Billions Flow Into Bitcoin ETFs: A Wave Of Institutional Investment

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Billions Flow into Bitcoin ETFs: A Wave of Institutional Investment Ushers in a New Era

The cryptocurrency market is experiencing a seismic shift, as billions of dollars pour into Bitcoin exchange-traded funds (ETFs). This surge of institutional investment marks a significant turning point, signaling a growing acceptance of Bitcoin as a legitimate asset class and potentially paving the way for wider mainstream adoption. The recent approvals of several Bitcoin ETFs in major markets have unleashed a flood of capital, driving up trading volumes and sparking renewed interest in the digital asset.

The Impact of ETF Approvals:

The approval of Bitcoin ETFs by regulatory bodies like the SEC in the United States has been a game-changer. Previously, institutional investors faced significant hurdles in accessing Bitcoin directly, leading to a reliance on less regulated and more complex investment vehicles. ETFs, however, offer a familiar and regulated pathway for large-scale investment, mitigating many of the risks associated with direct Bitcoin ownership. This accessibility is a key factor driving the current influx of capital.

Who's Investing?

The billions flowing into Bitcoin ETFs aren't just coming from individual investors. Large institutional players, including pension funds, hedge funds, and asset management firms, are increasingly allocating a portion of their portfolios to Bitcoin through these newly available ETFs. This strategic shift underscores a growing belief in Bitcoin's long-term potential as a store of value and a hedge against inflation. The participation of these sophisticated investors lends considerable credibility to the asset class.

What Does This Mean for the Future of Bitcoin?

This wave of institutional investment carries significant implications for the future of Bitcoin. The increased liquidity provided by ETFs could lead to greater price stability and reduce volatility, making Bitcoin a more attractive investment option for a wider range of investors. Furthermore, the increased regulatory scrutiny surrounding ETFs could help to build trust and confidence in the cryptocurrency market as a whole.

Potential Challenges:

While the current trend is overwhelmingly positive, it's crucial to acknowledge potential challenges. Regulatory uncertainty remains a factor, and future regulatory decisions could significantly impact the Bitcoin ETF market. Furthermore, the long-term performance of Bitcoin remains uncertain, and investors should carefully consider the inherent risks associated with cryptocurrency investments.

Looking Ahead:

The billions flowing into Bitcoin ETFs represent a pivotal moment in the history of cryptocurrency. While challenges remain, the sheer volume of institutional investment signals a growing acceptance of Bitcoin as a viable asset class. This trend is likely to continue, potentially further integrating Bitcoin into the broader financial landscape. The future looks bright for Bitcoin, but investors should always exercise caution and conduct thorough research before investing.

Further Reading:

- (Replace with a relevant and current article)

- (Replace with a relevant and current article)

Disclaimer: This article is for informational purposes only and does not constitute financial advice. Investing in cryptocurrencies carries significant risks, and you should always conduct thorough research and seek professional advice before making any investment decisions.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Billions Flow Into Bitcoin ETFs: A Wave Of Institutional Investment. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Facial Difference Discrimination A Cafes Shameful Act

May 20, 2025

Facial Difference Discrimination A Cafes Shameful Act

May 20, 2025 -

Imperdible La Final De Juego De Voces 2025 Contara Con Estos Artistas

May 20, 2025

Imperdible La Final De Juego De Voces 2025 Contara Con Estos Artistas

May 20, 2025 -

Colombian Models Murder Femicide Condemnation Mounts After Mexican Influencers Killing

May 20, 2025

Colombian Models Murder Femicide Condemnation Mounts After Mexican Influencers Killing

