Beat The College Cost Crisis: Ohio Parents Share 529 Plan Successes

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Beat the College Cost Crisis: Ohio Parents Share 529 Plan Successes

The soaring cost of higher education is a major concern for families across the nation, and Ohio is no exception. But amidst the financial anxieties, a beacon of hope shines brightly: the 529 college savings plan. For many Ohio parents, strategic utilization of 529 plans has proven to be a crucial tool in mitigating the burden of college expenses. This article explores the real-life success stories of Ohio families who have successfully navigated the college cost crisis using 529 plans, offering valuable insights and actionable advice for others.

Understanding the Power of Ohio's 529 Plan

Ohio's 529 Plan, officially known as the Ohio Tuition Trust Authority (OTTA) 529 Plan, offers a tax-advantaged way to save for future education expenses. Contributions grow tax-deferred, and withdrawals used for qualified education expenses are generally tax-free. This makes it a powerful tool for building a substantial college fund, even with modest contributions over time. The plan offers several investment options to suit different risk tolerances and financial goals. Learn more about the specific benefits and investment options on the .

Ohio Families Share Their 529 Success Stories

Several Ohio families have generously shared their experiences, showcasing the positive impact of diligent 529 planning. Here are some key takeaways from their journeys:

1. Early Start, Significant Impact:

Many successful families emphasize the importance of starting early. Even small, regular contributions made from infancy can accumulate significantly over time thanks to the power of compounding interest. One parent, Sarah Miller from Cincinnati, stated, "We started contributing to our daughter's 529 plan when she was just a few months old. While the initial amounts were small, the consistent contributions, coupled with the tax advantages, made a huge difference by the time she started applying to colleges."

2. Setting Realistic Goals & Sticking to the Plan:

Setting achievable savings goals and adhering to a consistent contribution schedule is crucial. Many families utilize automatic monthly transfers from their checking accounts to ensure consistent contributions. This automated approach eliminates the need for manual transfers and minimizes the risk of missed contributions.

3. Diversification and Professional Advice:

Several families highlight the importance of diversifying their 529 plan investments. While some opted for more conservative options, others chose a more aggressive approach depending on their risk tolerance and time horizon. Seeking advice from a financial advisor can help determine the optimal investment strategy based on individual circumstances.

4. Utilizing Tax Advantages:

Ohio’s 529 plan offers several tax advantages, including deductions on state income taxes for contributions. Understanding and utilizing these tax benefits is crucial in maximizing savings. Many parents emphasized the importance of consulting a tax professional to ensure they're taking full advantage of all available deductions and credits.

5. Beyond Tuition: The Broader Scope of 529 Plans:

It’s important to remember that 529 funds can be used for a wide range of qualified education expenses beyond just tuition. These include room and board, books, fees, and even certain computer equipment. This flexibility makes 529 plans even more valuable in covering the overall cost of higher education.

Tips for Ohio Parents Considering a 529 Plan:

- Start saving early: The earlier you start, the more time your money has to grow.

- Set a realistic budget: Determine how much you can comfortably contribute each month.

- Consider professional advice: Consult a financial advisor to help you develop a personalized savings plan.

- Take advantage of tax benefits: Understand and utilize all available tax advantages offered by the Ohio 529 plan.

- Stay informed: Keep track of your account balance and adjust your contributions as needed.

Conclusion:

The success stories of Ohio families demonstrate the transformative power of the 529 college savings plan. By understanding the benefits, planning strategically, and leveraging the available resources, Ohio parents can significantly alleviate the financial burden of higher education and secure a brighter future for their children. Start planning your family's college savings journey today!

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Beat The College Cost Crisis: Ohio Parents Share 529 Plan Successes. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

After Stellar Minor League Performance Mets Call Up Ronny Mauricio

Jun 04, 2025

After Stellar Minor League Performance Mets Call Up Ronny Mauricio

Jun 04, 2025 -

Analyzing Jack Draper The Steps Needed To Compete With Alcaraz And Sinner By 2025

Jun 04, 2025

Analyzing Jack Draper The Steps Needed To Compete With Alcaraz And Sinner By 2025

