Bank Of England Cuts Rates: What This Means For The UK Economy

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Bank of England Cuts Rates: What This Means for the UK Economy

The Bank of England (BoE) has unexpectedly cut interest rates, sending shockwaves through the UK economy and sparking a flurry of debate among economists. This bold move, aimed at stimulating growth and combating slowing economic activity, has significant implications for borrowers, savers, and businesses alike. But what does this rate cut actually mean for the average Brit, and for the UK's financial future?

Understanding the Rate Cut:

The BoE's Monetary Policy Committee (MPC) decided to lower the base rate, a key interest rate that influences borrowing costs across the country. This reduction aims to encourage borrowing and spending, thereby boosting economic activity. A lower base rate typically translates to lower interest rates on loans, mortgages, and credit cards, making borrowing cheaper. However, it also usually means lower returns on savings accounts.

Impact on Borrowers:

For homeowners with variable-rate mortgages, this rate cut could mean lower monthly repayments, providing some much-needed relief amidst the current cost of living crisis. Similarly, individuals and businesses taking out new loans or refinancing existing ones will likely benefit from lower interest rates. This could stimulate investment and spending, boosting economic growth.

Impact on Savers:

Unfortunately, the flip side of lower borrowing costs is lower returns for savers. Interest rates on savings accounts and other deposit accounts are likely to fall, potentially reducing the income generated from savings. This could disproportionately affect those reliant on savings income, particularly retirees.

Implications for the UK Economy:

The BoE's decision reflects concerns about the UK's economic outlook. Slowing growth, high inflation, and the ongoing global economic uncertainty have prompted this intervention. The aim is to prevent a more significant economic downturn by injecting much-needed liquidity into the market. However, the effectiveness of this measure is subject to debate.

Potential Risks and Criticisms:

While the rate cut aims to boost the economy, critics argue that it may not be sufficient to address the underlying issues. Some economists believe that the current economic slowdown is primarily driven by factors beyond the reach of interest rate adjustments, such as supply chain disruptions and geopolitical instability. Furthermore, a sustained period of low interest rates could potentially fuel inflation in the long run.

What Happens Next?

The impact of this rate cut will unfold over time. The BoE will closely monitor economic indicators to assess the effectiveness of its policy and decide on future actions. It's crucial to stay informed about economic news and updates from reputable sources like the Bank of England website and the Office for National Statistics.

Key Takeaways:

- Lower borrowing costs: Expect lower interest rates on loans and mortgages.

- Lower savings returns: Interest earned on savings accounts will likely decrease.

- Stimulus for the economy: The BoE hopes this will boost spending and investment.

- Uncertainty remains: The long-term effectiveness of this measure is yet to be seen.

This rate cut represents a significant move by the Bank of England, signaling a concerted effort to navigate the challenges facing the UK economy. However, only time will tell the true impact of this decision and its long-term consequences for individuals and the nation as a whole. Stay informed, and consider consulting a financial advisor for personalized advice.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Bank Of England Cuts Rates: What This Means For The UK Economy. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Jd Vances Uk Trip Meeting With David Lammy At Country Estate

