Bank Of America Shares Plunge As Buffett Offloads Stake, Invests In Booming Consumer Brand

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Bank of America Shares Plunge as Buffett Offloads Stake, Invests in Booming Consumer Brand

Bank of America (BAC) experienced a significant share price drop today following the news that Warren Buffett's Berkshire Hathaway has reduced its stake in the financial giant. The move, coupled with Berkshire Hathaway's simultaneous investment in a rapidly growing consumer brand, has sent ripples through the financial markets and sparked considerable speculation. This unexpected shift in investment strategy raises questions about the future outlook for Bank of America and the broader banking sector.

Buffett's Strategic Shift: A Sign of Market Uncertainty?

The sale of a portion of Berkshire Hathaway's substantial Bank of America holdings has caught many investors off guard. While Berkshire Hathaway remains a significant shareholder, the reduction in its stake signifies a shift in investment priorities. This move comes amidst growing concerns about potential economic slowdown and rising interest rates, factors that can significantly impact the performance of financial institutions. Some analysts interpret this as a sign of caution from the "Oracle of Omaha," suggesting potential headwinds for the banking sector. The precise reasons behind Buffett's decision remain unclear, though market speculation points to several contributing factors.

The Rise of the Consumer Brand: A Contrarian Play?

In contrast to the divestment from Bank of America, Berkshire Hathaway's investment in [Name of Consumer Brand – Replace with actual brand name if known], a burgeoning consumer goods company, highlights a contrarian investment strategy. This suggests that Buffett sees significant growth potential in the consumer sector, even amidst economic uncertainty. [Name of Consumer Brand – Replace with actual brand name if known] has seen impressive growth in recent quarters, driven by [mention key factors driving growth, e.g., innovative products, strong marketing, expanding market share]. This strategic move underscores the dynamism of the consumer goods market and its resilience in the face of economic headwinds. The exact details of Berkshire Hathaway's investment are yet to be publicly disclosed, further fueling market intrigue.

Impact on Bank of America and the Banking Sector:

The immediate impact on Bank of America's share price is undeniable, with a noticeable drop in value following the announcement. However, the long-term implications remain to be seen. While some analysts express concern about the potential implications of reduced institutional investor confidence, others argue that Bank of America’s fundamentals remain strong, and this dip represents a buying opportunity. The broader banking sector is also likely to feel the impact, with investors closely monitoring market sentiment and assessing the potential for similar shifts in investment strategies from other major players.

What's Next for Investors?

The events of today underscore the volatile nature of the financial markets and the importance of diversification in investment portfolios. Investors are now left to analyze the implications of these significant developments, considering the potential long-term effects on both Bank of America and the broader economic landscape. Further analysis of Berkshire Hathaway’s 13F filings will provide more clarity on the details of their investment decisions, allowing investors to make informed decisions. It's crucial for investors to stay informed and consult with financial advisors before making any significant investment changes.

Keywords: Bank of America, BAC, Berkshire Hathaway, Warren Buffett, stock market, investment, consumer brands, economic slowdown, interest rates, financial news, market analysis, investment strategy, stock prices, share price, 13F filings.

(Note: Replace "[Name of Consumer Brand – Replace with actual brand name if known]" with the actual name of the consumer brand once it is publicly confirmed.)

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Bank Of America Shares Plunge As Buffett Offloads Stake, Invests In Booming Consumer Brand. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Alexander Bubliks View The Mental Landscape Of Professional Tennis

Jun 05, 2025

Alexander Bubliks View The Mental Landscape Of Professional Tennis

Jun 05, 2025 -

Patriot League Expands Villanova Added As Football Associate Member

Jun 05, 2025

Patriot League Expands Villanova Added As Football Associate Member

Jun 05, 2025 -

Supreme Court Ruling Favors Straight Woman Easing Reverse Discrimination Lawsuits

Jun 05, 2025

Supreme Court Ruling Favors Straight Woman Easing Reverse Discrimination Lawsuits

