Birmingham Capital Management Co. Inc. (AL) Decreases Bank Of America (NYSE:BAC) Stake

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Birmingham Capital Management Lightens its Bank of America Holdings

Birmingham, AL – October 26, 2023 – Birmingham Capital Management Co. Inc., an Alabama-based investment firm, has reduced its stake in Bank of America Corporation (NYSE:BAC), according to a recent filing with the Securities and Exchange Commission (SEC). This move comes amidst ongoing market volatility and shifts in the investment firm's overall portfolio strategy. The details of the sale, including the exact number of shares sold and the resulting position size, are significant for investors watching both Birmingham Capital Management and Bank of America's performance.

The SEC filing, a 13F form detailing institutional investors' holdings, revealed a decrease in Birmingham Capital Management's ownership of Bank of America stock. While the precise figures remain subject to interpretation based on the SEC's reporting requirements, the reduction signals a change in the firm's investment outlook regarding the financial giant. This adjustment could be attributed to several factors, including a reassessment of Bank of America's future prospects, a need to rebalance the portfolio, or opportunities perceived in other sectors.

<h3>Analyzing the Implications</h3>

This strategic move by Birmingham Capital Management raises several important questions for investors:

- What prompted the sale? Was it a tactical decision based on short-term market fluctuations, or a longer-term strategic shift reflecting a change in Birmingham Capital Management's view of Bank of America's long-term potential?

- What does this mean for Bank of America's stock price? While a single institutional investor's actions rarely dramatically affect a major company's stock price, it could be a contributing factor to overall market sentiment. Large-scale selling can sometimes trigger a downward pressure, although other market factors significantly outweigh the impact of any single sale.

- How does this affect Birmingham Capital Management's overall portfolio? The adjustment in Bank of America holdings likely reflects a larger portfolio rebalancing strategy. Understanding their overall investment approach is key to interpreting the meaning of this specific move. Further investigation into their other holdings would offer a more comprehensive understanding of their investment strategy.

<h3>Bank of America's Current Performance</h3>

Bank of America (BAC) remains a major player in the financial services sector, offering a wide range of banking services, investment products, and wealth management solutions. Recent performance indicators, including quarterly earnings reports and stock price trends, should be considered alongside Birmingham Capital Management's decision. Staying informed about BAC’s financial health and industry position is crucial for assessing the long-term implications of this divestment. You can find the latest financial information on the Bank of America investor relations website. [Link to Bank of America Investor Relations].

<h3>Understanding 13F Filings</h3>

It's important to remember that 13F filings represent a snapshot in time and only reflect holdings at a specific date. They don't reveal the full picture of an investment firm's trading activities, as they don't account for short-term trades or other investment strategies. Understanding the limitations of 13F filings is critical for interpreting the significance of these reports.

<h3>Conclusion</h3>

Birmingham Capital Management's decision to reduce its Bank of America stake is a noteworthy event in the financial world, highlighting the dynamic nature of institutional investment. Further analysis is required to fully understand the motivations behind this move and its potential impact on both Birmingham Capital Management and Bank of America. Investors should continue to monitor both companies' performance and announcements for a clearer picture of the future. Staying informed about market trends and the activities of major institutional investors is essential for successful investing.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Birmingham Capital Management Co. Inc. (AL) Decreases Bank Of America (NYSE:BAC) Stake. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Is Harvards Elitism A Political Liability

