Billions Flowing Into Bitcoin ETFs: A Look At The Bold Investment Strategies

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Billions Flowing into Bitcoin ETFs: A Look at the Bold Investment Strategies

The cryptocurrency market is buzzing. Billions of dollars are pouring into Bitcoin exchange-traded funds (ETFs), marking a significant shift in how institutional and individual investors are approaching the volatile yet potentially lucrative world of digital assets. This surge represents a bold new chapter in Bitcoin's history and signals a growing acceptance of cryptocurrencies within mainstream finance. But what's driving this influx of capital, and what investment strategies are fueling this trend?

The Rise of Bitcoin ETFs: A Gateway to Crypto Investing

The approval of the first Bitcoin futures ETF in the US in 2021 opened the floodgates. While not directly investing in Bitcoin itself, these ETFs offer exposure to its price movements, making it significantly easier for traditional investors to participate in the crypto market. This accessibility is a key driver behind the billions flowing into these funds. Previously, investing in Bitcoin directly involved navigating the complexities of cryptocurrency exchanges, a hurdle many institutional investors and less tech-savvy individuals were hesitant to overcome.

Who's Investing and Why?

The surge in Bitcoin ETF investments isn't solely driven by individual investors. Large institutional players, including hedge funds and pension funds, are increasingly allocating a portion of their portfolios to Bitcoin ETFs. Several factors contribute to this:

- Diversification: Bitcoin's price correlation with traditional assets is relatively low, making it an attractive addition to a diversified portfolio to potentially reduce overall risk.

- Inflation Hedge: Many view Bitcoin as a potential hedge against inflation, especially given its limited supply. This perception is particularly appealing in times of economic uncertainty.

- Long-Term Growth Potential: Despite its volatility, Bitcoin's long-term price trajectory has been remarkably positive, attracting investors seeking significant returns.

- Regulatory Clarity (Slowly Emerging): The increasing regulatory clarity surrounding cryptocurrencies, although still evolving, instills confidence in investors. The approval of ETFs is a key step in this process.

Different Strategies, Same Goal: Exposure to Bitcoin

Investors are employing various strategies to leverage Bitcoin ETFs:

- Long-Term Holding: Many adopt a "buy-and-hold" approach, believing in Bitcoin's long-term potential.

- Strategic Allocation: Others integrate Bitcoin ETFs into a broader portfolio as a strategic allocation to alternative assets.

- Tactical Trading: Some investors use ETFs for short-term trading opportunities, capitalizing on price fluctuations.

The Risks Remain Real

While the influx of capital is impressive, it's crucial to acknowledge the inherent risks associated with Bitcoin and Bitcoin ETFs:

- Volatility: Bitcoin's price can be highly volatile, leading to significant gains or losses in short periods.

- Regulatory Uncertainty: The regulatory landscape for cryptocurrencies remains fluid, and future regulations could impact the value of Bitcoin ETFs.

- Security Risks: While ETFs mitigate some of the security risks associated with direct Bitcoin ownership, they are not entirely risk-free.

Looking Ahead: A Promising Future?

The billions flowing into Bitcoin ETFs suggest a growing institutional acceptance of cryptocurrencies. While risks remain, the increasing accessibility and regulatory clarity are likely to continue driving investment in this space. The future of Bitcoin ETFs remains uncertain but undeniably exciting, shaping the landscape of both the cryptocurrency market and traditional finance. Will the trend continue? Only time will tell, but the current momentum suggests a bright future for Bitcoin's integration into mainstream investment portfolios. Stay informed and consult with a financial advisor before making any investment decisions.

Keywords: Bitcoin ETF, Bitcoin Exchange-Traded Fund, Cryptocurrency Investment, Institutional Investors, Bitcoin Price, Crypto Market, Investment Strategies, Bitcoin Volatility, Regulatory Clarity, Diversification, Inflation Hedge, Bitcoin Futures ETF.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Billions Flowing Into Bitcoin ETFs: A Look At The Bold Investment Strategies. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Always Kept It Real Jamie Lee Curtis On Her Longstanding Friendship With Lindsay Lohan

May 21, 2025

Always Kept It Real Jamie Lee Curtis On Her Longstanding Friendship With Lindsay Lohan

May 21, 2025 -

Lufthansa Co Pilots Fainting Flight Continues Unpiloted For 10 Minutes

May 21, 2025

Lufthansa Co Pilots Fainting Flight Continues Unpiloted For 10 Minutes

May 21, 2025 -

Colombian Model And Mexican Influencer Murders Highlight Global Femicide Crisis

May 21, 2025

Colombian Model And Mexican Influencer Murders Highlight Global Femicide Crisis

May 21, 2025 -

St Louis Tornado A Communitys Fight For Recovery In The Wake Of Disaster

May 21, 2025

St Louis Tornado A Communitys Fight For Recovery In The Wake Of Disaster

May 21, 2025 -

Investor Confidence In Ethereum 200 M Investment Following Pectra Upgrade

May 21, 2025

Investor Confidence In Ethereum 200 M Investment Following Pectra Upgrade

May 21, 2025

Latest Posts

-

Linekers Controversial Tweets The Fallout And Potential Match Of The Day Departure

