Billions Flow Into Bitcoin ETFs: A Look At The Driving Forces

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Billions Flow into Bitcoin ETFs: A Look at the Driving Forces

The cryptocurrency market is buzzing. Billions of dollars are pouring into Bitcoin exchange-traded funds (ETFs), marking a significant shift in institutional and retail investor sentiment. This unprecedented influx raises crucial questions: What's driving this surge? And what does it mean for the future of Bitcoin and the broader crypto landscape?

The Institutional Embrace of Bitcoin ETFs

The approval of the first Bitcoin futures ETF in the US in 2021 opened the floodgates. While not directly investing in Bitcoin itself, these ETFs offered a regulated and accessible entry point for institutional investors wary of the complexities and risks associated with directly holding cryptocurrency. This initial step paved the way for the current wave of interest. The recent approvals of spot Bitcoin ETFs are even more significant, allowing investors direct exposure to the price of Bitcoin, further fueling the investment boom.

This institutional adoption isn't merely a trend; it's a testament to Bitcoin's growing acceptance as a legitimate asset class. Major financial institutions, previously hesitant, are now actively incorporating Bitcoin into their portfolios, driven by factors like:

- Diversification: Bitcoin's low correlation with traditional assets makes it an attractive tool for portfolio diversification, potentially reducing overall risk.

- Inflation Hedge: Many investors see Bitcoin as a potential hedge against inflation, given its limited supply and decentralized nature.

- Technological Innovation: The underlying blockchain technology continues to evolve, leading to increased efficiency and potential applications beyond just a digital currency.

Retail Investor Participation: Fueling the Fire

Institutional investment isn't the only factor. Retail investors are also increasingly embracing Bitcoin ETFs, attracted by the convenience and regulatory oversight they offer. Platforms like Fidelity and Schwab are making it easier than ever for everyday investors to gain exposure to Bitcoin, lowering the barrier to entry significantly.

This increased accessibility is particularly appealing to investors who:

- Desire Simplicity: ETFs offer a straightforward way to invest in Bitcoin without the technical complexities of managing a cryptocurrency wallet.

- Seek Security: ETFs are subject to regulatory oversight, offering a level of security and protection not always present in the unregulated cryptocurrency market.

- Are Risk-Averse: While still volatile, ETFs offer a less risky approach to Bitcoin investment than directly buying and holding the cryptocurrency.

Looking Ahead: Challenges and Opportunities

While the influx of billions into Bitcoin ETFs is undeniably positive for Bitcoin's adoption, challenges remain. Regulatory uncertainty, price volatility, and the ongoing debate surrounding Bitcoin's environmental impact continue to be significant concerns.

However, the current trend suggests a maturing market. The increasing institutionalization and regulatory clarity are paving the way for broader adoption and further integration of Bitcoin into the mainstream financial system. This could unlock significant opportunities for growth, not just for Bitcoin, but for the entire cryptocurrency ecosystem.

Conclusion:

The billions flowing into Bitcoin ETFs represent a major milestone in the cryptocurrency's evolution. The confluence of institutional adoption, increased retail accessibility, and a growing recognition of Bitcoin's potential as an asset class is driving this significant investment surge. While challenges persist, the future looks bright for Bitcoin, and its continued integration into the mainstream financial landscape is almost certain. The question now becomes: how high can Bitcoin climb? Only time will tell.

Keywords: Bitcoin ETF, Bitcoin Exchange Traded Fund, Cryptocurrency Investment, Institutional Investors, Retail Investors, Bitcoin Price, Bitcoin Volatility, Blockchain Technology, Crypto Regulation, Bitcoin Future, Crypto Market, Investment Trends.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Billions Flow Into Bitcoin ETFs: A Look At The Driving Forces. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Arson Probe Widens Second Suspect Charged In Pm Linked Case

