Billions Flow Into Bitcoin ETFs: A Look At The Bold Investment Strategies

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Billions Flow into Bitcoin ETFs: A Look at the Bold Investment Strategies

The cryptocurrency market is abuzz. Billions of dollars are pouring into Bitcoin exchange-traded funds (ETFs), marking a significant shift in institutional and individual investor sentiment. This surge represents a bold new chapter in Bitcoin's journey towards mainstream financial acceptance, but what's driving this massive influx of capital, and what investment strategies are fueling this trend? Let's delve into the details.

The Rise of Bitcoin ETFs: A Game Changer for Institutional Investors

The approval of Bitcoin ETFs in various jurisdictions, most notably in the United States, has been a pivotal catalyst. Previously, institutional investors faced significant hurdles in directly investing in Bitcoin due to regulatory complexities and security concerns. ETFs, however, offer a regulated and convenient pathway for accessing this volatile yet potentially lucrative asset class. This ease of access has unlocked a flood of institutional money, significantly boosting the overall market capitalization.

Investment Strategies Fueling the Bitcoin ETF Boom:

Several key investment strategies are contributing to the current surge in Bitcoin ETF investments:

-

Diversification: Many investors view Bitcoin as a crucial element of a diversified portfolio, hedging against traditional market risks and inflation. The ETF format allows for seamless integration into existing investment strategies.

-

Exposure to Crypto Without the Hassle: Managing private keys and navigating the complexities of cryptocurrency exchanges can be daunting. ETFs simplify the process, offering a low-barrier entry point for those seeking crypto exposure without the technical hurdles.

-

Long-Term Growth Potential: Despite its volatility, Bitcoin has demonstrated significant long-term growth potential. Many investors are adopting a buy-and-hold strategy, leveraging ETFs for convenient long-term exposure.

-

Regulatory Certainty (to a degree): The approval of Bitcoin ETFs provides a level of regulatory certainty that was previously absent. This increased confidence is encouraging more conservative investors to enter the market.

Beyond the Hype: Understanding the Risks

While the influx of capital into Bitcoin ETFs is undeniably significant, it's crucial to acknowledge the inherent risks:

-

Volatility: Bitcoin's price is notoriously volatile, subject to sharp swings driven by market sentiment, regulatory announcements, and technological developments. Investors need to be prepared for potential losses.

-

Regulatory Uncertainty: While ETF approvals represent a step towards greater regulatory clarity, the regulatory landscape surrounding cryptocurrencies remains fluid and subject to change.

-

Security Risks (though mitigated by ETFs): Although ETFs mitigate some security risks associated with directly holding Bitcoin, the underlying technology and exchanges still carry inherent security vulnerabilities.

The Future of Bitcoin ETFs:

The future looks bright for Bitcoin ETFs. As more jurisdictions approve these products and investor confidence grows, we can expect even greater inflows of capital. The increasing institutional adoption is likely to further legitimize Bitcoin as an asset class, potentially driving further price appreciation over the long term. However, careful risk management remains paramount for any investor considering this asset class.

Call to Action: Stay informed about the evolving cryptocurrency landscape. Consult with a financial advisor before making any investment decisions, particularly those involving high-risk assets like Bitcoin. Understanding the potential rewards and risks is crucial for making informed choices. Learn more about investment strategies and ETFs by exploring reputable financial resources. [Link to a reputable financial news site].

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Billions Flow Into Bitcoin ETFs: A Look At The Bold Investment Strategies. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Strip The Duck Jon Jones And Tom Aspinalls Heated Exchange

