Billionaire Buffett's Strategic Shift: Reducing Bank Of America Stake, Betting Big On Consumer Giant

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Billionaire Buffett's Strategic Shift: Reducing Bank of America Stake, Betting Big on Consumer Giant

Warren Buffett's Berkshire Hathaway reveals a surprising shift in investment strategy, trimming its Bank of America holdings while significantly increasing its stake in a major consumer goods company. This move has sent ripples through the financial world, prompting analysts to dissect the implications for both companies and the broader market.

The Oracle of Omaha, known for his long-term investment philosophy and value-oriented approach, has made headlines with his recent filings. Berkshire Hathaway's 13F filing, which reveals its equity holdings, showed a decrease in its Bank of America (BAC) shares, a position it has held for years. Simultaneously, the filing revealed a substantial increase in Berkshire's investment in [Insert Name of Consumer Goods Giant Here], a company known for [briefly describe the company's key products and market position].

This strategic shift raises several key questions: Why is Buffett reducing his exposure to Bank of America, a historically stable investment? And what factors drove such a significant increase in his position in the consumer goods sector?

The Bank of America Downgrade: A Sign of Changing Times?

Berkshire Hathaway's decreased stake in Bank of America isn't necessarily a vote of no confidence. While the exact reasoning behind the move remains unclear, several factors could be at play. The current economic climate, with rising interest rates and potential recessionary pressures, may be prompting Buffett to diversify his portfolio. Banks, while generally considered stable, are vulnerable to economic downturns. This move could be a proactive measure to mitigate risk.

- Interest Rate Sensitivity: Rising interest rates can impact bank profitability. Buffett, known for his prudence, may be anticipating potential challenges for Bank of America in this environment.

- Portfolio Diversification: Maintaining a balanced portfolio is crucial. Reducing the concentration in a single sector, even a seemingly stable one, is a standard risk management practice.

- Shifting Market Dynamics: The banking sector is constantly evolving. New regulations and technological advancements could be influencing Buffett's decision.

The Consumer Goods Gamble: A Bet on Long-Term Growth

The contrasting move – significantly increasing the stake in [Insert Name of Consumer Goods Giant Here] – points towards a bullish outlook on consumer spending and the company's future performance. This company, a stalwart in the [Industry Sector, e.g., food and beverage, personal care] industry, enjoys strong brand recognition and consistent demand for its products.

- Resilience During Recessions: Consumer staples often demonstrate resilience during economic downturns, as demand for essential goods remains relatively stable. This inherent defensive characteristic likely appeals to Buffett's risk-averse strategy.

- Long-Term Growth Potential: The company's robust market share and potential for expansion in both domestic and international markets suggest strong long-term growth prospects.

- Value Investing Principle: Buffett’s investment likely aligns with his well-known value investing strategy. He is probably seeing an undervalued opportunity with strong potential for future returns.

Implications for Investors

Buffett's moves serve as a potent reminder of the dynamic nature of the investment landscape. His decisions, while not always immediately clear, often provide valuable insights into market trends and potential opportunities. For investors, this shift highlights the importance of diversification, careful risk assessment, and a long-term investment horizon. While mimicking Buffett's strategy isn't always feasible, understanding his decision-making process can inform individual investment strategies.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. Consult with a qualified financial advisor before making any investment decisions. Always conduct thorough research before investing in any security.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Billionaire Buffett's Strategic Shift: Reducing Bank Of America Stake, Betting Big On Consumer Giant. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

