Billionaire Buffett's Bold Bet: Exit Bank Of America, Enter High-Growth Consumer Stock

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Billionaire Buffett's Bold Bet: Exit Bank of America, Enter High-Growth Consumer Stock

Warren Buffett's Berkshire Hathaway makes headlines again, this time with a surprising strategic shift. The Oracle of Omaha, renowned for his value investing approach and long-term holdings, has sent shockwaves through the financial world with a significant divestment from Bank of America and a simultaneous investment in a high-growth consumer goods company. This bold move signals a potential shift in Berkshire Hathaway's investment strategy, prompting analysts to reassess the future direction of the investment giant.

The news broke earlier this week, revealing that Berkshire Hathaway had significantly reduced its stake in Bank of America (BAC), a long-standing and substantial holding. Simultaneously, the company revealed a new, substantial position in [Insert Name of Consumer Stock Here], a company experiencing rapid growth in the [Insert Industry Sector, e.g., e-commerce, sustainable food, etc.] sector. This unexpected pairing has sparked considerable debate and analysis among financial experts.

<h3>Why the Bank of America Exit?</h3>

Buffett's decision to decrease his Bank of America holdings has raised eyebrows. While the exact reasons remain undisclosed, several factors are likely at play. These could include:

- Changing Economic Landscape: Rising interest rates and a potential economic slowdown could impact Bank of America's profitability. Buffett's move might reflect a more cautious outlook on the financial sector in the near term.

- Rebalancing Portfolio: The sale of Bank of America shares might be part of a broader strategy to rebalance Berkshire Hathaway's portfolio, allocating more capital to sectors perceived as having higher growth potential.

- Profit Taking: After years of holding BAC, this could simply represent a strategic decision to take profits and reinvest elsewhere. Given Buffett's long-term perspective, this is not necessarily a negative indicator for Bank of America's long-term prospects.

<h3>The Allure of High-Growth Consumer Stocks</h3>

The simultaneous investment in [Insert Name of Consumer Stock Here] highlights a growing interest in the burgeoning consumer sector. [Insert Name of Consumer Stock Here]'s success is attributed to [Insert Key Factors Driving Growth, e.g., innovative products, strong brand recognition, disruptive business model]. This focus on consumer goods suggests that Buffett anticipates sustained growth in this sector, even amidst economic uncertainty. The company's [mention specific metrics like market share, revenue growth, etc.] demonstrates its strong position within the market.

This move isn't entirely out of character for Buffett. While known for his value investing philosophy, he has shown a willingness to adapt his strategies over time, recognizing the importance of staying ahead of market trends. This strategic shift shows a willingness to embrace higher-growth opportunities, even if they stray slightly from his traditional value-oriented approach.

<h3>What Does This Mean for Investors?</h3>

Buffett's actions are closely watched by investors worldwide, and this move has significant implications. It suggests a renewed focus on high-growth potential, potentially influencing other investors to re-evaluate their portfolios and consider similar high-growth consumer stocks. This bold decision underscores the dynamic nature of the investment landscape and the importance of staying informed about market trends.

While the long-term implications remain to be seen, this strategic shift by Warren Buffett is undoubtedly a significant event in the financial world. It will be fascinating to observe how this decision impacts both Bank of America and [Insert Name of Consumer Stock Here] in the coming months and years. Further analysis and careful monitoring of both companies' performance will be crucial in understanding the full scope of this impactful move.

Disclaimer: This article provides general information and commentary and does not constitute financial advice. Readers should conduct their own research and consult with a financial advisor before making any investment decisions.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Billionaire Buffett's Bold Bet: Exit Bank Of America, Enter High-Growth Consumer Stock. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Emergency Rescue 22 Sailors Saved After Car Carrier Fire

