Berkshire Hathaway's Major Shift: Bank Of America Sale Fuels Consumer Brand Investment

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Berkshire Hathaway's Major Shift: Bank of America Sale Fuels Consumer Brand Investment

Warren Buffett's Berkshire Hathaway has sent shockwaves through the financial world, announcing a significant reduction in its Bank of America stake alongside a noticeable increase in investments targeting consumer brands. This strategic shift marks a departure from Berkshire's traditional focus on established financial institutions and reveals a new appetite for the dynamism of the consumer goods market. The move has sparked intense speculation about Buffett's long-term investment strategy and the future direction of the Berkshire Hathaway portfolio.

A Billions-Dollar Bet on Consumer Confidence

The sale of a substantial portion of Berkshire's Bank of America shares, reportedly valued at billions of dollars, has freed up significant capital. This capital isn't being channeled into more traditional financial investments; instead, it's fueling a noticeable increase in holdings within the consumer brands sector. While Berkshire hasn't publicly disclosed the specifics of all its new investments, recent filings reveal increased stakes in companies known for their strong consumer appeal and brand recognition. This bolder approach signals a bet on the resilience and growth potential of the consumer market, even amidst current economic uncertainties.

Diversification Strategy or a Change in Philosophy?

This shift raises questions about whether this is simply a diversification strategy or a fundamental change in Berkshire Hathaway's investment philosophy. For decades, Buffett has favored established, blue-chip companies with predictable earnings. However, the recent investments in consumer brands suggest a willingness to embrace companies with higher growth potential, albeit with potentially higher risk. This could reflect an adaptation to evolving market conditions and a recognition of the growing importance of the consumer sector in the global economy. Analysts are closely watching to see if this marks a long-term trend or a temporary adjustment.

Which Consumer Brands are Attracting Berkshire's Attention?

While specific details remain limited due to the complexities of Berkshire's investment portfolio, some analysts point to increased holdings in companies within the food, beverage, and retail sectors as indicative of this new focus. The strength and recognition of these brands likely offer a level of stability that aligns with Buffett's risk-averse approach, even within a more dynamic sector. Further investigation into Berkshire's SEC filings will be necessary to fully understand the scope of this investment shift.

The Implications for Investors

This significant strategic move by Berkshire Hathaway has significant implications for investors. It suggests that the traditionally conservative investment giant is adapting to a changing economic landscape and seeking higher-growth opportunities. This could influence other investors to reconsider their own portfolio allocations and explore opportunities within the consumer brands market. The long-term effects of this shift remain to be seen, but it undeniably represents a major turning point in Berkshire Hathaway's history.

What are your thoughts on Berkshire Hathaway's shift towards consumer brands? Share your insights in the comments below!

(Disclaimer: This article provides general information and should not be considered financial advice. Consult a financial professional before making any investment decisions.)

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Berkshire Hathaway's Major Shift: Bank Of America Sale Fuels Consumer Brand Investment. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Following The Case The Latest News On The Sean Combs Trial

Jun 05, 2025

Following The Case The Latest News On The Sean Combs Trial

Jun 05, 2025 -

Instability In The Netherlands Coalition Government Faces Collapse After Wilders Exit

Jun 05, 2025

Instability In The Netherlands Coalition Government Faces Collapse After Wilders Exit

Jun 05, 2025 -

French Open Bubliks Shock Win Djokovic Advances Match Highlights

Jun 05, 2025

French Open Bubliks Shock Win Djokovic Advances Match Highlights

Jun 05, 2025 -

Patriot League Welcomes Villanova Football A 2026 Addition

Jun 05, 2025

Patriot League Welcomes Villanova Football A 2026 Addition

Jun 05, 2025 -

Your Guide To Glastonbury 2025 Lineup Schedule And Unannounced Acts

Jun 05, 2025

Your Guide To Glastonbury 2025 Lineup Schedule And Unannounced Acts

Jun 05, 2025

Latest Posts

-

Battlefield 6s Rush Mode A Letdown Player Feedback On Map Size

Aug 17, 2025

Battlefield 6s Rush Mode A Letdown Player Feedback On Map Size

Aug 17, 2025 -

Stalker 2 Coming To Ps 5 And Ps 5 Pro Development Update Includes Engine Upgrade

Aug 17, 2025

Stalker 2 Coming To Ps 5 And Ps 5 Pro Development Update Includes Engine Upgrade

Aug 17, 2025 -

1992 Biden Sounds Alarm On Dc Crime Democrats Now Criticize Trumps Response

Aug 17, 2025

1992 Biden Sounds Alarm On Dc Crime Democrats Now Criticize Trumps Response

Aug 17, 2025 -

Ryo Otas Eighth Bases Loaded Grand Slam Narrows The Gap

Aug 17, 2025

Ryo Otas Eighth Bases Loaded Grand Slam Narrows The Gap

Aug 17, 2025 -

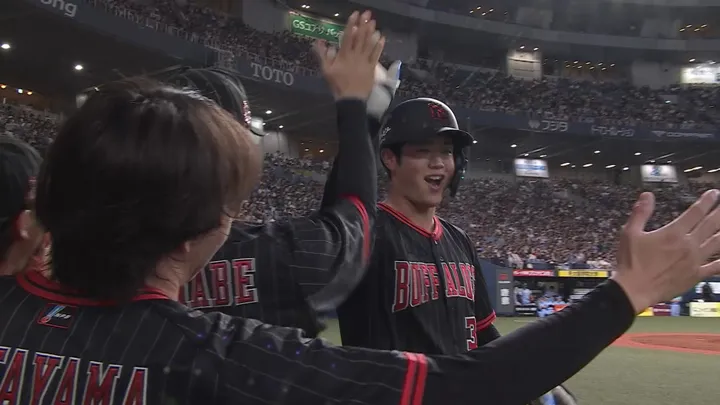

Orixs Nakagawa Delivers Two Run Blast Sixth Inning Comeback

Aug 17, 2025

Orixs Nakagawa Delivers Two Run Blast Sixth Inning Comeback

Aug 17, 2025