Bank Of America (BAC) Stock: Two Sigma's Significant Stake Explained

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Bank of America (BAC) Stock: Two Sigma's Significant Stake Explained

Bank of America (BAC) recently saw a significant increase in its institutional investment, with Two Sigma Investments acquiring a substantial stake. This move has sent ripples through the financial markets, prompting questions about the hedge fund's strategy and the future implications for BAC stock. This article delves into the details of Two Sigma's investment, analyzing the potential reasons behind it and exploring what it means for both investors and the broader financial landscape.

Two Sigma's Growing Interest in BAC:

Two Sigma, a quantitative investment firm known for its data-driven approach, is not new to the financial markets. However, its recent acquisition of a significant stake in Bank of America (BAC) has captured the attention of analysts and investors alike. The exact size of the stake isn't publicly disclosed in full detail due to regulatory reporting complexities, but SEC filings reveal a considerable increase in holdings, positioning Two Sigma as a significant player in BAC's shareholder base.

Why Two Sigma Invested in Bank of America:

Several factors could explain Two Sigma's interest in Bank of America:

-

BAC's Strong Financial Performance: Bank of America has consistently delivered solid financial results in recent years. Strong earnings, robust loan growth, and effective cost management have all contributed to investor confidence. Two Sigma's quantitative models likely identified BAC as a financially sound investment opportunity.

-

Undervalued Asset Potential: Some analysts believe that BAC's stock price may not fully reflect its underlying value. Two Sigma's data-driven approach might have identified this undervaluation, making BAC an attractive investment target.

-

Long-Term Growth Prospects: The US banking sector is expected to experience moderate growth in the coming years, and Bank of America is well-positioned to benefit from this trend. Two Sigma's investment likely reflects a long-term perspective on BAC's growth potential.

-

Diversification Strategy: Two Sigma might be diversifying its portfolio by investing in a large, established financial institution like Bank of America. This move could offer stability and reduced risk compared to investments in smaller or more volatile companies.

Implications for BAC Stock:

Two Sigma's investment carries significant implications for Bank of America's stock price:

-

Increased Investor Confidence: The involvement of a prominent quantitative investment firm like Two Sigma can boost investor confidence in BAC. This could lead to increased demand for BAC shares and potentially drive up the stock price.

-

Potential for Future Growth: Two Sigma's long-term investment horizon suggests a belief in BAC's future growth prospects. This could signal positive developments for the bank and its shareholders.

-

Market Sentiment: The market's reaction to Two Sigma's investment will largely depend on broader market conditions and investor sentiment towards the banking sector.

What This Means for Investors:

While Two Sigma's investment is positive news for BAC, it's important for individual investors to conduct their own due diligence before making any investment decisions. Consider consulting with a financial advisor to assess your risk tolerance and investment goals before buying or selling BAC stock.

Conclusion:

Two Sigma's significant stake in Bank of America (BAC) is a noteworthy event that warrants close observation. While the precise motivations behind the investment remain somewhat opaque, the overall positive implications for BAC's stock price and future prospects are undeniable. Investors should continue to monitor developments and consider this factor when making their investment decisions. Remember to always perform thorough research and consult with a financial professional before making any investment decisions.

Related Articles:

- [Link to an article about Bank of America's recent earnings report]

- [Link to an article about the current state of the US banking sector]

- [Link to an article about Two Sigma's investment strategy]

Disclaimer: This article is for informational purposes only and should not be considered financial advice. Investing in the stock market involves risk, and you could lose money.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Bank Of America (BAC) Stock: Two Sigma's Significant Stake Explained. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Explore Sirius Xms Dark Wave The Slicing Up Eyeballs Playlist 5 25 25

