Birmingham Capital Management Co. Inc. (AL) Sells 20,850 Bank Of America Shares

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Birmingham Capital Management Offloads Bank of America Stake: What Does it Mean?

Birmingham, AL – October 26, 2023 – Birmingham Capital Management Co. Inc., an Alabama-based investment firm, recently reduced its holdings in Bank of America Corporation (BAC), shedding 20,850 shares, according to a recent filing with the Securities and Exchange Commission (SEC). This move has sparked interest among financial analysts and investors, prompting questions about the future trajectory of both Birmingham Capital Management and Bank of America's stock price.

The SEC filing, dated [Insert Date of Filing], revealed that Birmingham Capital Management now owns 110,301 shares of Bank of America, a significant decrease from its previous holdings. While the exact reasons behind the sale remain undisclosed, several factors could contribute to this decision. Let's delve into some potential explanations and their implications.

Potential Reasons Behind the Sale

Several possibilities exist for Birmingham Capital Management's decision to sell a portion of its Bank of America holdings. These include:

-

Portfolio Rebalancing: Investment firms regularly rebalance their portfolios to manage risk and optimize returns. Selling some Bank of America shares might be part of a broader strategy to diversify holdings or adjust exposure to the financial sector. This is a common practice, particularly in times of market uncertainty.

-

Profit-Taking: If Birmingham Capital Management purchased Bank of America shares at a lower price, the recent sale could represent profit-taking, capitalizing on gains realized from the stock's performance.

-

Shifting Market Outlook: Changes in economic forecasts or industry-specific predictions could influence investment strategies. Birmingham Capital Management might have revised its outlook on Bank of America's future performance, leading to a reduction in its position.

-

Investment in Other Opportunities: The sale proceeds might be reinvested in other opportunities deemed more promising by Birmingham Capital Management, reflecting a shift in their investment priorities.

It's crucial to note that these are merely potential explanations. Without a formal statement from Birmingham Capital Management, the precise reasons behind the share sale remain speculative.

Implications for Bank of America and Investors

While a single institutional investor's move might not significantly impact Bank of America's overall stock price, it does contribute to the broader market narrative. This transaction adds to the ongoing conversation surrounding investor sentiment towards major financial institutions like Bank of America. For individual investors, this news serves as a reminder of the dynamic nature of the stock market and the importance of conducting thorough due diligence before making investment decisions.

Understanding Birmingham Capital Management Co. Inc.

Birmingham Capital Management Co. Inc. is a relatively low-profile investment firm operating out of Alabama. Further research into their investment history and strategies could provide valuable insights into their decision-making process. More information on their investment portfolio and approach can potentially be found through [Link to Birmingham Capital Management's website, if available, or a relevant financial news source].

The Importance of Diversification

This event underscores the importance of diversification in investment portfolios. No single stock, regardless of its perceived stability, should constitute a significant portion of an investor's holdings. Diversification across different sectors and asset classes is a key strategy to mitigate risk and potentially enhance long-term returns. Consider consulting with a financial advisor to build a personalized and diversified investment strategy tailored to your risk tolerance and financial goals.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. Investing in the stock market involves risk, and past performance is not indicative of future results. Always conduct thorough research and consider consulting with a qualified financial advisor before making any investment decisions.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Birmingham Capital Management Co. Inc. (AL) Sells 20,850 Bank Of America Shares. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

