Bank Of America (BAC) Stock: Two Sigma's Significant $236.55M Stake

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Bank of America (BAC) Stock: Two Sigma's Massive $236.55M Investment Signals Confidence

Bank of America (BAC) stock has seen a significant boost in confidence following the revelation that Two Sigma Investments, a prominent quantitative investment firm, has acquired a substantial stake worth $236.55 million. This move by Two Sigma, known for its data-driven investment strategies, is sending ripples through the financial markets and sparking considerable interest amongst investors. The question on everyone's mind: What does this mean for BAC stock's future?

This article delves into the implications of Two Sigma's investment, analyzing the potential reasons behind this significant move and exploring what it could mean for current and prospective Bank of America shareholders.

Two Sigma's Strategic Play: A Deeper Dive

Two Sigma's investment represents a significant vote of confidence in Bank of America's future performance. The firm's quantitative approach relies heavily on data analysis and sophisticated algorithms to identify undervalued assets. Their investment in BAC suggests a positive outlook on the bank's:

- Financial Strength: Bank of America boasts a strong balance sheet and consistent profitability. This makes it an attractive investment, especially in times of economic uncertainty. [Link to Bank of America's investor relations page]

- Growth Potential: The bank is actively pursuing growth opportunities in various sectors, including digital banking and wealth management. Two Sigma's investment may indicate belief in the success of these strategies.

- Long-Term Stability: In a volatile market, large institutional investors like Two Sigma often seek stability. BAC's established position in the financial industry likely contributes to its appeal.

The size of the investment – $236.55 million – is particularly noteworthy. This isn't a small, opportunistic purchase; it represents a substantial commitment to Bank of America's long-term prospects.

What This Means for Investors

Two Sigma's investment could have several positive consequences for BAC shareholders:

- Increased Stock Price: The news is likely to increase investor interest in Bank of America, potentially driving up the stock price. This is especially true given the positive signal sent by such a large and sophisticated investor.

- Enhanced Market Confidence: The move lends credibility to Bank of America's overall strategy and financial health. It reinforces confidence in the bank amongst a broader range of investors.

- Potential for Future Growth: Two Sigma's involvement could act as a catalyst for further growth and expansion within Bank of America.

Potential Risks and Considerations

While the news is overwhelmingly positive, investors should always consider potential risks:

- Market Volatility: The overall financial market remains subject to unpredictable swings, and Bank of America's stock price is not immune to these fluctuations.

- Economic Conditions: The broader economic climate will undoubtedly impact Bank of America's performance. Recessions or economic slowdowns could negatively affect the bank's profitability.

- Competition: Bank of America faces intense competition within the financial services industry.

Conclusion: A Bullish Signal for BAC?

Two Sigma's substantial investment in Bank of America stock is undeniably bullish. It signifies strong belief in the bank's future performance and financial strength. While no investment is without risk, this significant move suggests a positive outlook for BAC stock in the medium to long term. Investors should, however, conduct their own thorough due diligence before making any investment decisions. [Link to a reputable financial news source for further market analysis]

Disclaimer: This article is for informational purposes only and does not constitute financial advice. Investing in the stock market involves risk, and you could lose money.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Bank Of America (BAC) Stock: Two Sigma's Significant $236.55M Stake. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Hunger In Gaza Bbc Focuses On Infant Affected By Blockade

