Big Beautiful Bill: Key Provisions And Stimulus Payment Information

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Big Beautiful Bill: Key Provisions and Stimulus Payment Information

The American Rescue Plan Act of 2021, often referred to informally as the "Big Beautiful Bill," delivered a substantial economic stimulus package designed to combat the effects of the COVID-19 pandemic. While the immediate headlines focused on the stimulus checks, the Act contained a wide range of provisions impacting various aspects of American life. This article delves into the key provisions and provides crucial information about the stimulus payments.

Understanding the Stimulus Payments:

The heart of the "Big Beautiful Bill" for many Americans was the third round of Economic Impact Payments (EIP), commonly known as stimulus checks. These payments provided crucial financial relief to millions.

- Eligibility: Eligibility criteria were largely based on adjusted gross income (AGI) reported on 2019 or 2020 tax returns. Dependents also played a role in determining the amount received. [Link to IRS guidance on eligibility]

- Payment Amounts: The maximum payment was $1,400 per eligible individual, with an additional $1,400 for qualifying dependents. [Link to IRS tax form explaining payment amounts]

- Payment Methods: Payments were distributed via direct deposit, paper check, or debit card, depending on the recipient's information on file with the IRS. [Link to IRS FAQs about payment methods]

- Tax Implications: The stimulus payments were generally not taxable income, although there might be reporting requirements depending on individual circumstances. [Link to IRS information on tax implications]

Beyond Stimulus Checks: Key Provisions of the American Rescue Plan Act:

The American Rescue Plan Act encompassed far more than just stimulus checks. It included a comprehensive array of provisions aimed at bolstering the economy and supporting individuals and families.

H2: COVID-19 Relief:

- Vaccine Distribution: The Act significantly funded the national COVID-19 vaccination effort, contributing to widespread vaccine rollout across the country. [Link to CDC website on vaccination efforts]

- Testing and Treatment: Funding was allocated for COVID-19 testing, treatment, and contact tracing, crucial for combating the pandemic's spread. [Link to relevant government health website]

- Healthcare Support: The Act provided financial assistance to hospitals and healthcare providers struggling under the strain of the pandemic.

H2: Economic Recovery and Support:

- Enhanced Unemployment Benefits: The bill extended and increased unemployment benefits, providing crucial financial assistance to those who lost their jobs due to the pandemic. [Link to Department of Labor website on unemployment benefits]

- Small Business Assistance: The Act provided further aid to small businesses through the Paycheck Protection Program (PPP) and other initiatives. [Link to SBA website on small business assistance programs]

- State and Local Funding: Substantial funding was allocated to state and local governments to help them address budget shortfalls and provide essential services.

H2: Other Key Provisions:

- Child Tax Credit Expansion: The Act expanded the Child Tax Credit, significantly increasing the amount and making it fully refundable. This provided substantial relief to many families. [Link to IRS information on the Child Tax Credit]

- Affordable Care Act Subsidies: The Act increased subsidies for Affordable Care Act (ACA) marketplace plans, making healthcare more affordable for millions. [Link to Healthcare.gov]

Conclusion:

The American Rescue Plan Act, or "Big Beautiful Bill," was a landmark piece of legislation with far-reaching consequences. While the stimulus checks grabbed immediate attention, the Act's comprehensive provisions addressed various crucial aspects of the pandemic's economic and social impact, providing a vital lifeline for millions of Americans. Understanding these provisions is key to navigating the post-pandemic economic landscape. For detailed information, always refer to official government websites and resources.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Big Beautiful Bill: Key Provisions And Stimulus Payment Information. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Firework Explosion Rapper Suffers Horrific Hand Injury Using 4 Xtra Product

Jul 06, 2025

Firework Explosion Rapper Suffers Horrific Hand Injury Using 4 Xtra Product

Jul 06, 2025 -

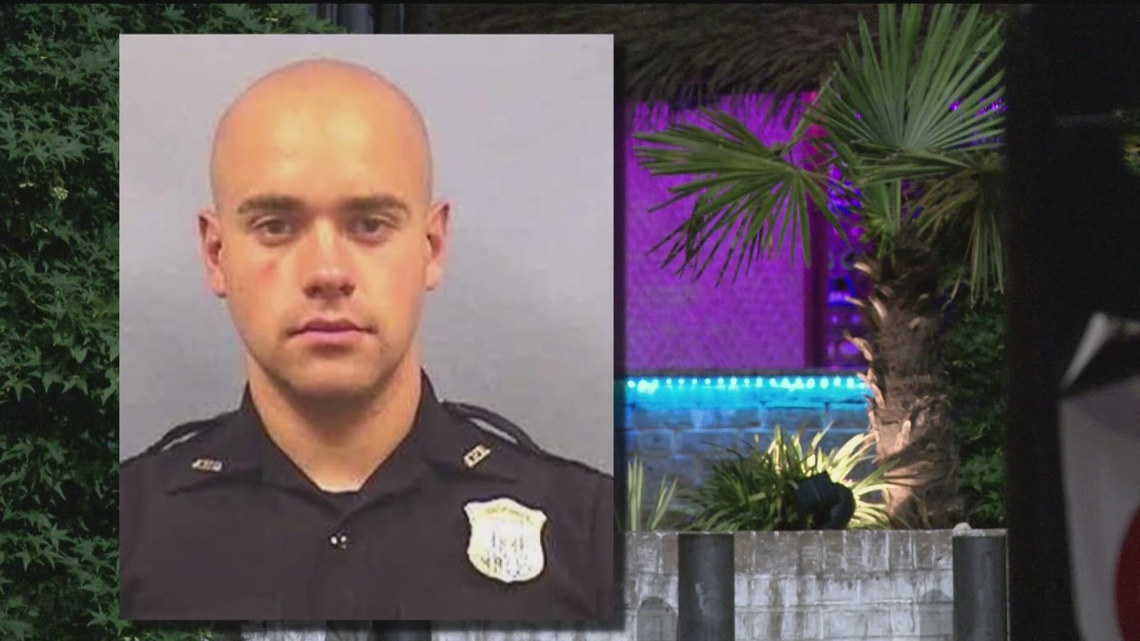

Atlanta Police Officer And Bar Employee Fight 911 Call Details Revealed

Jul 06, 2025

Atlanta Police Officer And Bar Employee Fight 911 Call Details Revealed

Jul 06, 2025 -

Drakes Recent Comments Hint At Fallout With Friends Post Kendrick Lamar Beef

Jul 06, 2025

Drakes Recent Comments Hint At Fallout With Friends Post Kendrick Lamar Beef

Jul 06, 2025 -

Bangor Cathedral Faces Scrutiny Over Alcohol Abuse Claims

Jul 06, 2025

Bangor Cathedral Faces Scrutiny Over Alcohol Abuse Claims

Jul 06, 2025 -

Texas Bajo El Agua Cobertura En Vivo De Las Inundaciones Y Sus Consecuencias

Jul 06, 2025

Texas Bajo El Agua Cobertura En Vivo De Las Inundaciones Y Sus Consecuencias

Jul 06, 2025