Jun 05, 2025

Emergency Rescue 22 Sailors Saved After Car Carrier Fire

Jun 05, 2025 -

Energy Crisis Looms Key Big Battery Supplier In Australia Threatens Closure

Jun 05, 2025

Energy Crisis Looms Key Big Battery Supplier In Australia Threatens Closure

Jun 05, 2025 -

Jannik Sinner On Alcaraz The Honest Truth Ahead Of Potential Roland Garros Match

Jun 05, 2025

Jannik Sinner On Alcaraz The Honest Truth Ahead Of Potential Roland Garros Match

Jun 05, 2025 -

Inflation And Tariffs How Dollar General Benefits

Jun 05, 2025

Inflation And Tariffs How Dollar General Benefits

Jun 05, 2025 -

Inflations Unexpected Winner Dollar Generals Rise Amidst Tariff Hikes

Jun 05, 2025

Inflations Unexpected Winner Dollar Generals Rise Amidst Tariff Hikes

Jun 05, 2025

Latest Posts

-

Beyond The Radar Mike Vennarts Impact On Uk Rock And Sleep Tokens Recognition

Aug 17, 2025

Beyond The Radar Mike Vennarts Impact On Uk Rock And Sleep Tokens Recognition

Aug 17, 2025 -

The Complex Legacy Of And Just Like That A Critical Review

Aug 17, 2025

The Complex Legacy Of And Just Like That A Critical Review

Aug 17, 2025 -

Travel To South Korea New Measles Vaccination Advisory Issued

Aug 17, 2025

Travel To South Korea New Measles Vaccination Advisory Issued

Aug 17, 2025 -

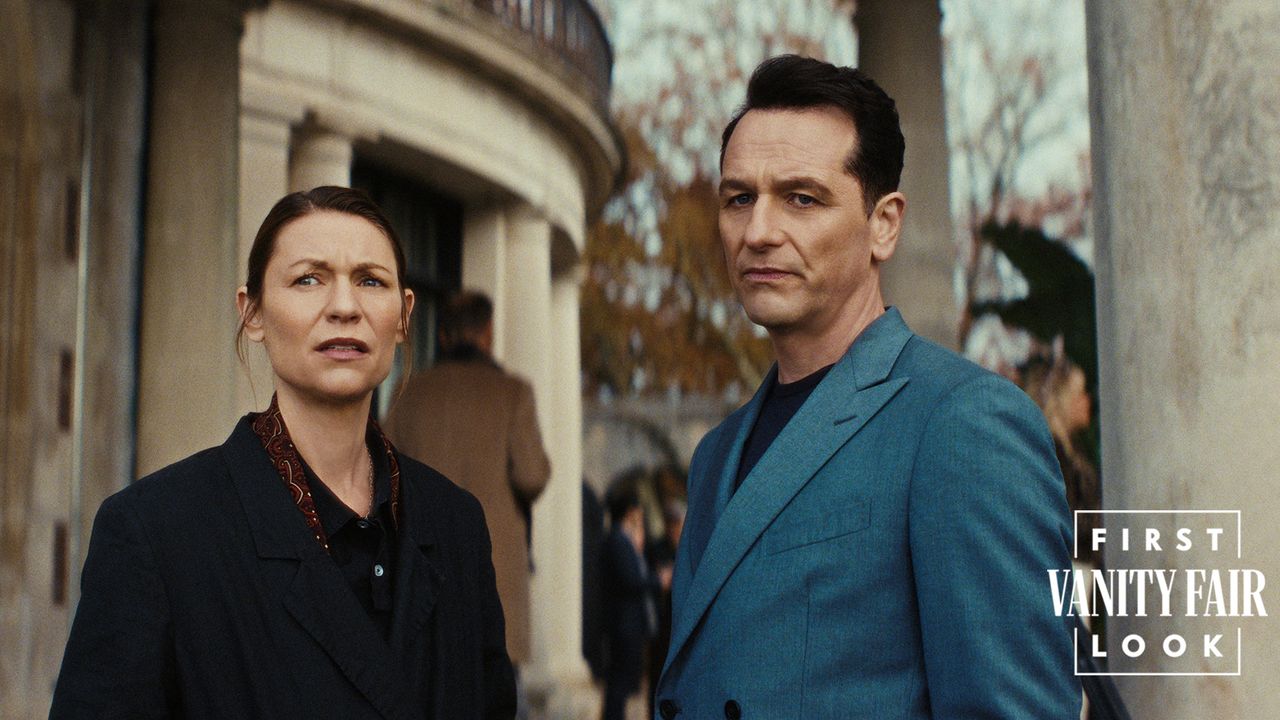

The Beast In Me Claire Danes And Matthew Rhys Explore Gritty New Roles

Aug 17, 2025

The Beast In Me Claire Danes And Matthew Rhys Explore Gritty New Roles

Aug 17, 2025 -

Nigel Farage Pushes For Reform Uk Appointments To The House Of Lords

Aug 17, 2025

Nigel Farage Pushes For Reform Uk Appointments To The House Of Lords

Aug 17, 2025