Billionaire Buffett's Strategic Shift: From Banking To Booming Consumer Brand

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Billionaire Buffett's Strategic Shift: From Banking to Booming Consumer Brands

Warren Buffett's Berkshire Hathaway makes a bold move, pivoting from traditional banking investments towards a portfolio brimming with consumer brands. This strategic shift signals a significant change in investment philosophy for the legendary investor.

The Oracle of Omaha, Warren Buffett, is known for his shrewd investments and long-term vision. For decades, Berkshire Hathaway, his investment conglomerate, has held significant stakes in major banks and financial institutions. However, recent acquisitions and investment patterns reveal a fascinating shift: a significant move towards consumer brands experiencing robust growth. This isn't just a minor adjustment; it's a strategic realignment reflecting a changing economic landscape and Buffett's keen eye for future market trends.

This surprising pivot raises several key questions: What factors are driving this change? Which consumer brands are attracting Buffett's attention? And what does this mean for the future of Berkshire Hathaway and the broader investment world?

From Financial Institutions to Everyday Essentials

Buffett's traditional focus on stable, dividend-paying financial stocks has been a cornerstone of his success. However, recent years have witnessed increased volatility in the banking sector, prompting a reassessment of risk. This, coupled with the explosive growth of certain consumer brands, has arguably influenced his decision. Instead of relying solely on the often-predictable, albeit slower-growing, returns from banking, Buffett is now diversifying into sectors with higher growth potential.

This isn't to say that Berkshire Hathaway is abandoning its banking holdings entirely. However, the increased allocation of resources towards consumer brands indicates a significant alteration in investment strategy. This diversification reduces overall portfolio risk and capitalizes on the explosive growth potential within the consumer goods sector.

The Allure of Consumer Brands: A Deeper Dive

Several recent acquisitions highlight Buffett's burgeoning interest in consumer brands. While specifics vary depending on the brand and its market, the common thread seems to be a strong, established brand recognition, consistent profitability, and a robust potential for future growth. This focus on established brands suggests a preference for predictable revenue streams, even amidst market fluctuations.

- [Insert Example 1: Specific Brand Acquisition – e.g., Berkshire Hathaway's acquisition of a significant stake in a popular food company.]: This acquisition highlights Buffett's interest in… [Explain the reasoning behind this specific acquisition – market analysis, brand strength, etc.]

- [Insert Example 2: Specific Brand Acquisition – e.g., A recent investment in a well-known consumer goods manufacturer.]: This strategic move demonstrates… [Explain the rationale behind this acquisition – potential for market expansion, synergy with existing holdings, etc.]

This shift emphasizes a move toward brands that directly impact consumers' daily lives, offering a more resilient investment strategy compared to the fluctuations within the financial sector.

The Implications for Investors

Buffett's strategic shift sends a powerful message to the investment community. It suggests that the traditional focus on banking and financial institutions might be waning, at least partially, in favor of the robust growth potential within select consumer brand markets. This could influence other investors to re-evaluate their own portfolios and consider diversifying into similar sectors.

The move also underscores the importance of adapting to changing market dynamics. Even seasoned investors like Buffett recognize the need to adjust their strategies to remain competitive and capitalize on emerging opportunities. This adaptability should serve as a lesson for both experienced and novice investors alike.

Looking Ahead: What's Next for Buffett and Berkshire Hathaway?

The future remains uncertain, but one thing is clear: Buffett's strategic shift represents a significant turning point for Berkshire Hathaway. It will be fascinating to observe how this new focus on consumer brands impacts the company's long-term performance and influences the investment strategies of others. This strategic move is a compelling case study in adapting to a changing economic landscape, making it a story worth following closely. Will this bold move redefine the legacy of the Oracle of Omaha? Only time will tell.

Call to action (subtle): Stay tuned for future updates on Berkshire Hathaway's investment decisions and their impact on the market. Follow us for more insightful analysis of the ever-evolving investment landscape.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Billionaire Buffett's Strategic Shift: From Banking To Booming Consumer Brand. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Navigating The Classification System The Oxford Cambridge Rail Line In England And Wales

Jun 04, 2025

Navigating The Classification System The Oxford Cambridge Rail Line In England And Wales

Jun 04, 2025 -

Englands Cricket Clash With West Indies Delayed Live Updates On Traffic Hold Up

Jun 04, 2025

Englands Cricket Clash With West Indies Delayed Live Updates On Traffic Hold Up

Jun 04, 2025 -

Maximize Retirement Savings Investing In Gold And Precious Metals Through Self Directed Iras