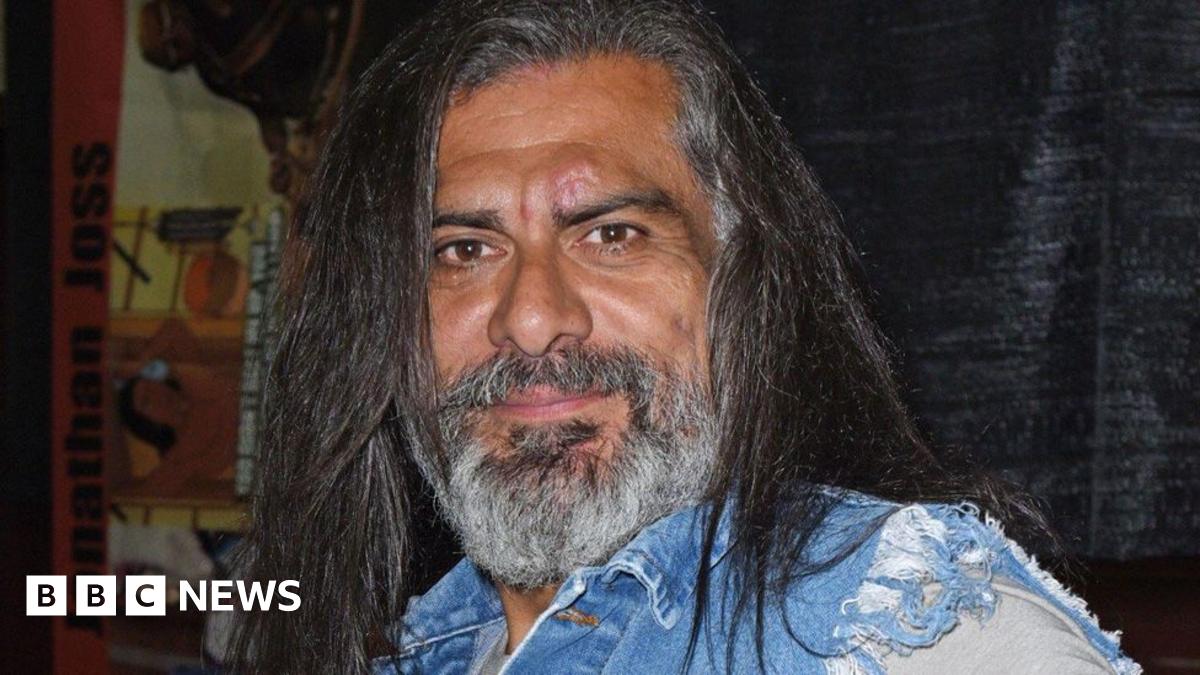

King Of The Hill Actor Jonathan Joss Fatally Shot Fans Mourn Loss Of John Redcorn

Jun 05, 2025

King Of The Hill Actor Jonathan Joss Fatally Shot Fans Mourn Loss Of John Redcorn

Jun 05, 2025 -

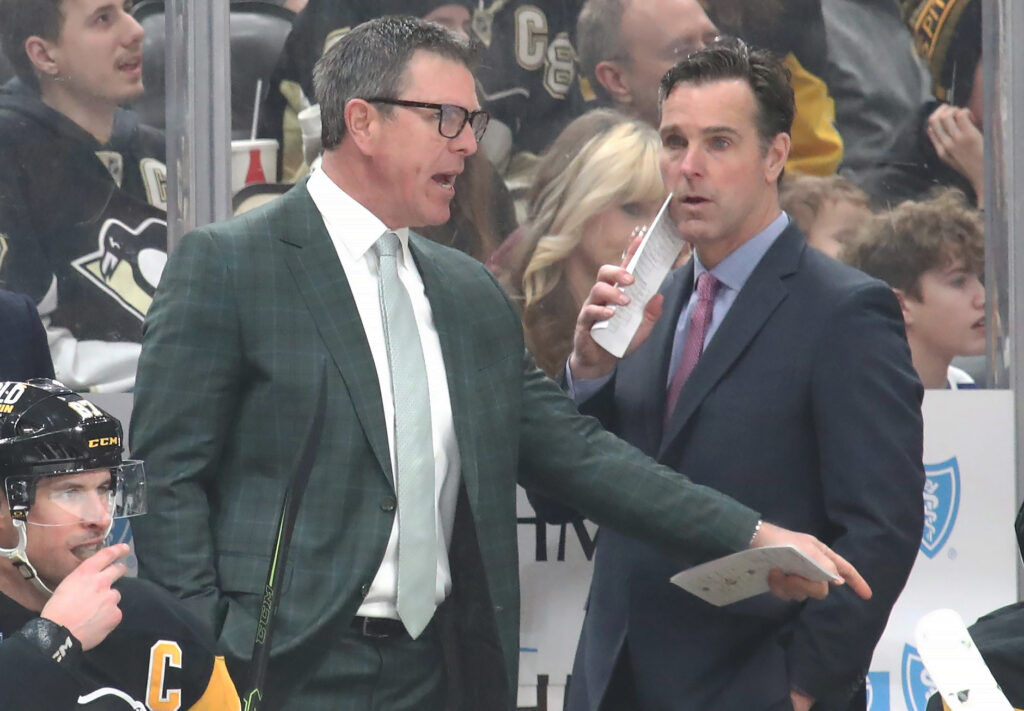

New York Rangers Announce Assistant Coaches Quinn And Sacco

Jun 05, 2025

New York Rangers Announce Assistant Coaches Quinn And Sacco

Jun 05, 2025 -

Inside Grace Potters Vault An Exclusive Look At Unseen Music And Memorabilia

Jun 05, 2025

Inside Grace Potters Vault An Exclusive Look At Unseen Music And Memorabilia

Jun 05, 2025 -

French Open 2025 Bubliks Path To The Quarter Finals A Las Vegas Story

Jun 05, 2025

French Open 2025 Bubliks Path To The Quarter Finals A Las Vegas Story

Jun 05, 2025 -

Following The Case The Latest News On The Sean Combs Trial

Jun 05, 2025

Following The Case The Latest News On The Sean Combs Trial

Jun 05, 2025

Latest Posts

-

Newly Found Documents Shed Light On Trump Putin Meeting In Alaska

Aug 17, 2025

Newly Found Documents Shed Light On Trump Putin Meeting In Alaska

Aug 17, 2025 -

Actor Tristan Rogers Iconic General Hospital Star Passes Away At 79

Aug 17, 2025

Actor Tristan Rogers Iconic General Hospital Star Passes Away At 79

Aug 17, 2025 -

Premier League Racism Antoine Semenyo Details Abuse During Liverpool Game

Aug 17, 2025

Premier League Racism Antoine Semenyo Details Abuse During Liverpool Game

Aug 17, 2025 -

The Untold Story Of A Wwii Veteran A Vj Day Memory That Moved Queen Camilla

Aug 17, 2025

The Untold Story Of A Wwii Veteran A Vj Day Memory That Moved Queen Camilla

Aug 17, 2025 -

Battlefield 6 Map Size Controversy Players React To Latest Mini Map

Aug 17, 2025

Battlefield 6 Map Size Controversy Players React To Latest Mini Map

Aug 17, 2025