May 28, 2025

Is Harvards Elitism A Political Liability

May 28, 2025 -

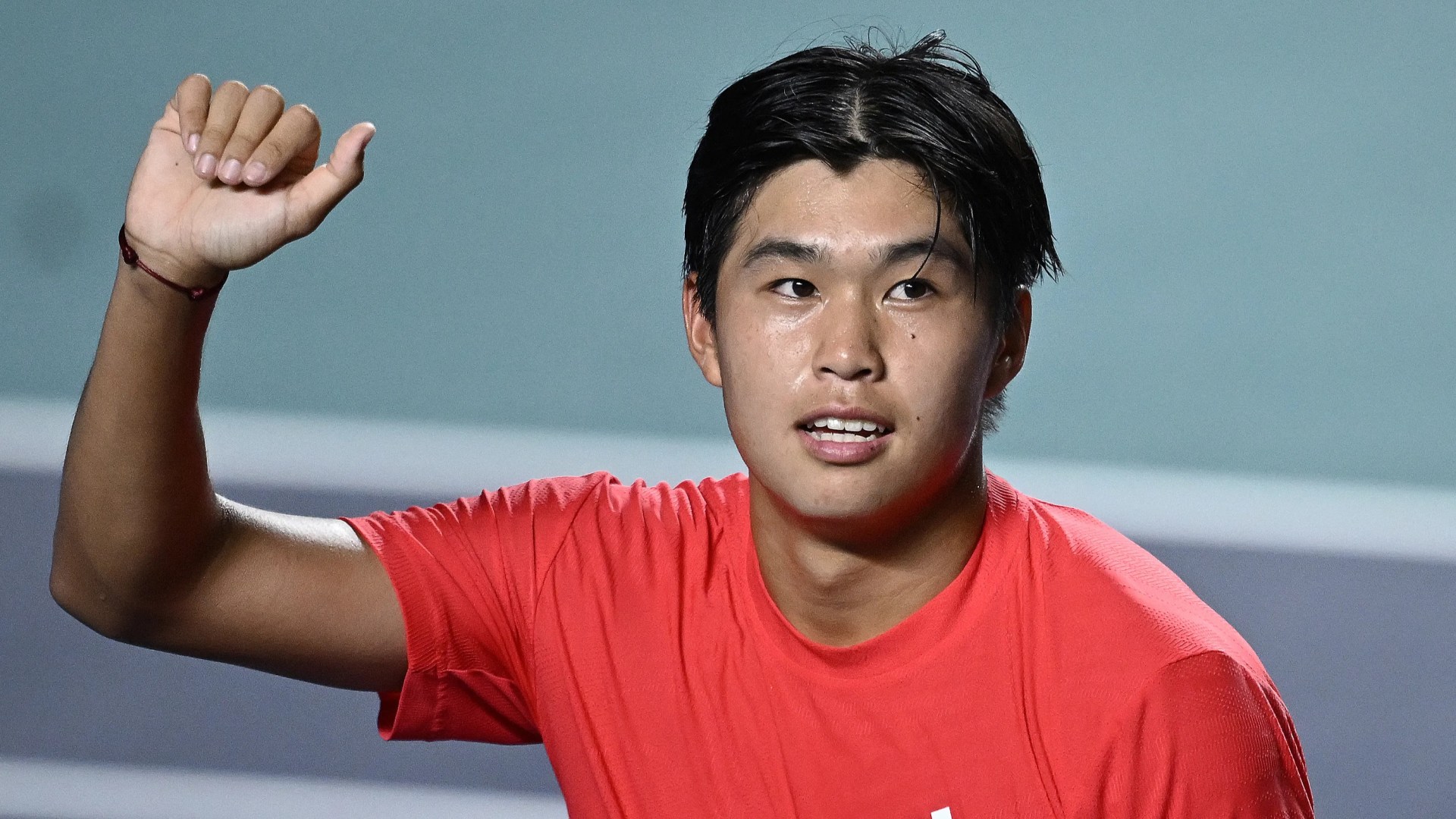

Challenging The Elite The Story Of A Us Tennis Prodigy And Their Unconventional Name

May 28, 2025

Challenging The Elite The Story Of A Us Tennis Prodigy And Their Unconventional Name

May 28, 2025 -

From Ultimo To Controversy Understanding Michelle Mones Business Trajectory

May 28, 2025

From Ultimo To Controversy Understanding Michelle Mones Business Trajectory

May 28, 2025 -

After Trading Holiday Bucks Future Hinges On Doc Rivers And Giannis

May 28, 2025

After Trading Holiday Bucks Future Hinges On Doc Rivers And Giannis

May 28, 2025 -

73 Arrested Including 21 Children After Jersey Shore Boardwalk Shutdown

May 28, 2025

73 Arrested Including 21 Children After Jersey Shore Boardwalk Shutdown

May 28, 2025

Latest Posts

-

I Saw Harvards Problems But Trumps Are Worse A Comparative Analysis

May 29, 2025

I Saw Harvards Problems But Trumps Are Worse A Comparative Analysis

May 29, 2025 -

Police Officer Hurt In Crash Driver Faces Charges In Thames Valley

May 29, 2025

Police Officer Hurt In Crash Driver Faces Charges In Thames Valley

May 29, 2025 -

Dior Presents Cruise 2026 Collection In Rome

May 29, 2025

Dior Presents Cruise 2026 Collection In Rome

May 29, 2025 -

Navigating Canada The Current Climate For American Travelers

May 29, 2025

Navigating Canada The Current Climate For American Travelers

May 29, 2025 -

Giannis Future In Milwaukee The Bucks Risky Bet On Doc Rivers Coaching

May 29, 2025

Giannis Future In Milwaukee The Bucks Risky Bet On Doc Rivers Coaching

May 29, 2025