Bank Of England Interest Rate Cut: Reasons And Implications

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Bank of England Interest Rate Cut: Reasons and Implications for the UK Economy

The Bank of England (BoE) recently announced a surprise interest rate cut, sending shockwaves through the financial markets. This unexpected move, a significant shift in monetary policy, has sparked considerable debate about its underlying reasons and potential consequences for the UK economy. Understanding the rationale behind this decision and its broader implications is crucial for businesses, investors, and consumers alike.

Why the Interest Rate Cut? A Deep Dive into the BoE's Rationale

The BoE's decision to lower interest rates wasn't taken lightly. Several key factors contributed to this bold move, primarily centered around concerns regarding economic slowdown and inflation. While inflation remains stubbornly high, the central bank clearly prioritized mitigating the risks of a significant economic contraction.

-

Weakening Economic Growth: Recent data pointed towards a weakening UK economy, with indicators suggesting slower-than-expected growth. Concerns about a potential recession, fueled by global uncertainty and the ongoing impact of Brexit, played a significant role in the BoE's assessment. This slowdown threatens job security and consumer spending, potentially leading to a deflationary spiral.

-

Inflationary Pressures Easing (Slightly): While inflation remains above the BoE's target of 2%, there are signs that inflationary pressures are beginning to ease, albeit slowly. This provided a small window of opportunity for the central bank to stimulate growth without exacerbating inflation further. However, the BoE will be closely monitoring inflation figures in the coming months.

-

Global Economic Uncertainty: The global economic landscape remains precarious, with geopolitical tensions and ongoing supply chain disruptions contributing to uncertainty. The BoE likely aimed to provide a buffer against potential negative shocks emanating from abroad, bolstering the UK's economic resilience.

Implications of the Interest Rate Cut: Winners and Losers

The implications of this interest rate cut are multifaceted and will impact various sectors differently:

-

Borrowers: Lower interest rates make borrowing cheaper, potentially boosting consumer spending and business investment. This is a boon for mortgage holders, businesses seeking loans for expansion, and individuals planning large purchases.

-

Savers: Conversely, lower interest rates mean lower returns on savings accounts. This could negatively impact individuals reliant on interest income for their livelihoods.

-

The Housing Market: The impact on the housing market is complex. While cheaper mortgages could stimulate demand, the overall economic outlook remains uncertain, potentially dampening the effect.

-

Pound Sterling: The interest rate cut could weaken the Pound Sterling against other currencies, making imports more expensive but exports potentially more competitive.

Looking Ahead: What to Expect

The BoE's decision is a calculated gamble, aiming to strike a balance between supporting economic growth and controlling inflation. The effectiveness of this strategy will depend on several factors, including the global economic environment, consumer confidence, and the future trajectory of inflation. The BoE will continue to monitor economic data closely and may adjust its monetary policy further depending on evolving circumstances.

Further Reading:

- – Official announcements and data.

-

- For in-depth analysis and commentary.

This interest rate cut marks a significant turning point in UK monetary policy. Only time will tell if it proves to be the correct course of action in navigating the complex economic challenges facing the nation. Staying informed about future developments is crucial for anyone seeking to understand and adapt to the changing economic landscape.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Bank Of England Interest Rate Cut: Reasons And Implications. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Uncovering The Brands Behind Tommy Fleetwood A Deep Dive Into His Sponsorships

