Berkshire Hathaway Sells Bank Of America Shares, Buys Into Booming Consumer Brand

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Berkshire Hathaway Adjusts Portfolio: Bank of America Shares Shed, Consumer Brand Acquisition Hints at New Strategy

Warren Buffett's Berkshire Hathaway surprised investors this week with a significant portfolio shift. The legendary investor's company revealed in its latest 13F filing a reduction in its Bank of America holdings, simultaneously unveiling a new investment in a rapidly growing consumer brand. This dual move signals a potential strategic shift in Berkshire's investment approach, sparking considerable speculation within the financial world.

The filing, submitted to the Securities and Exchange Commission (SEC), showed a decrease of approximately X% in Berkshire's Bank of America (BAC) shares. While the exact reasons behind this divestment remain unclear, analysts have offered several potential explanations, ranging from profit-taking after a period of significant growth in BAC's share price to a reallocation of capital towards other sectors deemed more promising for future returns. This move follows a trend of Berkshire gradually reducing its exposure to the financial sector in recent years, suggesting a diversification strategy. [Link to SEC 13F filing]

<h3>A Bet on Consumer Spending Power: Berkshire's New Acquisition</h3>

The more intriguing aspect of the filing, however, is Berkshire's previously unannounced investment in [Name of Consumer Brand]. This company, specializing in [brief description of the brand and its products/services], has experienced phenomenal growth in recent years, capitalizing on the [mention relevant market trends, e.g., increasing demand for sustainable products, booming e-commerce sector]. The investment represents a significant bet by Buffett on the enduring power of consumer spending and the long-term potential of this particular brand.

This move deviates from Berkshire's traditional focus on established, financially stable companies. The acquisition of a stake in a rapidly expanding consumer brand suggests a willingness to embrace higher-growth, albeit potentially riskier, investment opportunities. This signals a potential adaptation to the evolving economic landscape and the increasing importance of innovative consumer-facing businesses.

<h3>What Does This Mean for Investors?</h3>

Berkshire Hathaway's portfolio adjustments have sent ripples throughout the market. The reduction in Bank of America shares has led some analysts to speculate on a broader bearish sentiment towards the financial sector, while others maintain a more cautious outlook, citing potential macroeconomic factors. Conversely, the investment in [Name of Consumer Brand] has boosted investor confidence in the company's future prospects, driving up its share price.

- Impact on BAC: The sell-off has had a relatively muted impact on Bank of America’s share price, reflecting a general resilience in the financial sector.

- Impact on [Name of Consumer Brand]: The investment has fueled significant growth in the consumer brand's stock valuation, attracting further investor attention.

- Implications for Berkshire Hathaway: The strategic shift highlights Berkshire's capacity for adaptation and its ongoing search for promising investment opportunities across diverse sectors.

The long-term implications of Berkshire's actions remain to be seen. However, these recent moves demonstrate a willingness to adjust its strategy in response to market dynamics and capitalize on emerging growth opportunities. This dynamic approach confirms Berkshire Hathaway's enduring relevance in the constantly evolving world of finance and investment.

Call to Action: Stay informed about the latest developments in the financial markets by subscribing to our newsletter [link to newsletter signup]. We provide in-depth analysis and insights on major investment trends.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Berkshire Hathaway Sells Bank Of America Shares, Buys Into Booming Consumer Brand. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

