Perception of Justice: The incident has undoubtedly eroded public confidence in the fairness and impartiality of the justice system.

This case is far from over. The legal and political ramifications will continue to unfold, shaping the future of discussions surrounding presidential power, white-collar crime, and the pursuit of justice in the face of wealth and influence. It remains to be seen whether this controversial decision will serve as a cautionary tale or a precedent for future abuses of power. The debate, fueled by the spectacle of reality TV and the weight of justice, is sure to continue for years to come. What are your thoughts on this controversial case? Share your opinion in the comments below.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Bank Fraud, Tax Evasion, And A Presidential Pardon: The Reality TV Couple's Case. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Bucks Gamble Will Doc Rivers Keep Giannis In Milwaukee

May 29, 2025

Bucks Gamble Will Doc Rivers Keep Giannis In Milwaukee

May 29, 2025 -

George Straits Moving Eulogy A Country Icons Farewell To A Friend

May 29, 2025

George Straits Moving Eulogy A Country Icons Farewell To A Friend

May 29, 2025 -

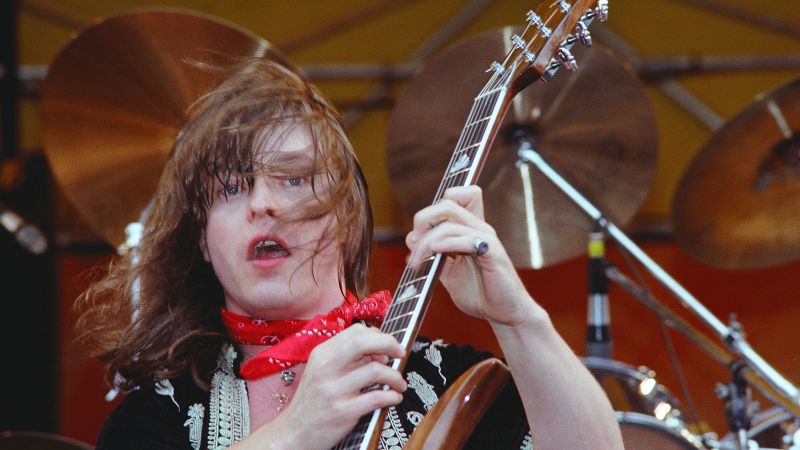

Rick Derringer Guitarist For Weird Al Yankovic Passes Away At 77

May 29, 2025

Rick Derringer Guitarist For Weird Al Yankovic Passes Away At 77

May 29, 2025 -

Washington Dc Weather Alert Heavy Rain And Potential Flooding

May 29, 2025

Washington Dc Weather Alert Heavy Rain And Potential Flooding

May 29, 2025 -

Milwaukee Bucks Gamble Is Doc Rivers The Answer To Retaining Giannis

May 29, 2025

Milwaukee Bucks Gamble Is Doc Rivers The Answer To Retaining Giannis

May 29, 2025

Latest Posts

-

Physician Associates A Case For A New Job Designation

Jul 17, 2025

Physician Associates A Case For A New Job Designation

Jul 17, 2025 -

Investigation Deepens Into 7bn Cover Up And Allegations Of Financial Mismanagement

Jul 17, 2025

Investigation Deepens Into 7bn Cover Up And Allegations Of Financial Mismanagement

Jul 17, 2025 -

Hung Jury Results In September Retrial For Ynw Melly On Murder Charges

Jul 17, 2025

Hung Jury Results In September Retrial For Ynw Melly On Murder Charges

Jul 17, 2025 -

Investigation Launched National Park Services Handling Of Devastating Lodge Fire Questioned

Jul 17, 2025

Investigation Launched National Park Services Handling Of Devastating Lodge Fire Questioned

Jul 17, 2025 -

Nvidias China Ai Chip Sales A Significant Shift In U S Policy

Jul 17, 2025

Nvidias China Ai Chip Sales A Significant Shift In U S Policy

Jul 17, 2025