May 28, 2025

Hunger In Gaza Bbc Focuses On Infant Affected By Blockade

May 28, 2025 -

Regrets And Realities An Expats Return To Germany After Living In The Us

May 28, 2025

Regrets And Realities An Expats Return To Germany After Living In The Us

May 28, 2025 -

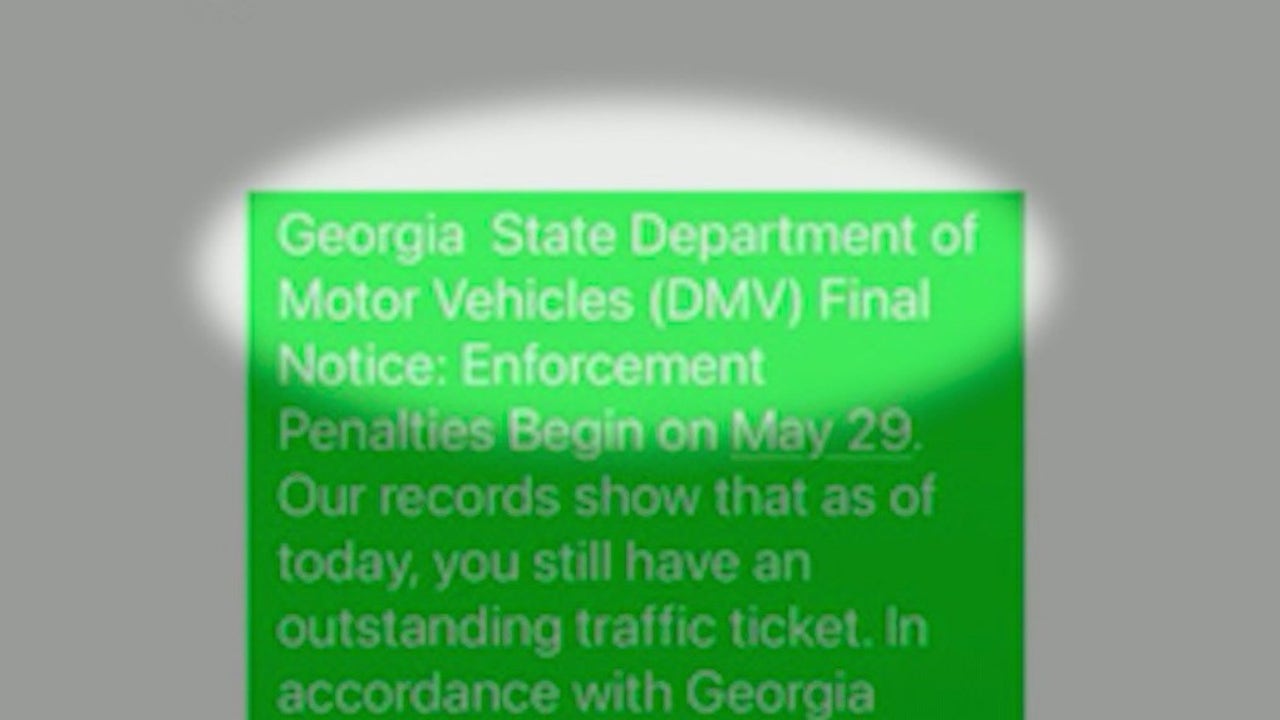

Scam Alert Fake Traffic Tickets Targeting Georgia Drivers Via Text

May 28, 2025

Scam Alert Fake Traffic Tickets Targeting Georgia Drivers Via Text

May 28, 2025 -

Police Concerns Revealed In Leaked Recording Of Abortion Arrest

May 28, 2025

Police Concerns Revealed In Leaked Recording Of Abortion Arrest

May 28, 2025 -

Research Cuts Spark Nih Staff Rebellion Walkout At Directors Town Hall

May 28, 2025

Research Cuts Spark Nih Staff Rebellion Walkout At Directors Town Hall

May 28, 2025

Latest Posts

-

Under The Stadium Lights Day 4 Success For Former Junior Competitors

May 31, 2025

Under The Stadium Lights Day 4 Success For Former Junior Competitors

May 31, 2025 -

Kelly Smith Sentenced South African Kidnapping And Sale Of Joshlin Smith

May 31, 2025

Kelly Smith Sentenced South African Kidnapping And Sale Of Joshlin Smith

May 31, 2025 -

Saharan Dust Cloud Timing And Impact On Louisiana Sunsets

May 31, 2025

Saharan Dust Cloud Timing And Impact On Louisiana Sunsets

May 31, 2025 -

Newark Airport Air Traffic Control Projected Improvements Delayed

May 31, 2025

Newark Airport Air Traffic Control Projected Improvements Delayed

May 31, 2025 -

Heartbreaking Testimony Palestinian Representative Details Gaza Childrens Ordeal At Un

May 31, 2025

Heartbreaking Testimony Palestinian Representative Details Gaza Childrens Ordeal At Un

May 31, 2025