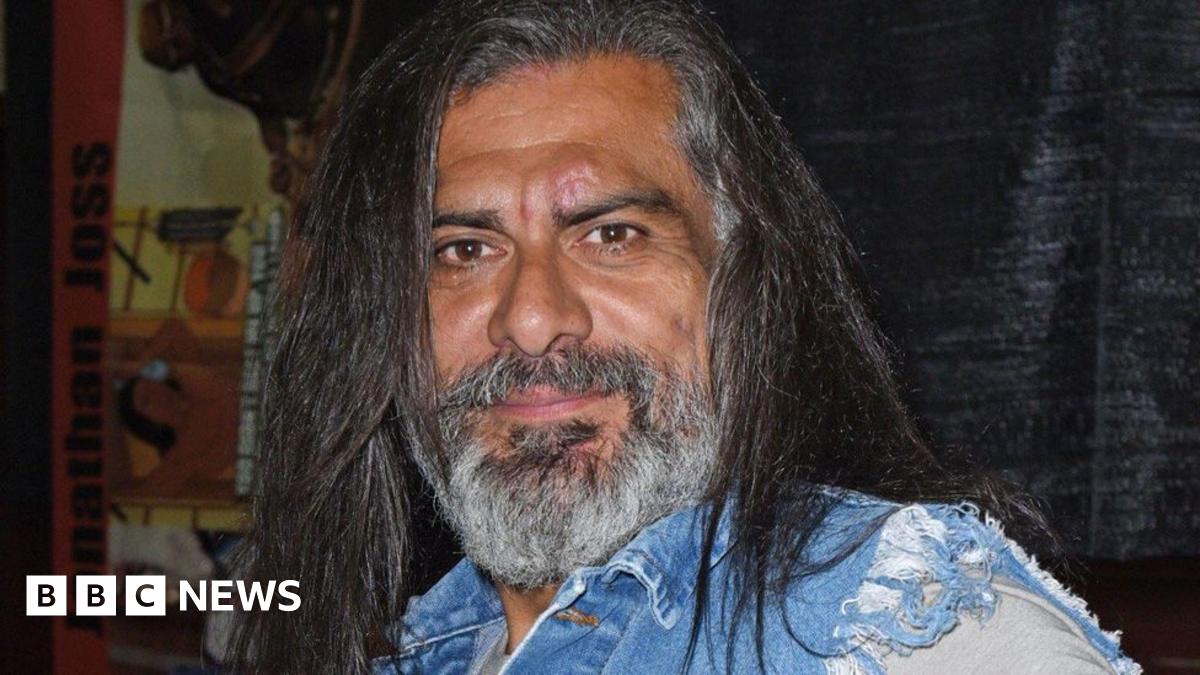

Actor Jonathan Joss John Redcorn King Of The Hill Shot And Killed

Jun 04, 2025

Actor Jonathan Joss John Redcorn King Of The Hill Shot And Killed

Jun 04, 2025 -

Private Equity Firm Accel Kkr Invests In Healthcare Technology Leader Care Line Live

Jun 04, 2025

Private Equity Firm Accel Kkr Invests In Healthcare Technology Leader Care Line Live

Jun 04, 2025 -

Roland Garros 2024 Tiafoes Historic Win Ends Two Decade Wait For Us Men

Jun 04, 2025

Roland Garros 2024 Tiafoes Historic Win Ends Two Decade Wait For Us Men

Jun 04, 2025 -

9 Proven Ways To Fund Your Childs College Education

Jun 04, 2025

9 Proven Ways To Fund Your Childs College Education

Jun 04, 2025 -

Whats New In The Sean Diddy Combs Case The Latest Updates

Jun 04, 2025

Whats New In The Sean Diddy Combs Case The Latest Updates

Jun 04, 2025

Latest Posts

-

Is Nvidias Core Weave The Next Us Profit Giant A Financial Analysis

Jun 06, 2025

Is Nvidias Core Weave The Next Us Profit Giant A Financial Analysis

Jun 06, 2025 -

Supreme Court Weighs In On Reverse Discrimination A Womans Case

Jun 06, 2025

Supreme Court Weighs In On Reverse Discrimination A Womans Case

Jun 06, 2025 -

U Turn On Winter Fuel Payments What You Need To Know

Jun 06, 2025

U Turn On Winter Fuel Payments What You Need To Know

Jun 06, 2025 -

Supreme Court Decision Impacts Reverse Discrimination Lawsuits

Jun 06, 2025

Supreme Court Decision Impacts Reverse Discrimination Lawsuits

Jun 06, 2025 -

Robinhood Stock Solid Reasons For Investors To Buy Now

Jun 06, 2025

Robinhood Stock Solid Reasons For Investors To Buy Now

Jun 06, 2025