Aug 09, 2025

Uncovering The Brands Behind Tommy Fleetwood A Deep Dive Into His Sponsorships

Aug 09, 2025 -

Tommy Fleetwoods Net Worth And Relationship History Fact Vs Fiction

Aug 09, 2025

Tommy Fleetwoods Net Worth And Relationship History Fact Vs Fiction

Aug 09, 2025 -

Preseason 2025 Identifying A Tradeable Player From Every Nfl Team

Aug 09, 2025

Preseason 2025 Identifying A Tradeable Player From Every Nfl Team

Aug 09, 2025 -

Police Apprehend Two Following Water Spray Attack On Orthodox Jewish Community

Aug 09, 2025

Police Apprehend Two Following Water Spray Attack On Orthodox Jewish Community

Aug 09, 2025 -

Daily Pill For Weight Management 12 Weight Loss Reported

Aug 09, 2025

Daily Pill For Weight Management 12 Weight Loss Reported

Aug 09, 2025

Latest Posts

-

Detroit Lions Suffer Setback Ennis Rakestraw Jr To Miss Entire Season

Aug 09, 2025

Detroit Lions Suffer Setback Ennis Rakestraw Jr To Miss Entire Season

Aug 09, 2025 -

David Lammy Hosts Jd Vance At Private Uk Residence For Talks

Aug 09, 2025

David Lammy Hosts Jd Vance At Private Uk Residence For Talks

Aug 09, 2025 -

Ennis Rakestraw Injury How It Impacts The Lions Secondary

Aug 09, 2025

Ennis Rakestraw Injury How It Impacts The Lions Secondary

Aug 09, 2025 -

Trumps Domestic Military Deployment A Looming Reality

Aug 09, 2025

Trumps Domestic Military Deployment A Looming Reality

Aug 09, 2025 -

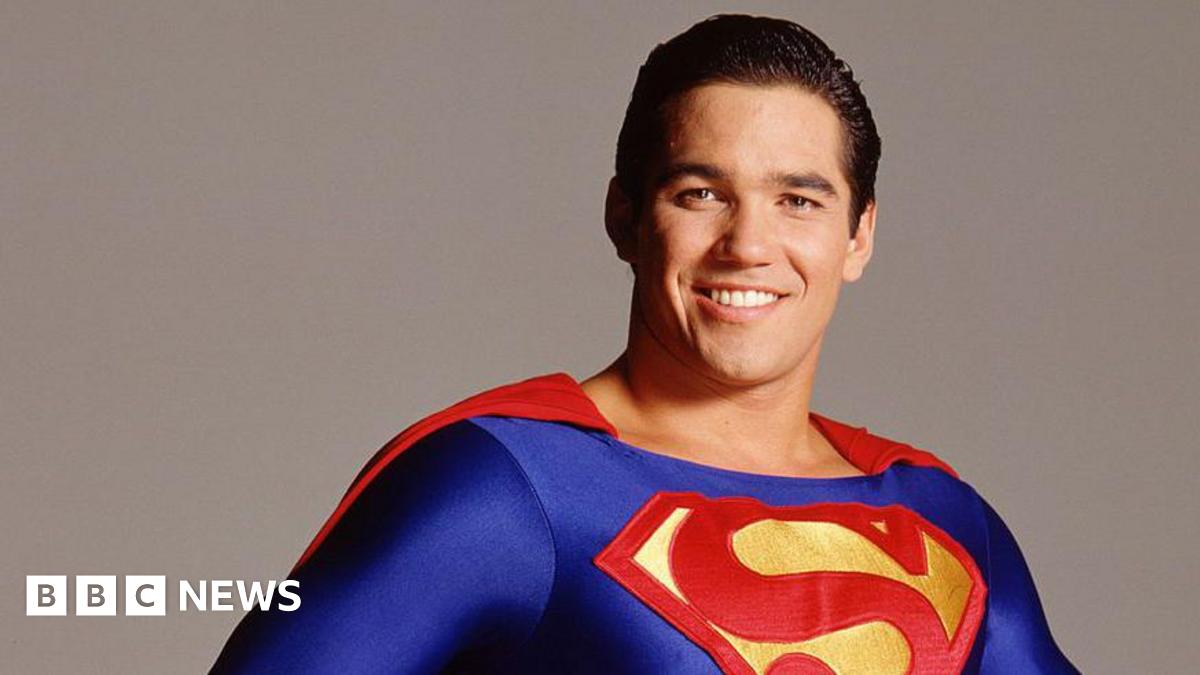

Dean Cains Unexpected Career Change Joining Ice

Aug 09, 2025

Dean Cains Unexpected Career Change Joining Ice

Aug 09, 2025