May 20, 2025 -

Urgent Search Underway Child Missing After Train Hits Family Killing Two

May 20, 2025

Urgent Search Underway Child Missing After Train Hits Family Killing Two

May 20, 2025 -

Is Your Child Ready To Give Up Their Pacifier Or Thumb A Parents Guide

May 20, 2025

Is Your Child Ready To Give Up Their Pacifier Or Thumb A Parents Guide

May 20, 2025

Latest Posts

-

Driverless Cars In The Uk A 2027 Timeline And Ubers Contention

May 20, 2025

Driverless Cars In The Uk A 2027 Timeline And Ubers Contention

May 20, 2025 -

What Is Femicide Examining The Factors Contributing To Its Increase

May 20, 2025

What Is Femicide Examining The Factors Contributing To Its Increase

May 20, 2025 -

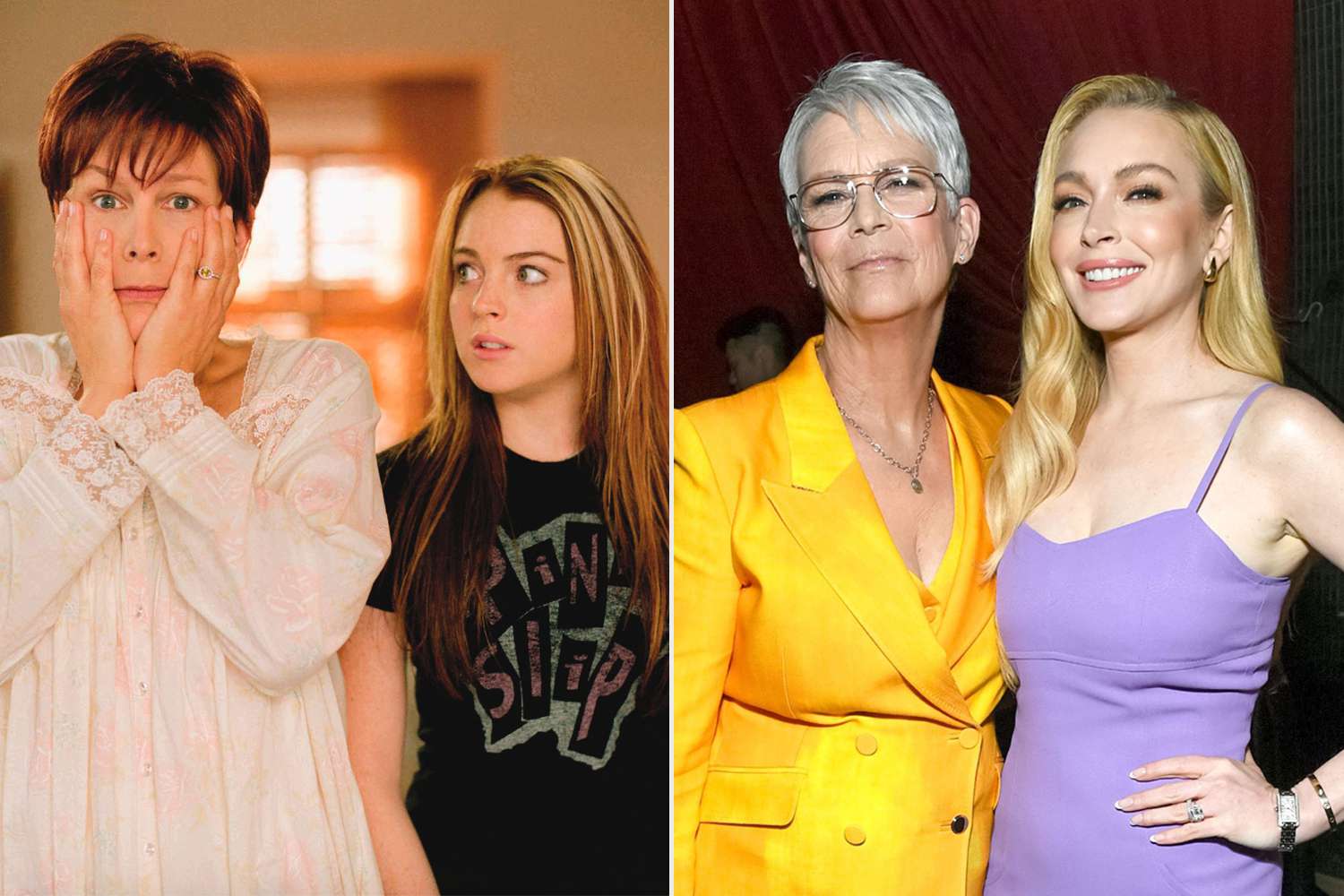

Exclusive Interview Jamie Lee Curtis On Her Relationship With Lindsay Lohan After Freaky Friday

May 20, 2025

Exclusive Interview Jamie Lee Curtis On Her Relationship With Lindsay Lohan After Freaky Friday

May 20, 2025 -

Jamie Lee Curtis Speaks Out Her Honest Take On Lindsay Lohans Authenticity

May 20, 2025

Jamie Lee Curtis Speaks Out Her Honest Take On Lindsay Lohans Authenticity

May 20, 2025 -

Enhancing Tourist Conduct In Bali A Call For International Support

May 20, 2025

Enhancing Tourist Conduct In Bali A Call For International Support

May 20, 2025