Billions Flow Into Bitcoin ETFs: A Look At The Recent Investment Surge

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Billions Flow into Bitcoin ETFs: A Look at the Recent Investment Surge

The cryptocurrency market has witnessed a significant influx of investment in recent weeks, with billions of dollars pouring into Bitcoin exchange-traded funds (ETFs). This surge marks a pivotal moment for Bitcoin's mainstream adoption and signifies growing institutional confidence in the digital asset. But what's driving this unprecedented investment wave? Let's delve into the details.

The Rise of Bitcoin ETFs and Institutional Adoption:

The approval of the first Bitcoin futures ETF in the US in 2021 opened the floodgates for institutional investors seeking regulated exposure to the cryptocurrency market. Previously, direct investment in Bitcoin presented significant challenges, including security concerns and regulatory uncertainties. ETFs, however, offer a more streamlined and regulated pathway, attracting a wider range of investors. This year has seen a flurry of new applications and approvals, significantly boosting the overall investment volume. This increased accessibility is a key factor in the recent surge.

Factors Fueling the Investment Surge:

Several factors are contributing to this massive inflow of capital into Bitcoin ETFs:

- Growing Institutional Interest: Large financial institutions, hedge funds, and pension funds are increasingly allocating a portion of their portfolios to Bitcoin, viewing it as a potential hedge against inflation and a diversifying asset. The ease of access through ETFs is a major catalyst for this trend.

- Regulatory Clarity (or the Lack Thereof): While regulatory clarity remains a work in progress globally, the gradual acceptance and regulation of Bitcoin ETFs in key markets like the US are reassuring to many investors, mitigating some of the perceived risks.

- Bitcoin's Price Stability (Relative): While Bitcoin's price remains volatile, it has shown relative stability compared to some other cryptocurrencies, making it an attractive investment option for those seeking a less risky (relatively speaking) entry point into the crypto market.

- Inflationary Pressures: With global inflation remaining a concern, investors are actively seeking alternative assets to protect their purchasing power. Bitcoin, often touted as "digital gold," is seen by some as a hedge against inflation.

A Look at the Numbers:

While precise figures fluctuate daily, recent reports indicate billions of dollars have flowed into Bitcoin ETFs in just the past few months. This represents a significant increase compared to previous periods, highlighting the accelerating momentum in this sector. (Specific numbers and sources should be added here, referencing reputable financial news outlets).

The Future of Bitcoin ETFs:

The future of Bitcoin ETFs appears bright, with ongoing applications for spot Bitcoin ETFs expected to further fuel this investment trend. However, regulatory developments and market volatility will continue to play a significant role in shaping the trajectory of this burgeoning asset class.

Potential Risks to Consider:

It's crucial to remember that investing in Bitcoin, even through ETFs, carries inherent risks. Price volatility, regulatory uncertainty, and security concerns remain factors to consider before investing. It's always advisable to conduct thorough research and consult with a financial advisor before making any investment decisions.

Conclusion:

The recent surge in investment into Bitcoin ETFs represents a significant milestone for the cryptocurrency market. While challenges remain, the growing institutional adoption and regulatory progress suggest a promising future for Bitcoin and its derivative investment vehicles. However, investors should approach this market with caution and a clear understanding of the associated risks. Stay tuned for further updates as this dynamic market continues to evolve.

(CTA: Consider subscribing to our newsletter for the latest updates on cryptocurrency and ETF market trends.)

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Billions Flow Into Bitcoin ETFs: A Look At The Recent Investment Surge. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

The Putin Trump Dynamic A Power Imbalance Revealed

May 20, 2025

The Putin Trump Dynamic A Power Imbalance Revealed

May 20, 2025 -

Harsh Coaching Regime And Weight Comments Left Olympic Champion Devastated

May 20, 2025

Harsh Coaching Regime And Weight Comments Left Olympic Champion Devastated

May 20, 2025 -

Analysis Putins Actions Underscore Trumps Reduced Global Power

May 20, 2025

Analysis Putins Actions Underscore Trumps Reduced Global Power

May 20, 2025 -

Investor Confidence In Ethereum Boosted 200 M Investment Following Pectra Upgrade

May 20, 2025

Investor Confidence In Ethereum Boosted 200 M Investment Following Pectra Upgrade

May 20, 2025 -

The Therapeutic Brain Understanding How Therapy Alters Neural Pathways

May 20, 2025

The Therapeutic Brain Understanding How Therapy Alters Neural Pathways

May 20, 2025

Latest Posts

-

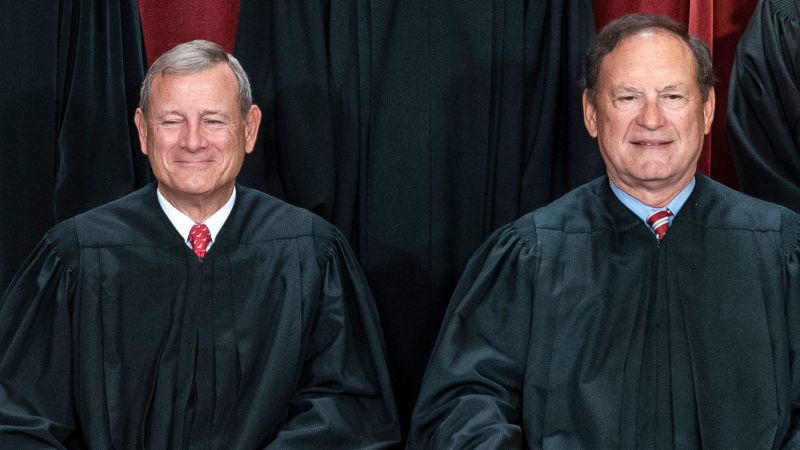

Supreme Court Justices Alito And Roberts Examining Their Enduring Impact

May 20, 2025

Supreme Court Justices Alito And Roberts Examining Their Enduring Impact

May 20, 2025 -

200 Million Poured Into Ethereum Funds Following Pectra Upgrade

May 20, 2025

200 Million Poured Into Ethereum Funds Following Pectra Upgrade

May 20, 2025 -

Billions Flow Into Bitcoin Etfs A Look At The Surge In Investment

May 20, 2025

Billions Flow Into Bitcoin Etfs A Look At The Surge In Investment

May 20, 2025 -

Jamie Lee Curtis On Lindsay Lohan Shes Always Kept It Real With Me

May 20, 2025

Jamie Lee Curtis On Lindsay Lohan Shes Always Kept It Real With Me

May 20, 2025 -

Urgent Security Alert Legal Aid Suffers Data Breach Criminal Records At Risk

May 20, 2025

Urgent Security Alert Legal Aid Suffers Data Breach Criminal Records At Risk

May 20, 2025