Birmingham Capital Management Co. Inc. Reduces Bank Of America Holdings

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Birmingham Capital Management Co. Inc. Reduces Bank of America Holdings: A Deeper Dive into the Investment Strategy Shift

Birmingham Capital Management Co. Inc., a prominent investment firm, recently announced a significant reduction in its holdings of Bank of America Corporation (BAC) stock. This move has sparked considerable interest within the financial community, prompting analysts to dissect the underlying reasons and potential implications. This article will delve into the details of this strategic shift, exploring its potential impact on both Birmingham Capital Management and the broader financial landscape.

The Reduction: A Key Detail

According to recent filings, Birmingham Capital Management Co. Inc. decreased its stake in Bank of America by [Insert Percentage or Number of Shares Here] during the [Insert Quarter/Reporting Period Here]. This represents a notable change in their investment portfolio, raising questions about their future outlook on the financial giant.

Why the Shift? Potential Reasons Explored

While the firm hasn't explicitly stated its reasoning, several factors could contribute to this decision. These include:

-

Market Volatility: The current economic climate is marked by considerable uncertainty. Rising inflation, interest rate hikes, and geopolitical instability have created a volatile market environment, leading many investors to reassess their portfolios. The reduction in Bank of America holdings could be a risk-management strategy to mitigate potential losses in a downturn.

-

Sectoral Rebalancing: Birmingham Capital Management might be strategically reallocating its assets to other sectors perceived as having higher growth potential. This could involve shifting investments towards technology, healthcare, or renewable energy, depending on the firm's overall investment philosophy.

-

Internal Portfolio Optimization: The reduction could be part of an internal portfolio optimization strategy. This might involve adjusting the firm's asset allocation to better align with their long-term investment goals and risk tolerance.

-

Specific Concerns Regarding Bank of America: While less likely given Bank of America's relatively stable position, it's possible that Birmingham Capital Management identified specific concerns about Bank of America's future performance or outlook, leading to the decision to reduce their stake.

Impact and Implications

The implications of this move are multifaceted. For Birmingham Capital Management, it signifies a strategic recalibration of their investment strategy. For Bank of America, the reduction represents a shift in investor sentiment, although it's unlikely to significantly impact the company's overall performance.

The broader market impact is less direct but still noteworthy. This move, along with similar actions from other investment firms, can influence the overall market perception of Bank of America and potentially the financial sector as a whole.

Looking Ahead: What to Watch For

Investors and analysts will be closely monitoring Birmingham Capital Management's future moves to better understand their long-term investment strategy. Further adjustments to their portfolio and any public statements regarding the Bank of America reduction will provide crucial insights into their investment philosophy and market outlook. It will be interesting to see if other firms follow suit, signaling a broader trend in the market.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. Always consult with a qualified financial advisor before making any investment decisions. Information presented here is based on publicly available data and may be subject to change.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Birmingham Capital Management Co. Inc. Reduces Bank Of America Holdings. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Post Office Compensation Dispute Bates Fights For Full Payment After Receiving Half

May 27, 2025

Post Office Compensation Dispute Bates Fights For Full Payment After Receiving Half