May 21, 2025

Linekers Controversial Tweets The Fallout And Potential Match Of The Day Departure

May 21, 2025 -

Gary Linekers Bbc Departure Whats Next For Match Of The Day Host

May 21, 2025

Gary Linekers Bbc Departure Whats Next For Match Of The Day Host

May 21, 2025 -

Watch Now A Powerful Wwi Drama Featuring Daniel Craig Cillian Murphy And Tom Hardy

May 21, 2025

Watch Now A Powerful Wwi Drama Featuring Daniel Craig Cillian Murphy And Tom Hardy

May 21, 2025 -

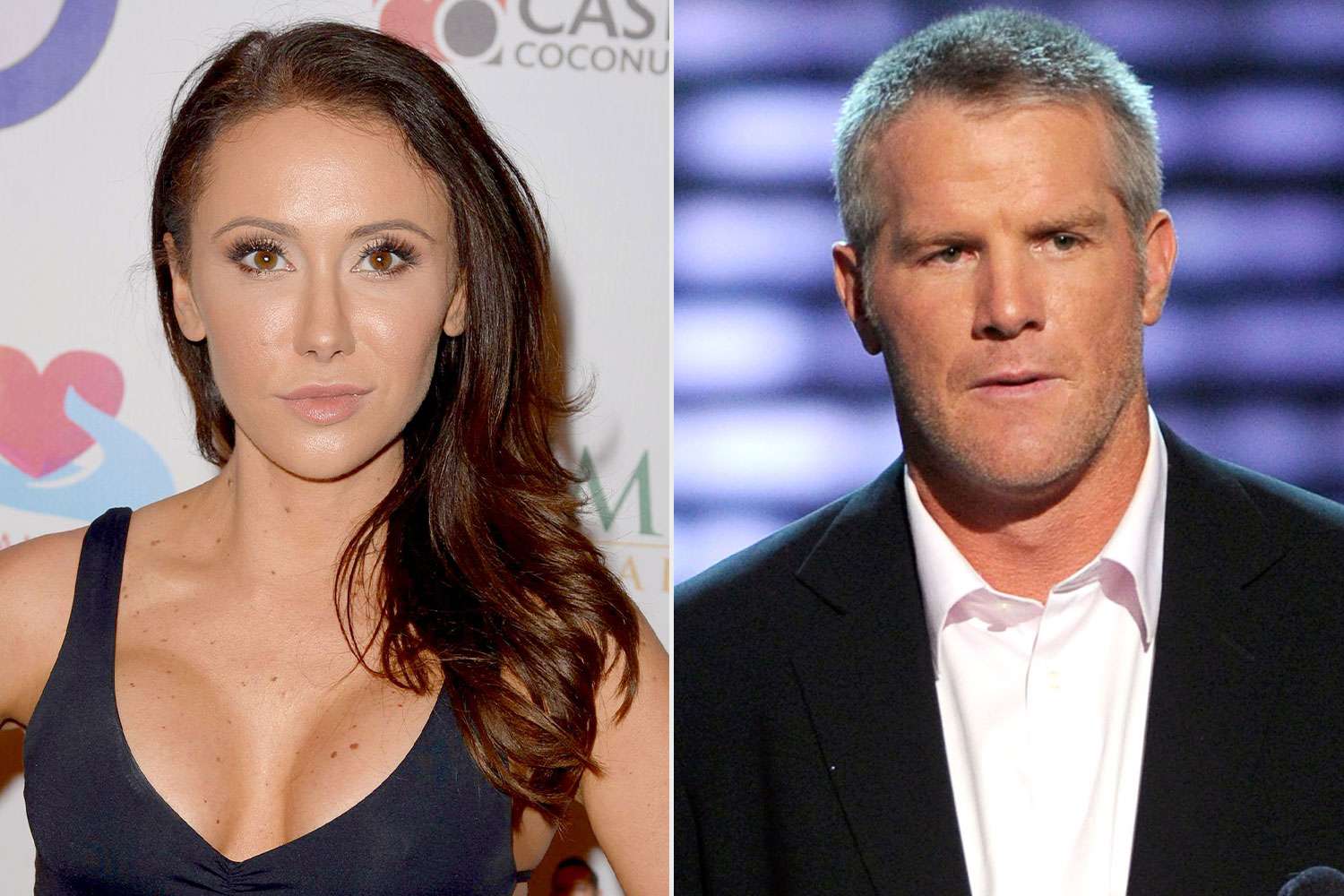

Jenn Sterger Speaks Out The Fallout From The Brett Favre Sexting Scandal

May 21, 2025

Jenn Sterger Speaks Out The Fallout From The Brett Favre Sexting Scandal

May 21, 2025 -

Jon Jones Cryptic I M Done Message Ufc Career Hanging In The Balance After Aspinall Stalemate

May 21, 2025

Jon Jones Cryptic I M Done Message Ufc Career Hanging In The Balance After Aspinall Stalemate

May 21, 2025