May 20, 2025

Strip The Duck Jon Jones And Tom Aspinalls Heated Exchange

May 20, 2025 -

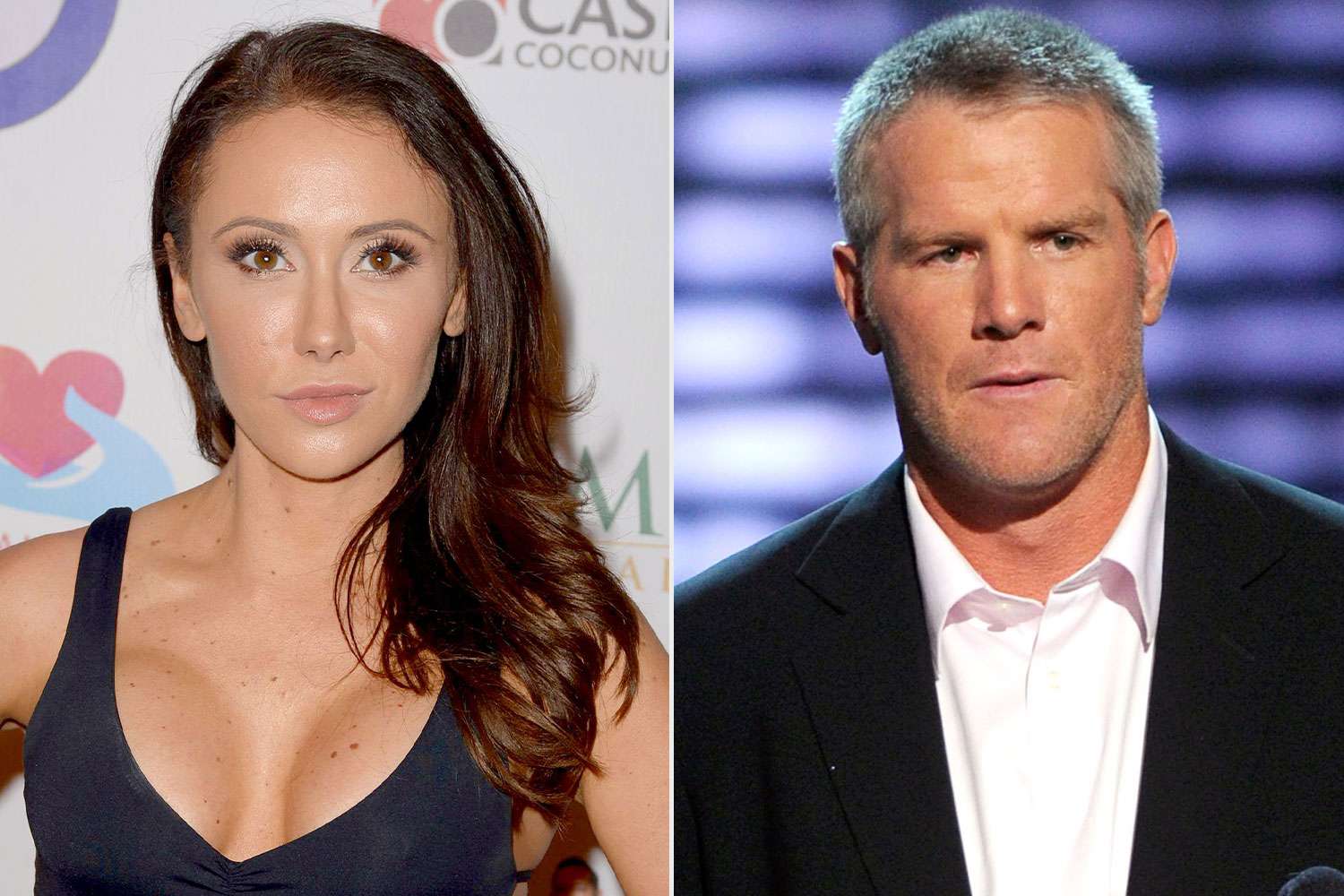

Jenn Sterger On Brett Favre Sext Scandal I Was Never Treated Like A Person

May 20, 2025

Jenn Sterger On Brett Favre Sext Scandal I Was Never Treated Like A Person

May 20, 2025 -

Super League Last Minute Drama As Leeds Rhinos Defeat Hull Fc 18 16

May 20, 2025

Super League Last Minute Drama As Leeds Rhinos Defeat Hull Fc 18 16

May 20, 2025 -

Israels Humanitarian Aid Promises And Shortcomings Of The Food Package

May 20, 2025

Israels Humanitarian Aid Promises And Shortcomings Of The Food Package

May 20, 2025 -

Fda Approval For Novavax Covid 19 Vaccine Understanding The Conditions

May 20, 2025

Fda Approval For Novavax Covid 19 Vaccine Understanding The Conditions

May 20, 2025

Latest Posts

-

Femicide Causes Consequences And The Urgent Need For Action

May 20, 2025

Femicide Causes Consequences And The Urgent Need For Action

May 20, 2025 -

Analysis Jon Jones Strip The Duck Comment And Its Implications For The Ufc Heavyweight Division

May 20, 2025

Analysis Jon Jones Strip The Duck Comment And Its Implications For The Ufc Heavyweight Division

May 20, 2025 -

Devastating St Louis Tornado The Aftermath And Road To Recovery

May 20, 2025

Devastating St Louis Tornado The Aftermath And Road To Recovery

May 20, 2025 -

New Discoveries The Significance Of A Canadian Pachyrhinosaurus Fossil Site

May 20, 2025

New Discoveries The Significance Of A Canadian Pachyrhinosaurus Fossil Site

May 20, 2025 -

Pectra Upgrade Fuels Ethereum Investment Boom 200 Million Inflows

May 20, 2025

Pectra Upgrade Fuels Ethereum Investment Boom 200 Million Inflows

May 20, 2025