May 27, 2025 -

Harvards 2024 Commencement A Doctors Advocacy For The Power Of Human Connection

May 27, 2025

Harvards 2024 Commencement A Doctors Advocacy For The Power Of Human Connection

May 27, 2025 -

American Dream German Reality A Return To The Fatherland

May 27, 2025

American Dream German Reality A Return To The Fatherland

May 27, 2025 -

Kings Visit To Canada A Show Of Support Amidst Us Trade Tensions

May 27, 2025

Kings Visit To Canada A Show Of Support Amidst Us Trade Tensions

May 27, 2025 -

Is Amazon Amzn A Momentum Stock Worth Investing In

May 27, 2025

Is Amazon Amzn A Momentum Stock Worth Investing In

May 27, 2025

Latest Posts

-

Man To Be Prosecuted After Crash Leaves Thames Valley Police Officer Hurt

May 29, 2025

Man To Be Prosecuted After Crash Leaves Thames Valley Police Officer Hurt

May 29, 2025 -

No Sewage No Homes Residents Fight New Development In Historic Area

May 29, 2025

No Sewage No Homes Residents Fight New Development In Historic Area

May 29, 2025 -

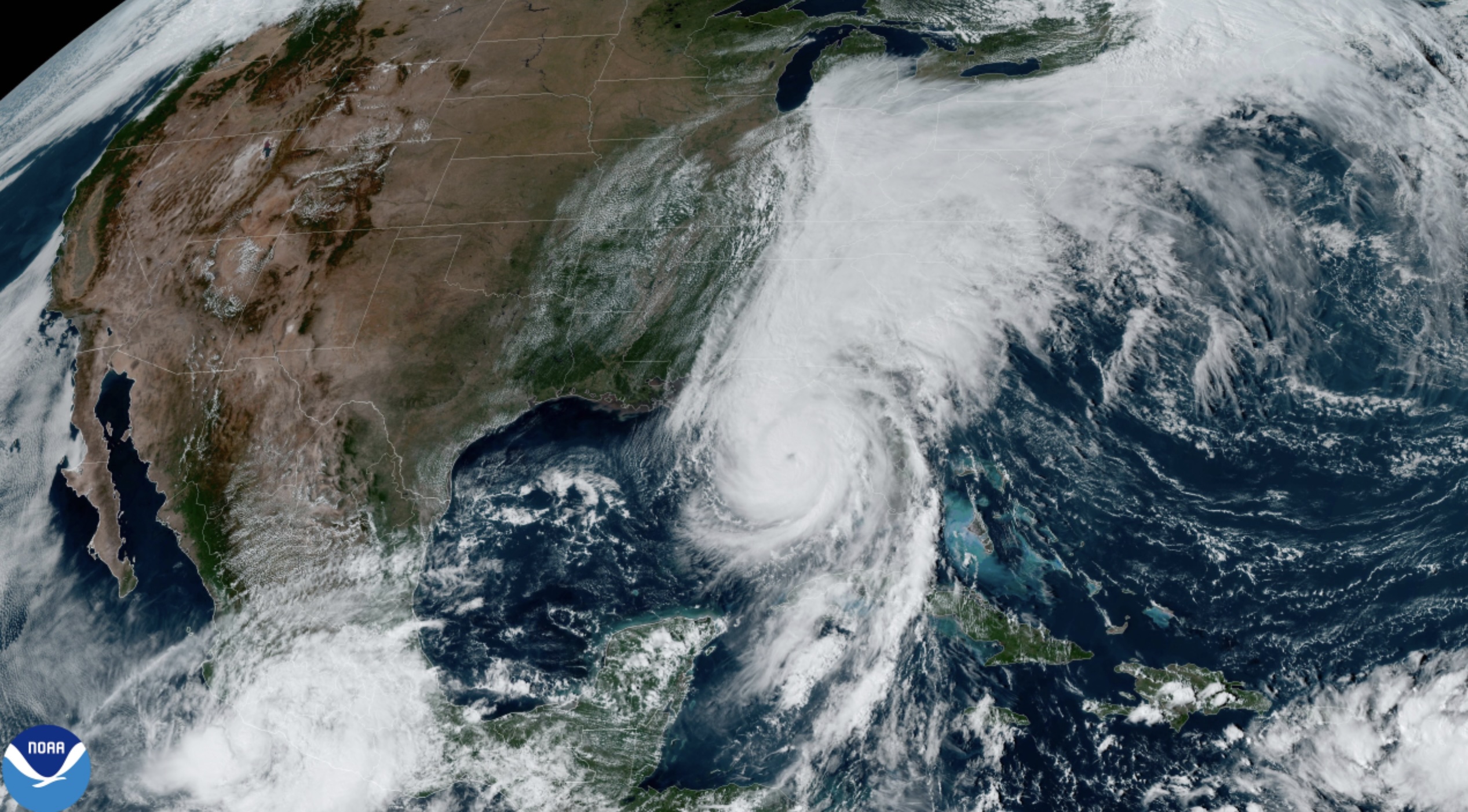

Us Faces Risk Of 10 Hurricanes This Summer Due To Above Normal Conditions

May 29, 2025

Us Faces Risk Of 10 Hurricanes This Summer Due To Above Normal Conditions

May 29, 2025 -

Inside Harvard Criticisms And My Support Despite Them Over Trump

May 29, 2025

Inside Harvard Criticisms And My Support Despite Them Over Trump

May 29, 2025 -

Brooklyn Nets Draft Strategy Climbing The Ladder And Nba Trade Implications

May 29, 2025

Brooklyn Nets Draft Strategy Climbing The Ladder And Nba Trade Implications

May 29, 2025