Big Beautiful Bill: Do I Qualify For Stimulus Money?

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Big Beautiful Bill: Do I Qualify for Stimulus Money?

The American Rescue Plan Act, often referred to as the "Big Beautiful Bill," delivered significant stimulus payments to millions of Americans. But with complex eligibility requirements, many are still unsure if they qualified. This guide breaks down the key factors to determine if you received – or should have received – your stimulus check.

Understanding the American Rescue Plan Stimulus Payments

The American Rescue Plan Act, signed into law in March 2021, included a third round of Economic Impact Payments (EIP), also known as stimulus checks. Unlike previous rounds, the eligibility criteria and payment amounts were slightly different. This means that even if you received previous stimulus checks, you might not have received the full amount or any payment under this act.

Key Eligibility Factors:

- Filing Status: Your filing status (single, married filing jointly, head of household, etc.) significantly impacted your eligibility and the amount you received. Married couples filing jointly generally received a higher payment than single filers.

- Adjusted Gross Income (AGI): Your AGI, as reported on your 2019 or 2020 tax return, played a crucial role. There were income limits, and payments were reduced or eliminated for those exceeding specific thresholds. These thresholds varied based on your filing status.

- Dependents: The presence of qualifying dependents, such as children under 17, also influenced the amount of your stimulus payment. Each qualifying dependent added to your total payment. [Link to IRS guidelines on qualifying dependents]

- Citizenship and Residency Status: You had to be a U.S. citizen, U.S. national, or U.S. resident alien to qualify. Specific requirements applied to non-citizen spouses and dependents.

What if I Didn't Receive My Payment?

If you believe you were eligible for a stimulus payment but didn't receive it, don't despair. The IRS has resources available to help you.

- Check the IRS's Get My Payment portal: This online tool allows you to track the status of your payment and find out if one was issued. [Link to IRS Get My Payment portal]

- File an amended tax return (Form 1040-X): If you've already filed your taxes, you may be able to claim the Recovery Rebate Credit on an amended return. This credit can help you claim any missed stimulus payments. [Link to IRS Form 1040-X]

- Contact the IRS directly: If you have encountered issues or need further assistance, you can contact the IRS directly through their various communication channels. Be prepared to provide relevant documentation.

Frequently Asked Questions (FAQs):

- Q: What if I didn't file a tax return? A: You may still be eligible. You can file a simplified tax return to claim the Recovery Rebate Credit.

- Q: My income changed significantly between 2019 and 2020. Does that affect my eligibility? A: The IRS used either your 2019 or 2020 AGI, depending on which year resulted in a larger payment.

- Q: I'm a college student. Do I qualify? A: It depends on your income and filing status. Check the IRS guidelines for specifics.

Conclusion:

Navigating the complexities of the American Rescue Plan Act’s stimulus payments can be challenging. By understanding the key eligibility factors and utilizing the resources provided by the IRS, you can determine if you received your full entitlement and take steps to claim any missed payments. Remember to consult with a tax professional if you have any doubts or require personalized guidance. Don't hesitate to reach out – claiming your stimulus payment is your right!

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Big Beautiful Bill: Do I Qualify For Stimulus Money?. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Ineficaces Funcionarios Cuestionan La Precision De Los Pronosticos Del Clima En Texas

Jul 07, 2025

Ineficaces Funcionarios Cuestionan La Precision De Los Pronosticos Del Clima En Texas