Jun 04, 2025 -

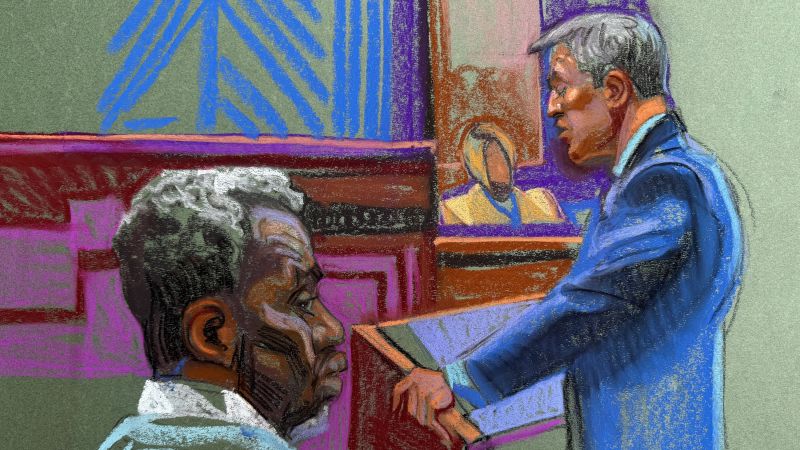

Following The Sean Diddy Combs Legal Battle Key Updates

Jun 04, 2025

Following The Sean Diddy Combs Legal Battle Key Updates

Jun 04, 2025 -

Care Line Live Announces Major Investment From Accel Kkr

Jun 04, 2025

Care Line Live Announces Major Investment From Accel Kkr

Jun 04, 2025 -

Emmy Winner John Brenkus Dead At 54 After Depression Battle

Jun 04, 2025

Emmy Winner John Brenkus Dead At 54 After Depression Battle

Jun 04, 2025

Latest Posts

-

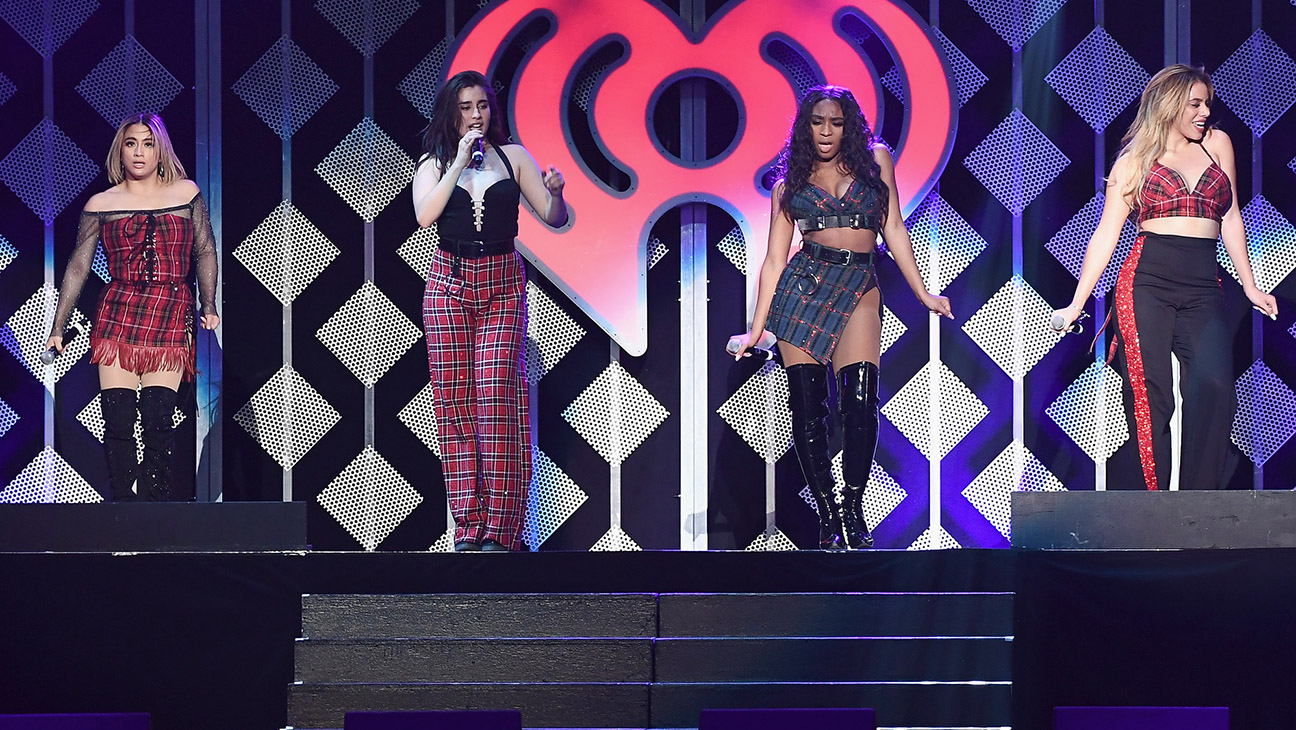

Exclusive Fifth Harmony Minus Camila Discuss Potential Reunion

Jun 06, 2025

Exclusive Fifth Harmony Minus Camila Discuss Potential Reunion

Jun 06, 2025 -

The Reason Behind Walton Goggins Tearful Instagram Unfollow Of Aimee Lou Wood

Jun 06, 2025

The Reason Behind Walton Goggins Tearful Instagram Unfollow Of Aimee Lou Wood

Jun 06, 2025 -

Relationship Update Matthew Hussey Ex Of Camila Cabello Announces Pregnancy

Jun 06, 2025

Relationship Update Matthew Hussey Ex Of Camila Cabello Announces Pregnancy

Jun 06, 2025 -

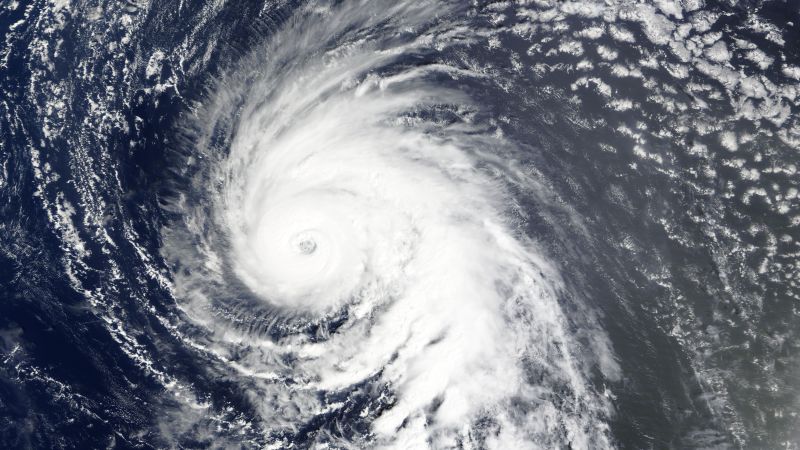

The Potential Of Ghost Hurricanes For Enhanced Hurricane Prediction Models

Jun 06, 2025

The Potential Of Ghost Hurricanes For Enhanced Hurricane Prediction Models

Jun 06, 2025 -

Ais Unforeseen Evolution A Ceo Sounds The Alarm

Jun 06, 2025

Ais Unforeseen Evolution A Ceo Sounds The Alarm

Jun 06, 2025