Jun 05, 2025 -

Survivors Speak Out The Reality Of Daily Grooming Abuse

Jun 05, 2025

Survivors Speak Out The Reality Of Daily Grooming Abuse

Jun 05, 2025 -

Dollar Generals Growth Amidst Economic Uncertainty A Tariff Driven Trend

Jun 05, 2025

Dollar Generals Growth Amidst Economic Uncertainty A Tariff Driven Trend

Jun 05, 2025

Latest Posts

-

Travel To South Korea New Measles Vaccination Advisory Issued

Aug 17, 2025

Travel To South Korea New Measles Vaccination Advisory Issued

Aug 17, 2025 -

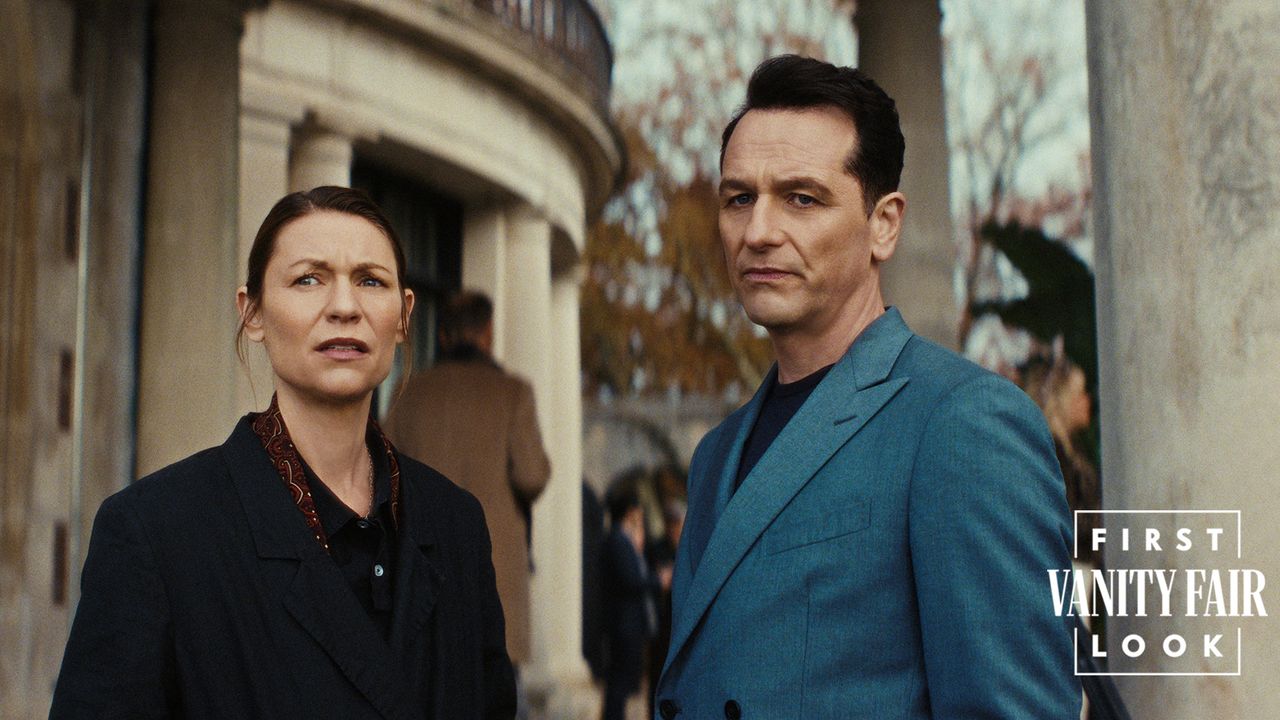

The Beast In Me Claire Danes And Matthew Rhys Explore Gritty New Roles

Aug 17, 2025

The Beast In Me Claire Danes And Matthew Rhys Explore Gritty New Roles

Aug 17, 2025 -

Nigel Farage Pushes For Reform Uk Appointments To The House Of Lords

Aug 17, 2025

Nigel Farage Pushes For Reform Uk Appointments To The House Of Lords

Aug 17, 2025 -

Caught Stealing Premiere Star Studded Affair In Texas

Aug 17, 2025

Caught Stealing Premiere Star Studded Affair In Texas

Aug 17, 2025 -

Is Measles A Travel Risk Your Guide To Safe International Travel

Aug 17, 2025

Is Measles A Travel Risk Your Guide To Safe International Travel

Aug 17, 2025