Bank Of America: Boeing To Benefit From Trump's Trade Agenda

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Bank of America: Boeing to Benefit from Trump's Trade Agenda

Boeing, a titan of the aerospace industry, is poised to reap significant rewards from the Trump administration's trade policies, according to a recent Bank of America report. This bullish outlook suggests a potential surge in Boeing's stock price and reinforces the company's position as a key player in the global aviation market. But how exactly will Trump's trade agenda benefit Boeing, and what are the potential downsides? Let's delve deeper.

Trump's Trade Policies: A Tailwind for Boeing?

Bank of America's analysts highlight several key areas where Trump's trade policies are expected to positively impact Boeing:

-

Reduced Tariffs and Trade Disputes: The administration's focus on renegotiating trade deals and reducing tariffs, particularly with key trading partners like China and the European Union, could lead to lower input costs for Boeing. This directly translates to improved profit margins and increased competitiveness in the global market. Less trade friction means smoother supply chains and fewer disruptions to production.

-

Increased Domestic Demand: Policies promoting domestic manufacturing and infrastructure spending could boost demand for Boeing's products within the United States. This is especially relevant for the company's defense contracts, a significant portion of its revenue stream. The increased emphasis on domestic production also reduces reliance on foreign suppliers, mitigating risks associated with global supply chain vulnerabilities.

-

Stronger Dollar: While a strong dollar can sometimes hurt exports, in Boeing's case, the benefit of reduced input costs from foreign suppliers often outweighs this potential negative. A strong dollar makes imports cheaper, further lowering production expenses.

-

Competitive Advantage: By leveraging trade negotiations to secure favorable terms, the Trump administration could potentially give Boeing a competitive advantage over its European rival, Airbus. This could translate into securing more lucrative contracts both domestically and internationally.

Potential Challenges Remain

While the outlook is generally positive, Bank of America acknowledges potential challenges:

-

Trade Wars: While the administration aims to reduce trade barriers, the risk of escalating trade wars remains a concern. Unpredictable trade policies could disrupt Boeing's supply chains and negatively impact its bottom line.

-

Global Economic Slowdown: A global economic slowdown could dampen demand for air travel and, consequently, for new aircraft. This is an external factor outside of the direct influence of trade policies.

-

Competition: The aerospace industry is fiercely competitive. Boeing faces stiff competition from Airbus and other manufacturers, regardless of trade policies.

What this Means for Investors

Bank of America's optimistic outlook on Boeing's prospects under Trump's trade agenda suggests a potentially lucrative investment opportunity. However, investors should carefully consider the inherent risks associated with the aerospace industry and the volatility of global trade relations. Diversification is crucial in any investment portfolio.

Conclusion: Navigating the Complex Landscape

Boeing's future performance will depend on a complex interplay of factors, including trade policies, global economic conditions, and competitive pressures. While Bank of America's report offers a positive outlook, it's crucial to approach any investment decision with caution and thorough due diligence. Stay informed about ongoing developments in both the aerospace industry and international trade relations for a comprehensive understanding of Boeing's potential. Remember to consult with a financial advisor before making any investment decisions.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Bank Of America: Boeing To Benefit From Trump's Trade Agenda. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Alleged Espionage British National Indicted For Transferring Us Military Technology To China

Jun 03, 2025

Alleged Espionage British National Indicted For Transferring Us Military Technology To China

Jun 03, 2025 -

French Open Day Date Drapers Upset Djokovic And Sinners Wins

Jun 03, 2025

French Open Day Date Drapers Upset Djokovic And Sinners Wins

Jun 03, 2025 -

The R Words Resurgence Analyzing The Factors Behind Its Renewed Use

Jun 03, 2025

The R Words Resurgence Analyzing The Factors Behind Its Renewed Use

Jun 03, 2025 -

Djokovic Sinner And Draper Win At French Open Monfils Falls To Draper

Jun 03, 2025

Djokovic Sinner And Draper Win At French Open Monfils Falls To Draper

Jun 03, 2025 -

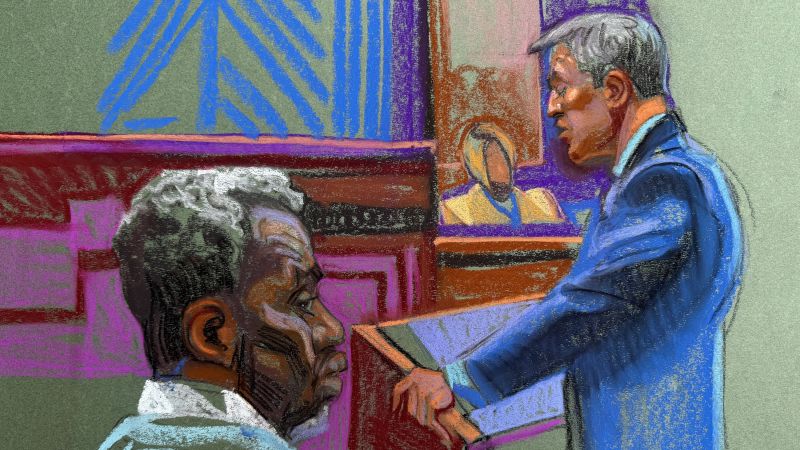

Following The Sean Diddy Combs Case Recent Proceedings And Potential Outcomes

Jun 03, 2025

Following The Sean Diddy Combs Case Recent Proceedings And Potential Outcomes

Jun 03, 2025