Bank Of America Stock Sale: Birmingham Capital Management's Recent Transaction

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Bank of America Stock Sale: Birmingham Capital Management's Strategic Move

Birmingham Capital Management's recent divestment of Bank of America (BAC) stock has sent ripples through the financial markets, prompting analysts to dissect the motivations behind this significant transaction. The sale, the details of which remain partially undisclosed, has sparked considerable interest and speculation regarding the future performance of both BAC and the broader financial sector. This article will delve into the available information, exploring the potential implications of this transaction and offering expert insights.

Understanding the Transaction:

While the exact volume of Bank of America shares sold by Birmingham Capital Management remains unconfirmed, market sources suggest a substantial reduction in their holdings. The timing of the sale, coinciding with [mention specific market conditions or events, e.g., rising interest rates, a period of market volatility], has added another layer of intrigue to the situation. Birmingham Capital Management, known for its [describe their investment strategy, e.g., long-term value investing, active trading approach], has not yet issued a public statement clarifying the reasoning behind this strategic move.

Possible Reasons Behind the Sale:

Several factors could have contributed to Birmingham Capital Management's decision to sell its Bank of America stock. These include:

- Profit-Taking: Following a period of growth in Bank of America's stock price, the sale could simply represent a strategic decision to secure profits and reallocate capital to other investment opportunities.

- Portfolio Rebalancing: Birmingham Capital Management might have decided to rebalance its portfolio, reducing its exposure to the financial sector in favor of other asset classes deemed more promising.

- Market Outlook: Concerns about the broader economic outlook or the future performance of the banking sector could have also prompted the sale. Rising interest rates and potential recessionary pressures are significant factors impacting the financial industry.

- Internal Investment Strategy Shifts: Changes in Birmingham Capital Management's internal investment strategy or risk tolerance could have also contributed to the decision.

Impact on Bank of America Stock:

The impact of Birmingham Capital Management's sale on Bank of America's stock price has been [describe the immediate impact – e.g., relatively minor, noticeable dip, etc.]. However, the long-term consequences remain uncertain. Many analysts are closely monitoring the situation, anticipating further market reactions. It's crucial to remember that individual investor transactions, even large ones, don't always dictate the overall market trajectory. Factors like broader economic trends and regulatory changes play a significantly larger role in long-term stock performance.

Expert Opinions and Future Outlook:

[Quote an expert analyst or financial news source on their perspective of the transaction and its potential implications. Link to the source]. The overall market sentiment towards Bank of America remains [positive/negative/neutral], with analysts citing [mention relevant factors, e.g., strong earnings reports, concerns about loan defaults, etc.].

Conclusion:

The sale of Bank of America stock by Birmingham Capital Management is a noteworthy event that warrants close observation. While the precise reasons remain undisclosed, potential factors ranging from profit-taking to strategic portfolio adjustments are plausible explanations. The long-term effects on both BAC and the wider financial market will depend on various factors, including the overall economic climate and the performance of the banking sector as a whole. Further developments and official statements from Birmingham Capital Management are eagerly anticipated. Stay tuned for updates on this unfolding story.

Keywords: Bank of America, BAC Stock, Birmingham Capital Management, Stock Sale, Financial News, Investment Strategy, Portfolio Rebalancing, Market Analysis, Stock Market, Economic Outlook, Financial Sector.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Bank Of America Stock Sale: Birmingham Capital Management's Recent Transaction. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Bank Of America Bac 8th Largest Position For Financial Avengers Inc

May 28, 2025

Bank Of America Bac 8th Largest Position For Financial Avengers Inc

May 28, 2025 -

The Seven Suspects Alleged Roles In Assisting New Orleans Jail Escapees

May 28, 2025

The Seven Suspects Alleged Roles In Assisting New Orleans Jail Escapees

May 28, 2025 -

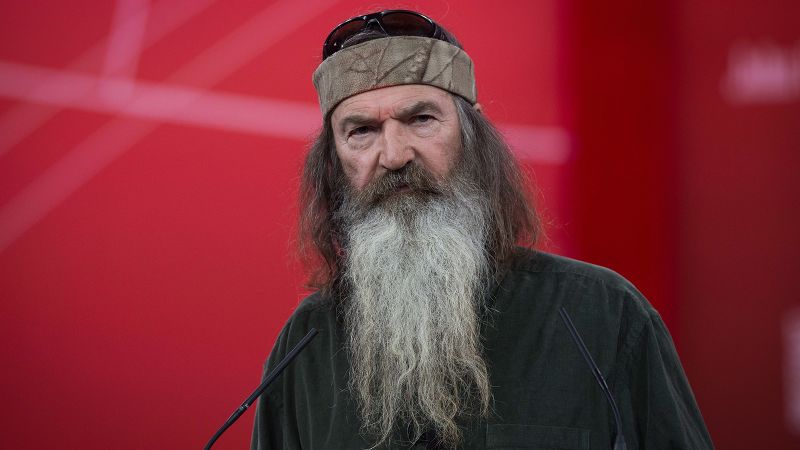

Duck Dynastys Phil Robertson Dead At 79 A Legacy Remembered

May 28, 2025

Duck Dynastys Phil Robertson Dead At 79 A Legacy Remembered

May 28, 2025 -

Liverpool Fc Parade Disruption Key Facts And Information

May 28, 2025

Liverpool Fc Parade Disruption Key Facts And Information

May 28, 2025 -

Important Social Security News 5 108 Payments Sent This Week

May 28, 2025

Important Social Security News 5 108 Payments Sent This Week

May 28, 2025

Latest Posts

-

Elon Musks Resignation Implications For The Trump Administration

May 30, 2025

Elon Musks Resignation Implications For The Trump Administration

May 30, 2025 -

Today Show Co Host Sheinelle Jones Mourns Husbands Passing

May 30, 2025

Today Show Co Host Sheinelle Jones Mourns Husbands Passing

May 30, 2025 -

Sacred Belongings Indigenous Communities Seek Repatriation From The Vatican

May 30, 2025

Sacred Belongings Indigenous Communities Seek Repatriation From The Vatican

May 30, 2025 -

California Track And Field Rule Change Debate Heats Up After Trans Athletes Win

May 30, 2025

California Track And Field Rule Change Debate Heats Up After Trans Athletes Win

May 30, 2025 -

Heat Pump Installation Made Easy The Importance Of Proper Planning

May 30, 2025

Heat Pump Installation Made Easy The Importance Of Proper Planning

May 30, 2025