Jun 04, 2025

Maximize Retirement Savings Investing In Gold And Precious Metals Through Self Directed Iras

Jun 04, 2025 -

Alcaraz Vs Sinner Andy Roddick Forecasts Their Future Tennis Careers

Jun 04, 2025

Alcaraz Vs Sinner Andy Roddick Forecasts Their Future Tennis Careers

Jun 04, 2025 -

Roland Garros 2025 Alcaraz Swiatek And Musettis Day 8 Wins

Jun 04, 2025

Roland Garros 2025 Alcaraz Swiatek And Musettis Day 8 Wins

Jun 04, 2025

Latest Posts

-

Karen Reads Retrial Defense Filing And The Question Of Testimony

Jun 06, 2025

Karen Reads Retrial Defense Filing And The Question Of Testimony

Jun 06, 2025 -

Madeleine Mc Cann Disappearance Hope And Despair After 18 Years

Jun 06, 2025

Madeleine Mc Cann Disappearance Hope And Despair After 18 Years

Jun 06, 2025 -

Understanding The Coca Cola Company Ko Investment Appeal

Jun 06, 2025

Understanding The Coca Cola Company Ko Investment Appeal

Jun 06, 2025 -

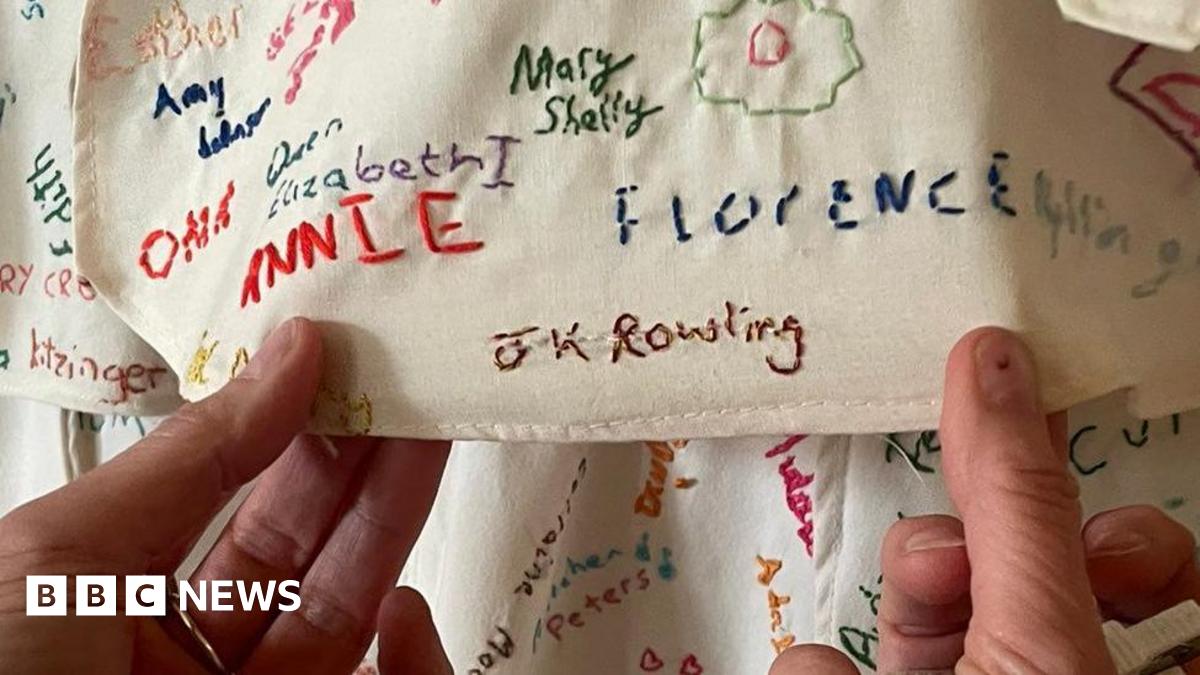

Investigation Launched Damaged J K Rowling Artwork At Derbyshire National Trust Site

Jun 06, 2025

Investigation Launched Damaged J K Rowling Artwork At Derbyshire National Trust Site

Jun 06, 2025 -

Bbc Rebuts White House Claims On Gaza Coverage Accuracy

Jun 06, 2025

Bbc Rebuts White House Claims On Gaza Coverage Accuracy

Jun 06, 2025