Billionaire Warren Buffett Dumps Key US Holdings

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Billionaire Warren Buffett Dumps Key US Holdings: What Does It Mean for Investors?

Oracle of Omaha's moves send shockwaves through the market. Warren Buffett, the legendary investor and CEO of Berkshire Hathaway, recently made headlines by significantly reducing Berkshire's stakes in several major US companies. This unexpected shift in investment strategy has left many wondering what it means for the market and individual investors. The moves, detailed in Berkshire Hathaway's latest quarterly 13F filing, reveal a departure from some of Buffett's long-held positions, sparking considerable speculation and analysis.

Key Holdings Reduced: A Closer Look

Berkshire Hathaway's 13F filing revealed significant reductions in holdings of several key companies. While the exact reasons behind these divestments remain somewhat unclear, analysts are pointing towards several potential factors. These include:

- Market Re-evaluation: Some analysts believe Buffett's adjustments reflect a reassessment of the current market conditions, potentially indicating a more cautious approach to certain sectors.

- Sectoral Shifts: The reduced holdings might also signal a shift in Buffett's investment focus, potentially towards other sectors he deems more promising for future growth.

- Portfolio Rebalancing: It's possible that these divestments are simply a part of a broader portfolio rebalancing strategy, aiming to optimize risk and reward.

Specific companies seeing significant reductions in Berkshire's holdings include [insert company names and percentage reductions here – requires up-to-date information from reliable financial news sources]. These companies represent significant sectors of the US economy, making the changes all the more noteworthy. The impact of these divestments is likely to be felt across the market.

What Does This Mean for Investors?

Buffett's investment decisions are closely watched by investors worldwide. His actions are often interpreted as indicators of broader market trends. While it's impossible to definitively predict the future based on a single quarterly filing, several implications can be considered:

- Increased Volatility: The news could lead to increased market volatility in the short term, as investors react to the uncertainty surrounding Buffett's strategy.

- Sector-Specific Impacts: The specific sectors affected by the divestments may experience more pronounced short-term impacts.

- Long-Term Implications Remain Unclear: The long-term effects of these moves remain uncertain and will likely depend on broader economic conditions and the performance of the companies in question.

Expert Opinions Diverge:

Financial analysts offer varying perspectives on the significance of Buffett’s moves. Some view the divestments as a sign of caution amidst growing economic uncertainty, suggesting a potential market correction is on the horizon. Others argue that these are simply strategic adjustments within a broader, long-term investment plan. This divergence of opinion underscores the complexity of interpreting these high-profile investment decisions.

Staying Informed:

For individual investors, staying informed about market trends and analyzing company performance remains crucial. Following reliable financial news sources and conducting thorough due diligence before making any investment decisions is paramount. Consulting with a financial advisor can also provide valuable personalized guidance. This recent development highlights the dynamic nature of the investment landscape and the importance of adapting to evolving market conditions.

Further Reading:

- [Link to a relevant article from a reputable financial news source, e.g., the Wall Street Journal]

- [Link to Berkshire Hathaway's official investor relations page]

Disclaimer: This article is for informational purposes only and does not constitute financial advice. Always conduct thorough research and consult with a financial professional before making any investment decisions.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Billionaire Warren Buffett Dumps Key US Holdings. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Robinhood Markets Inc Hood Stock Up 6 46 Understanding The June 3rd Increase

Jun 05, 2025

Robinhood Markets Inc Hood Stock Up 6 46 Understanding The June 3rd Increase

Jun 05, 2025 -

Missing Scot From Stag Party Found Dead Portugal Investigation Underway

Jun 05, 2025

Missing Scot From Stag Party Found Dead Portugal Investigation Underway

Jun 05, 2025 -

Glastonbury 2025 Your Essential Guide To The Festivals Performances

Jun 05, 2025

Glastonbury 2025 Your Essential Guide To The Festivals Performances

Jun 05, 2025 -

Local Police Disrupt All American Rejects Unpermitted Concert

Jun 05, 2025

Local Police Disrupt All American Rejects Unpermitted Concert

Jun 05, 2025 -

Dollar Generals Profitability Amidst Rising Tariffs A Case Study

Jun 05, 2025

Dollar Generals Profitability Amidst Rising Tariffs A Case Study

Jun 05, 2025

Latest Posts

-

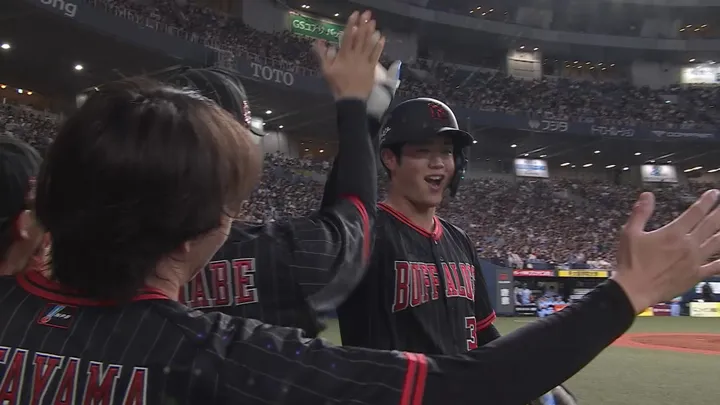

Ryo Otas Grand Slam Two Run Deficit After Eighth Bases Loaded Blast

Aug 17, 2025

Ryo Otas Grand Slam Two Run Deficit After Eighth Bases Loaded Blast

Aug 17, 2025 -

Federal Grand Jury Charges New Orleans Mayor With Corruption Years Long Investigation Concludes

Aug 17, 2025

Federal Grand Jury Charges New Orleans Mayor With Corruption Years Long Investigation Concludes

Aug 17, 2025 -

Controversy Erupts Uk Trade Envoy Quits Over Northern Cyprus Visit

Aug 17, 2025

Controversy Erupts Uk Trade Envoy Quits Over Northern Cyprus Visit

Aug 17, 2025 -

S T A L K E R 2 Heart Of Chornobyl Update Ps 5 Release Coming By End Of 2025

Aug 17, 2025

S T A L K E R 2 Heart Of Chornobyl Update Ps 5 Release Coming By End Of 2025

Aug 17, 2025 -

Northwest Ranks Poorly In Latest Livability Study

Aug 17, 2025

Northwest Ranks Poorly In Latest Livability Study

Aug 17, 2025