Jul 07, 2025 -

What You Need To Know About Stimulus Checks In The Big Beautiful Bill

Jul 07, 2025

What You Need To Know About Stimulus Checks In The Big Beautiful Bill

Jul 07, 2025 -

Perpetual Equity Investment Nta Support Confirmed For July 2025

Jul 07, 2025

Perpetual Equity Investment Nta Support Confirmed For July 2025

Jul 07, 2025 -

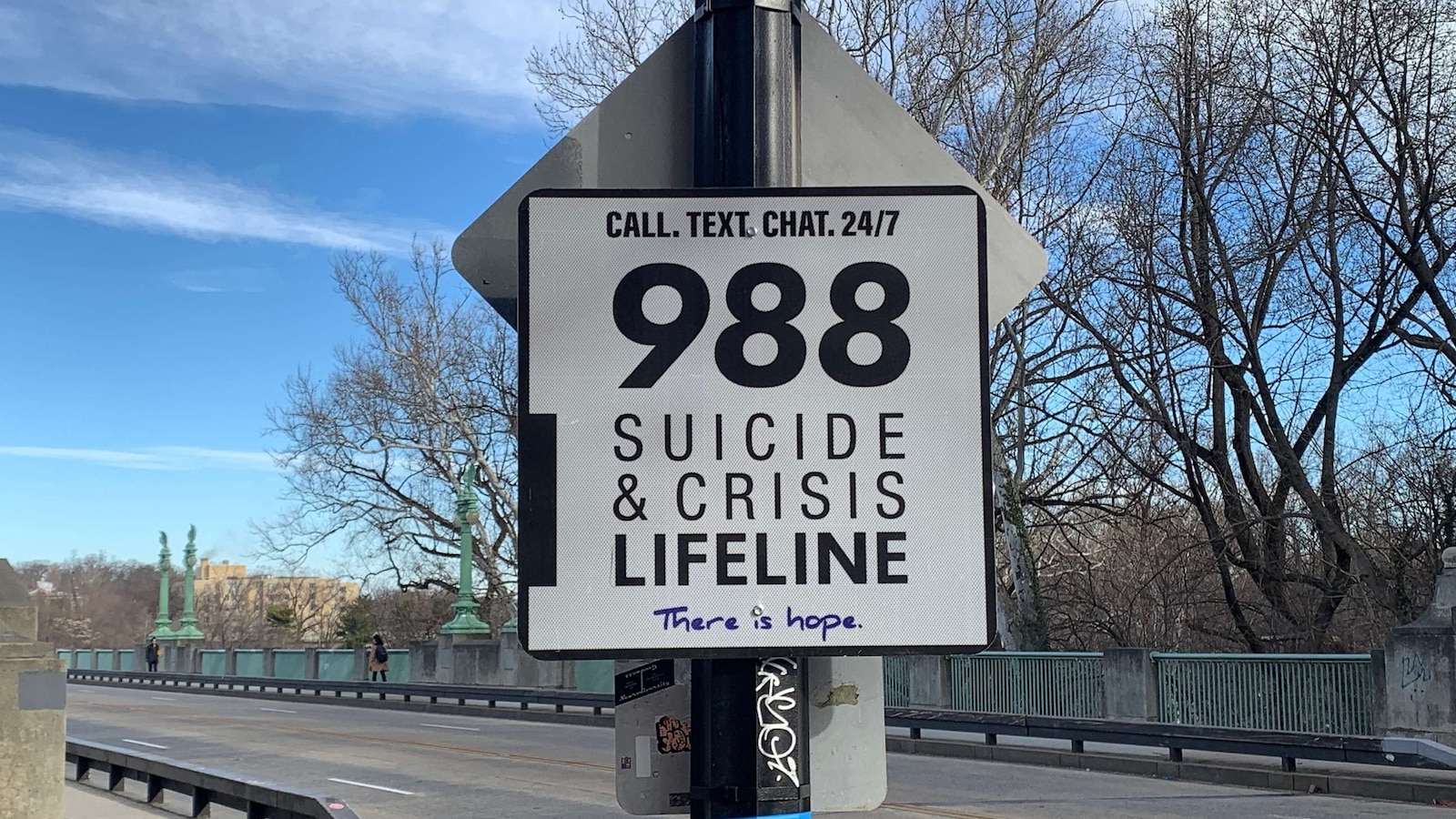

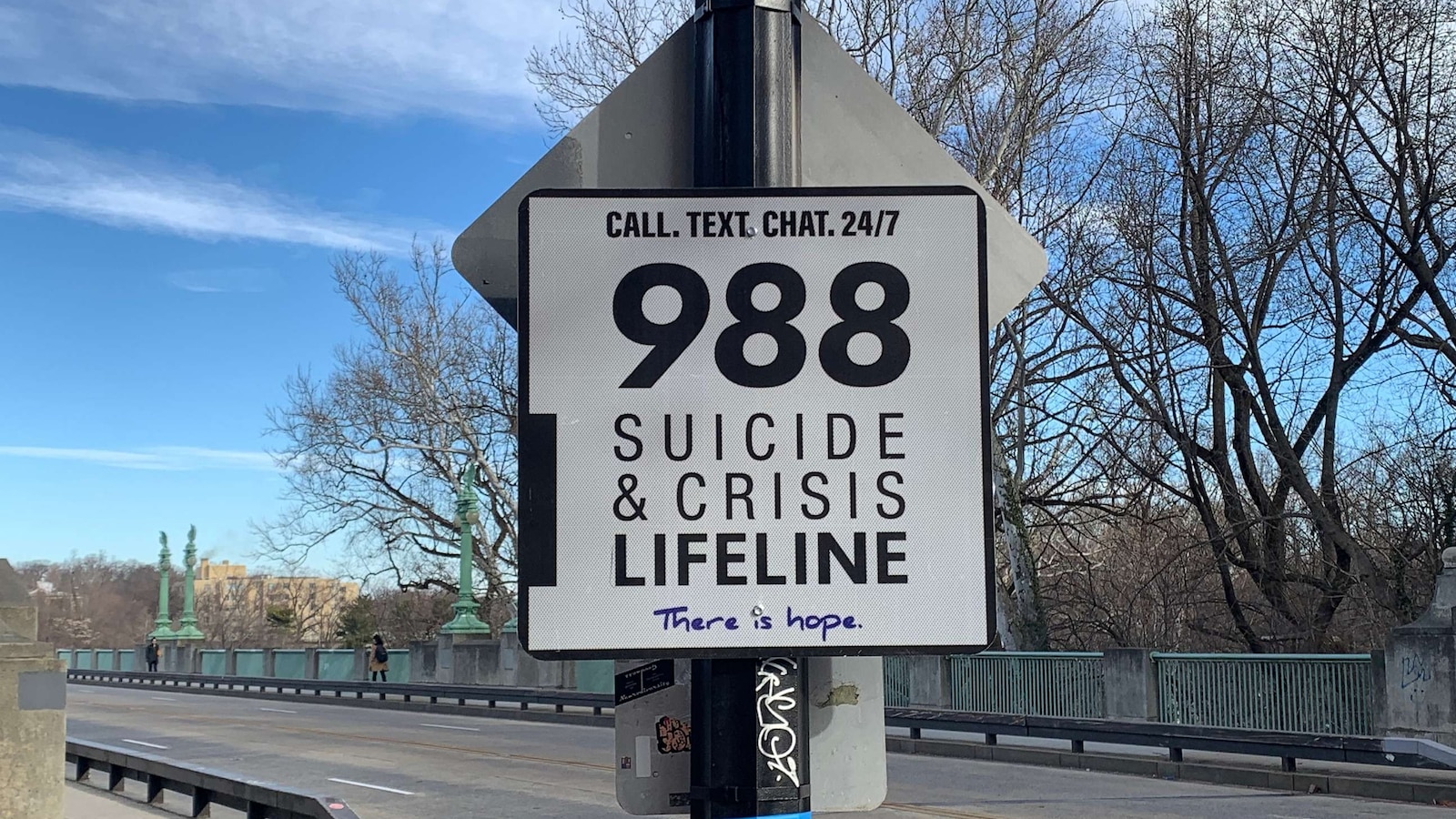

Three Years After Launch 988 Lifeline Faces Challenges Lgbtq Youth Support Cut

Jul 07, 2025

Three Years After Launch 988 Lifeline Faces Challenges Lgbtq Youth Support Cut

Jul 07, 2025 -

Texas Deluge 14 Children Among 32 Dead Rescue Efforts Underway

Jul 07, 2025

Texas Deluge 14 Children Among 32 Dead Rescue Efforts Underway

Jul 07, 2025

Latest Posts

-

Dogecoins Future Examining The Factors Behind Potential Price Increases

Jul 07, 2025

Dogecoins Future Examining The Factors Behind Potential Price Increases

Jul 07, 2025 -

Yemen Ports Hit In Israeli Military Operation Galaxy Leader Ship Involved

Jul 07, 2025

Yemen Ports Hit In Israeli Military Operation Galaxy Leader Ship Involved

Jul 07, 2025 -

Tragedy Strikes Poynton Police Discover Bodies Of Two Teenagers

Jul 07, 2025

Tragedy Strikes Poynton Police Discover Bodies Of Two Teenagers

Jul 07, 2025 -

Severe Tick Season Increased Risk And Essential Prevention Strategies

Jul 07, 2025

Severe Tick Season Increased Risk And Essential Prevention Strategies

Jul 07, 2025 -

988 Lifeline Call Volume Rises Yet Funding Cuts Impact Lgbtq Youth Support

Jul 07, 2025

988 Lifeline Call Volume Rises Yet Funding Cuts Impact Lgbtq Youth Support

Jul 07, 2025