May 28, 2025

Explore Sirius Xms Dark Wave The Slicing Up Eyeballs Playlist 5 25 25

May 28, 2025 -

Bbcs Match Of The Day Gary Linekers Legacy After 26 Years

May 28, 2025

Bbcs Match Of The Day Gary Linekers Legacy After 26 Years

May 28, 2025 -

Shepmates How A Lumber Company Became A Social Media Sensation

May 28, 2025

Shepmates How A Lumber Company Became A Social Media Sensation

May 28, 2025 -

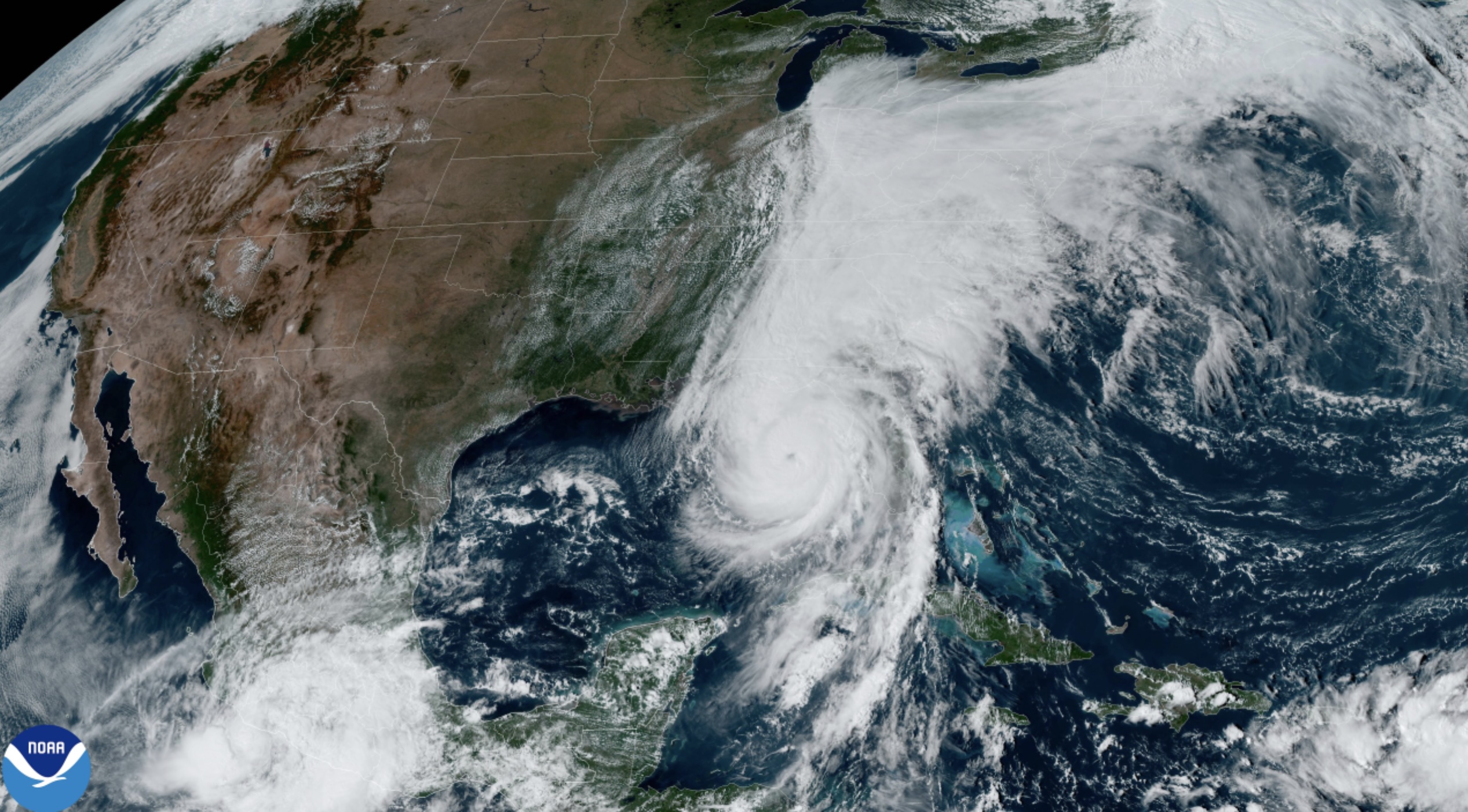

Ten Hurricanes Possible This Summer Experts Warn Of Above Normal Atlantic Hurricane Season

May 28, 2025

Ten Hurricanes Possible This Summer Experts Warn Of Above Normal Atlantic Hurricane Season

May 28, 2025 -

Israeli Ultra Nationalist March Jerusalem Tensions Escalate

May 28, 2025

Israeli Ultra Nationalist March Jerusalem Tensions Escalate

May 28, 2025

Latest Posts

-

A Flamstead Hawks Second Chance Finding A Forever Home And A Loving Falconer

May 31, 2025

A Flamstead Hawks Second Chance Finding A Forever Home And A Loving Falconer

May 31, 2025 -

Wilkes Barre Announces Road Closures For Water Main Upgrade

May 31, 2025

Wilkes Barre Announces Road Closures For Water Main Upgrade

May 31, 2025 -

French Open 2025 Can Fonseca Upset Draper And Carry Brazils Hopes

May 31, 2025

French Open 2025 Can Fonseca Upset Draper And Carry Brazils Hopes

May 31, 2025 -

North Sea Vessel Collision Captain Denies Responsibility

May 31, 2025

North Sea Vessel Collision Captain Denies Responsibility

May 31, 2025 -

Tornado Warning Near Miss For Durbin Crossing Liberty Pines Academy

May 31, 2025

Tornado Warning Near Miss For Durbin Crossing Liberty Pines Academy

May 31, 2025