Bank Of America (BAC): Two Sigma Takes Significant Stake

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Bank of America (BAC): Two Sigma Takes Significant Stake – What Does It Mean?

Two Sigma Investments, the quantitative investment firm, has quietly amassed a significant stake in Bank of America (BAC), sending ripples through the financial markets. This move, revealed in recent SEC filings, has sparked considerable speculation about the future direction of both the investment firm and the banking giant. What does this substantial investment signify for Bank of America's shareholders and the broader financial landscape? Let's delve into the details.

Two Sigma's Strategic Investment in BAC:

While the exact percentage of Two Sigma's holdings in Bank of America remains undisclosed beyond the required SEC filings, the sheer size of the investment suggests a significant commitment. Two Sigma, known for its data-driven approach to investing, doesn't typically make such large, passive investments. This leads analysts to believe their stake in BAC is likely more strategic than purely financial. This strategic investment could point towards several possibilities:

- Long-Term Growth Potential: Two Sigma may believe Bank of America is undervalued and poised for significant long-term growth. BAC's strong performance in recent quarters, coupled with a generally positive outlook for the financial sector, could be contributing factors.

- Undervalued Assets: Two Sigma's expertise in quantitative analysis could have identified undervalued assets within Bank of America's portfolio, suggesting potential for future gains through strategic restructuring or divestment.

- Potential for Corporate Actions: Some speculate that Two Sigma's investment could be a prelude to pushing for corporate actions at Bank of America, such as increased share buybacks or a more aggressive dividend policy. However, this remains purely speculative at this stage.

Implications for Bank of America (BAC) Shareholders:

The influx of a significant investor like Two Sigma can be viewed positively by existing Bank of America shareholders. The presence of a sophisticated quantitative investment firm suggests a level of confidence in BAC's future performance and potential for growth. This could contribute to increased investor confidence and potentially drive up the stock price. However, it's crucial to remember that market fluctuations are inevitable, and this investment doesn't guarantee future success.

The Broader Market Context:

Two Sigma's investment in Bank of America also provides insights into the broader market sentiment. The choice of a large, established bank like BAC suggests a degree of confidence in the stability of the financial sector, even amidst ongoing economic uncertainty. This move could further encourage other institutional investors to reassess their positions in the financial sector.

What to Watch For:

The coming weeks and months will be crucial in understanding the full implications of Two Sigma's investment. We can expect further analysis from financial experts, and any announcements from Bank of America regarding potential strategic initiatives will be closely scrutinized.

Conclusion:

Two Sigma's substantial investment in Bank of America is a significant development with potential far-reaching consequences. While the exact strategic goals of Two Sigma remain unclear, the move signals confidence in BAC's long-term prospects and could influence both the stock price and the broader financial market. Investors should continue to monitor developments closely and consult with their financial advisors for personalized advice. For up-to-date information on market trends, be sure to regularly check reputable financial news sources. [Link to reputable financial news source].

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Bank Of America (BAC): Two Sigma Takes Significant Stake. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

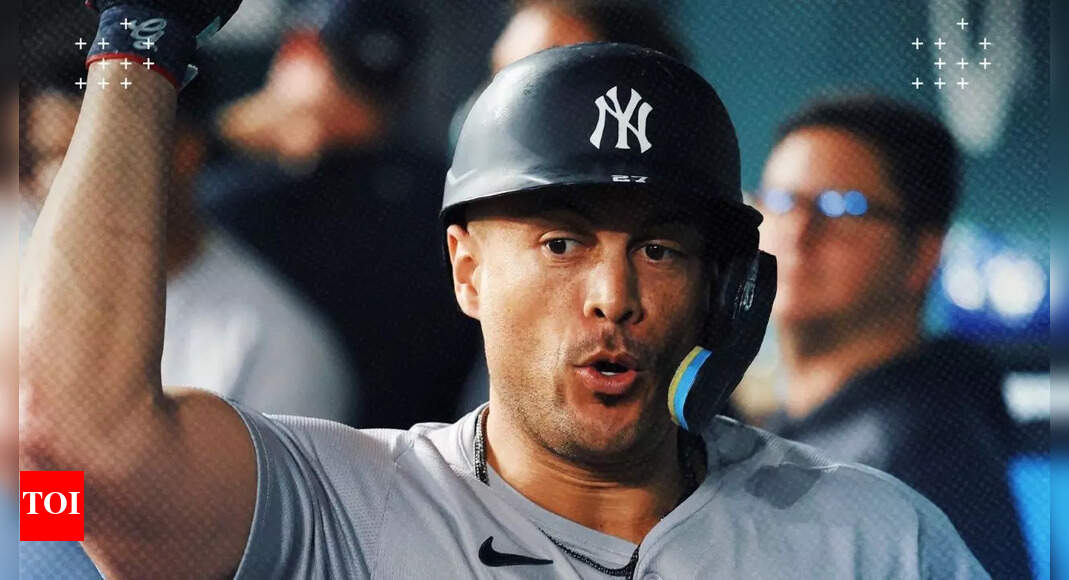

Yankees Release Giancarlo Stantons Potential Mariners Move

May 27, 2025

Yankees Release Giancarlo Stantons Potential Mariners Move

May 27, 2025 -

I Os 18 4 1 Update What To Know Before Installing On I Phone

May 27, 2025

I Os 18 4 1 Update What To Know Before Installing On I Phone

May 27, 2025 -

The Mysterious Death Of Andriy Portnov Ukraines Unresolved Enigma

May 27, 2025

The Mysterious Death Of Andriy Portnov Ukraines Unresolved Enigma

May 27, 2025 -

Kings Solidarity Visit Navigating The Canada Us Trade Conflict

May 27, 2025

Kings Solidarity Visit Navigating The Canada Us Trade Conflict

May 27, 2025 -

Remains Of Four Wwii Bomber Crew Members Identified Returned To Families

May 27, 2025

Remains Of Four Wwii Bomber Crew Members Identified Returned To Families

May 27, 2025

Latest Posts

-

Antonio Filosa What To Expect Under Stellantis New Ceo

May 29, 2025

Antonio Filosa What To Expect Under Stellantis New Ceo

May 29, 2025 -

Milwaukee Bucks Desperate Move Banking On Doc Rivers To Retain Giannis Antetokounmpo

May 29, 2025

Milwaukee Bucks Desperate Move Banking On Doc Rivers To Retain Giannis Antetokounmpo

May 29, 2025 -

Brooklyn Nets Draft Strategy Climbing The Ladder And Nba Trade Possibilities

May 29, 2025

Brooklyn Nets Draft Strategy Climbing The Ladder And Nba Trade Possibilities

May 29, 2025 -

Antonio Filosa Named Ceo Of Automotive Giant Stellantis

May 29, 2025

Antonio Filosa Named Ceo Of Automotive Giant Stellantis

May 29, 2025 -

Investigation Launched After Truck Explosion Propane Leak Suspected

May 29, 2025

Investigation Launched After Truck Explosion Propane Leak Suspected

May 29, 2025