My Stolen Bbc Bike Navigating Bike Theft In The Hague

May 27, 2025

My Stolen Bbc Bike Navigating Bike Theft In The Hague

May 27, 2025 -

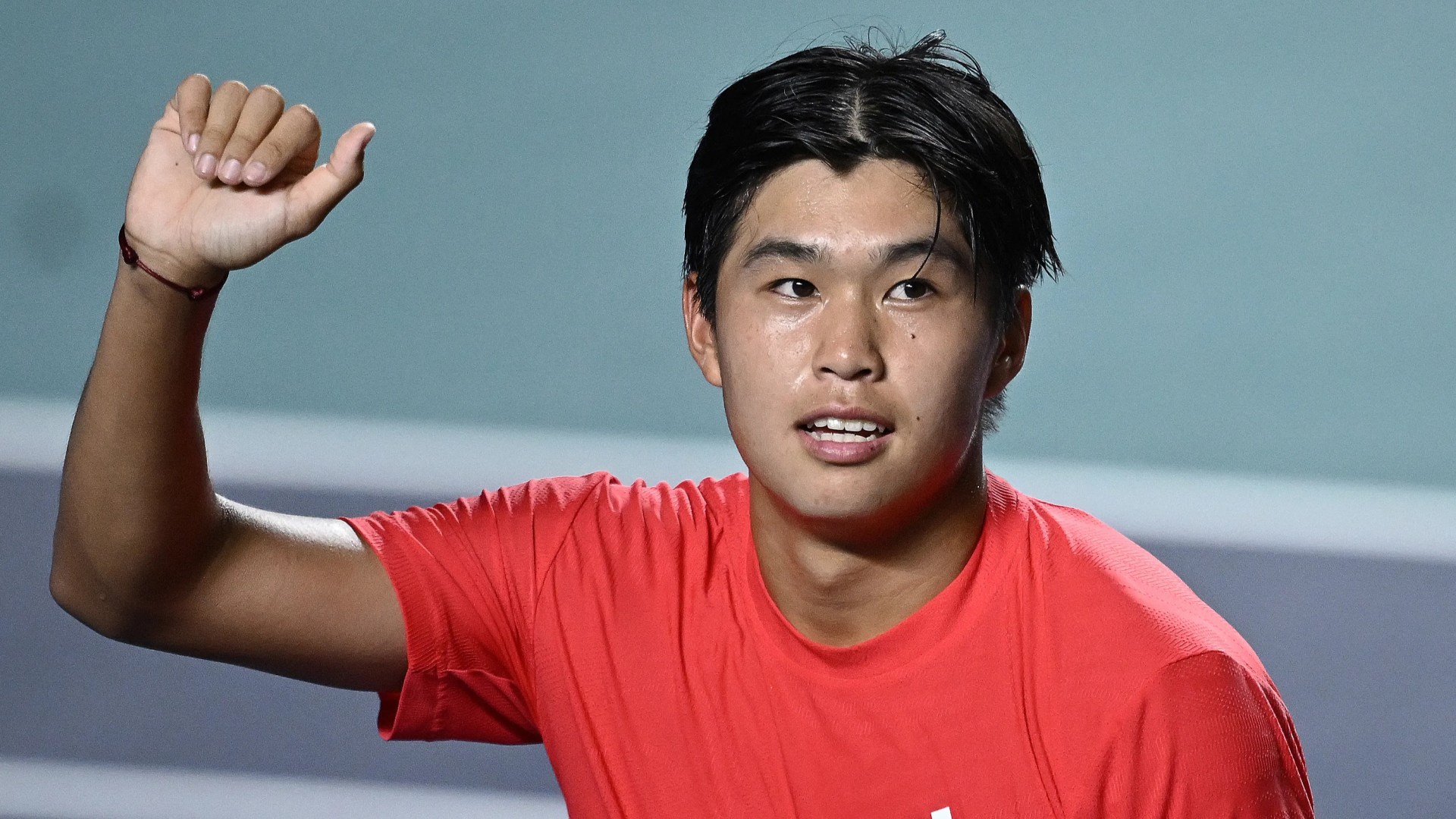

The Unlikely Path A Us Tennis Prodigys Rise From A Job Inspired Name To Facing World No 3

May 27, 2025

The Unlikely Path A Us Tennis Prodigys Rise From A Job Inspired Name To Facing World No 3

May 27, 2025 -

Ai Consciousness Are We Prepared For The Potential Reality

May 27, 2025

Ai Consciousness Are We Prepared For The Potential Reality

May 27, 2025 -

Kings Canadian Visit A Diplomatic Response To Trump Administration Actions

May 27, 2025

Kings Canadian Visit A Diplomatic Response To Trump Administration Actions

May 27, 2025 -

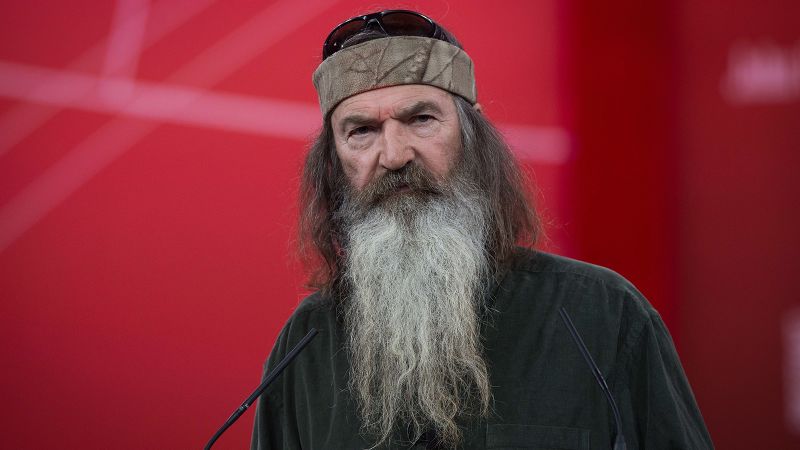

Duck Dynasty Star Phil Robertson Dead At 79 A Legacy Remembered

May 27, 2025

Duck Dynasty Star Phil Robertson Dead At 79 A Legacy Remembered

May 27, 2025

Latest Posts

-

Analyzing The Impact Of Recent Us Jailbreaks On Public Perception Of Law Enforcement

May 29, 2025

Analyzing The Impact Of Recent Us Jailbreaks On Public Perception Of Law Enforcement

May 29, 2025 -

Cassie Ventura Receives Apology Following Diddy Sex Party Allegations

May 29, 2025

Cassie Ventura Receives Apology Following Diddy Sex Party Allegations

May 29, 2025 -

Sucesso Em Paris Henrique Rocha Triunfa Na Sua Primeira Participacao Em Roland Garros

May 29, 2025

Sucesso Em Paris Henrique Rocha Triunfa Na Sua Primeira Participacao Em Roland Garros

May 29, 2025 -

Henrique Rocha E Nuno Borges Feito Historico Em Roland Garros

May 29, 2025

Henrique Rocha E Nuno Borges Feito Historico Em Roland Garros

May 29, 2025 -

A1 Northumberland Housing Development Failure And Neglect

May 29, 2025

A1 Northumberland Housing Development Failure And Neglect

May 29, 2025