Aug 09, 2025

Jd Vances Uk Trip Meeting With David Lammy At Country Estate

Aug 09, 2025 -

Get Your Tickets Watch Inter Milans Summer Friendlies

Aug 09, 2025

Get Your Tickets Watch Inter Milans Summer Friendlies

Aug 09, 2025 -

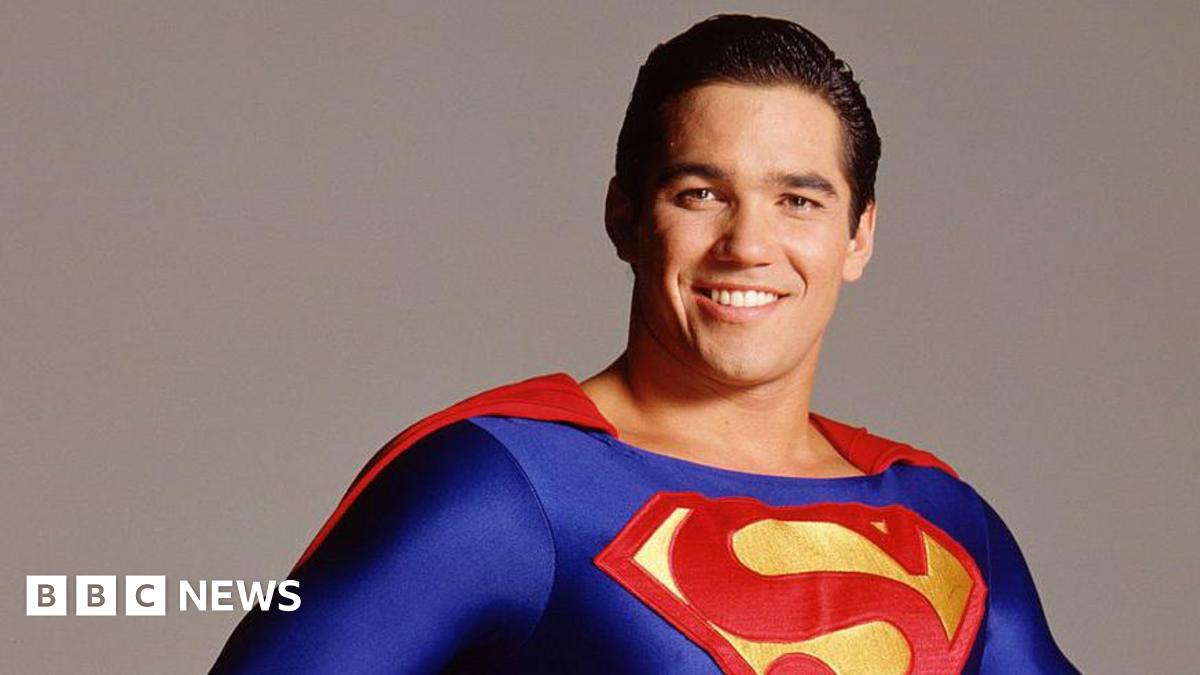

Dean Cain From Superman To Ice Agent Actor Announces Career Change

Aug 09, 2025

Dean Cain From Superman To Ice Agent Actor Announces Career Change

Aug 09, 2025 -

Two Year Low Uk Interest Rates Slashed By Bank Of England

Aug 09, 2025

Two Year Low Uk Interest Rates Slashed By Bank Of England

Aug 09, 2025 -

Escalating Tensions Examining Trumps Threats Of Military Action On Us Soil

Aug 09, 2025

Escalating Tensions Examining Trumps Threats Of Military Action On Us Soil

Aug 09, 2025

Latest Posts

-

Wwii Hypothetical Us Ambassador To Israel Criticizes Keir Starmers Leadership

Aug 10, 2025

Wwii Hypothetical Us Ambassador To Israel Criticizes Keir Starmers Leadership

Aug 10, 2025 -

From Courtside To Cyberspace How Wnba Sex Toy Tosses Highlight Online Behavior And Womens Sports Issues

Aug 10, 2025

From Courtside To Cyberspace How Wnba Sex Toy Tosses Highlight Online Behavior And Womens Sports Issues

Aug 10, 2025 -

Ufc Fight Night Edwards Vs Cachoeira Betting Odds And Analysis

Aug 10, 2025

Ufc Fight Night Edwards Vs Cachoeira Betting Odds And Analysis

Aug 10, 2025 -

Jaxson Darts Preseason Debut Best Plays And Highlights From Week 1

Aug 10, 2025

Jaxson Darts Preseason Debut Best Plays And Highlights From Week 1

Aug 10, 2025 -

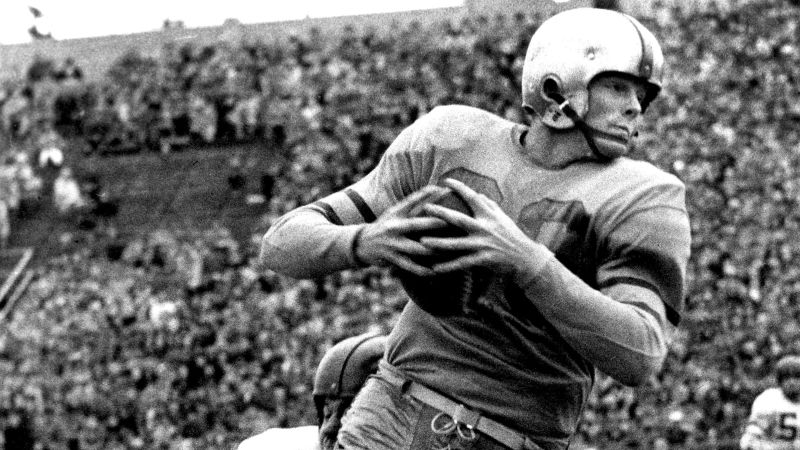

Hall Of Fame Candidate Billy Howton Packers Star And Nflpa Founder Dead At 95

Aug 10, 2025

Hall Of Fame Candidate Billy Howton Packers Star And Nflpa Founder Dead At 95

Aug 10, 2025