May 21, 2025

Arson Probe Widens Second Suspect Charged In Pm Linked Case

May 21, 2025 -

Ubisoft Milan Recruiting For Major Rayman Game Project

May 21, 2025

Ubisoft Milan Recruiting For Major Rayman Game Project

May 21, 2025 -

Two Boys Face Charges After Church Bathroom Vandalism

May 21, 2025

Two Boys Face Charges After Church Bathroom Vandalism

May 21, 2025 -

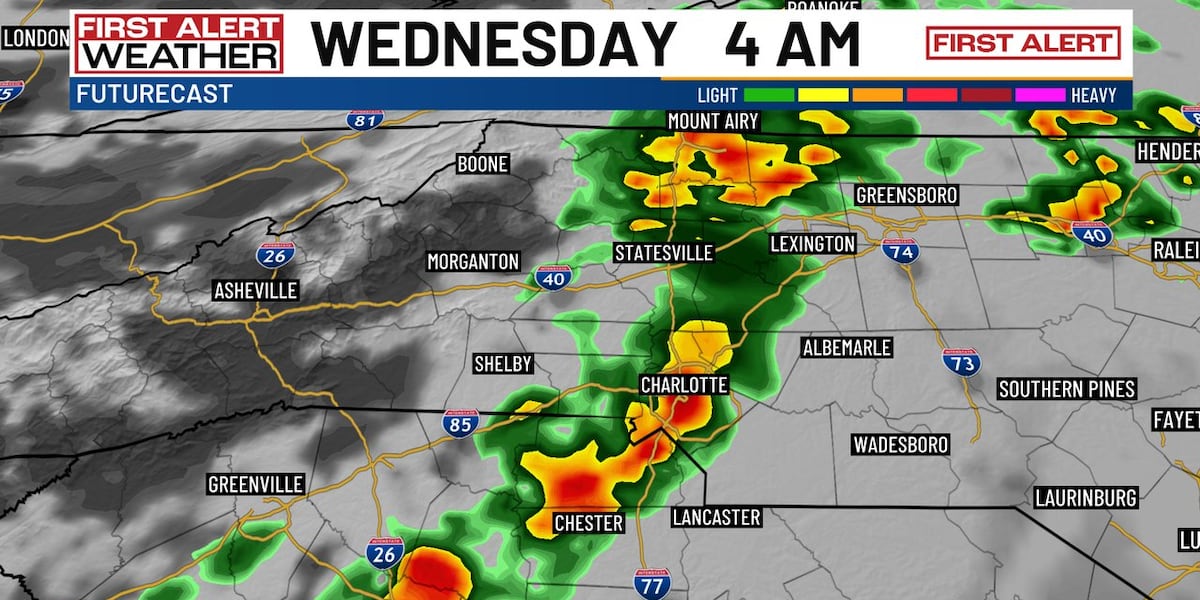

Charlotte Storm Forecast Overnight Showers And Significant Cooldown

May 21, 2025

Charlotte Storm Forecast Overnight Showers And Significant Cooldown

May 21, 2025 -

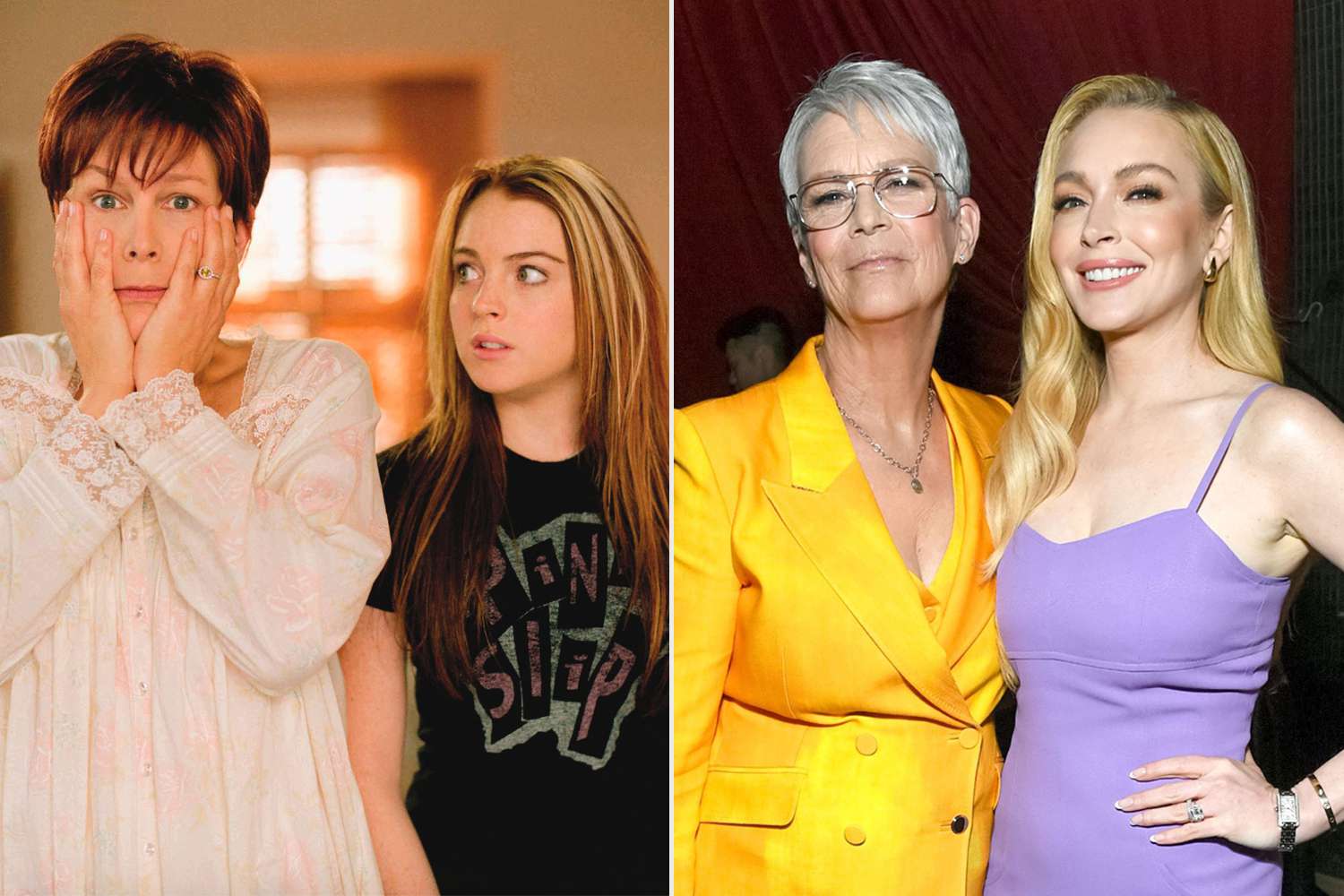

Freaky Friday Reunion Jamie Lee Curtis Discusses Her Relationship With Lindsay Lohan

May 21, 2025

Freaky Friday Reunion Jamie Lee Curtis Discusses Her Relationship With Lindsay Lohan

May 21, 2025

Latest Posts

-

Letitia Jamess Strategy Balancing Trump Litigation And Doj Investigation

May 21, 2025

Letitia Jamess Strategy Balancing Trump Litigation And Doj Investigation

May 21, 2025 -

Ellen De Generes Back On Social Media Following Heartbreaking Loss

May 21, 2025

Ellen De Generes Back On Social Media Following Heartbreaking Loss

May 21, 2025 -

Ice Facility Assault Federal Charges Filed Against A Congresswoman

May 21, 2025

Ice Facility Assault Federal Charges Filed Against A Congresswoman

May 21, 2025 -

Solo Leveling Garners Prestigious Award More Nominations Expected

May 21, 2025

Solo Leveling Garners Prestigious Award More Nominations Expected

May 21, 2025 -

De Generes Return To Social Media A Heartfelt Message To Fans

May 21, 2025

De Generes Return To Social Media A Heartfelt Message To Fans

May 21, 2025