Birmingham Capital Management Offloads Bank Of America Shares: 20,850 Shares Sold

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Birmingham Capital Management Sheds Bank of America Stake: 20,850 Shares Sold

Birmingham, AL – October 26, 2023 – Birmingham Capital Management, a prominent investment firm, has reduced its holdings in Bank of America Corporation (BAC), according to a recent filing with the Securities and Exchange Commission (SEC). The firm sold 20,850 shares of the financial giant, a move that has sparked some interest within the investment community. This strategic divestment raises questions about Birmingham Capital Management's overall investment strategy and the future outlook for Bank of America stock.

This significant sale comes at a time of fluctuating market conditions and ongoing uncertainty within the banking sector. Understanding the reasons behind this decision requires a closer look at Birmingham Capital Management's portfolio and the broader economic landscape.

Why the Sell-Off? Analyzing Birmingham Capital Management's Decision

While Birmingham Capital Management hasn't publicly commented on the specific reasons behind the sale, several factors could be at play. These include:

- Portfolio Rebalancing: Investment firms routinely rebalance their portfolios to manage risk and optimize returns. The sale of Bank of America shares might be part of a broader strategy to diversify holdings or adjust exposure to the financial sector.

- Profit-Taking: If Birmingham Capital Management purchased Bank of America shares at a lower price, selling at a higher price point would represent a profitable exit strategy. This is a standard practice in active investment management.

- Market Outlook: Concerns about the overall economic climate, potential interest rate hikes, or weakening consumer confidence could have influenced the decision to reduce exposure to a large banking institution like Bank of America.

- Alternative Investments: The capital freed up from the sale of Bank of America shares might be allocated to more promising investment opportunities perceived to offer higher potential returns.

Bank of America Stock Performance and Future Outlook

Bank of America's stock price has experienced volatility in recent months, mirroring the broader market trends. Investors are carefully monitoring factors such as inflation, interest rates, and geopolitical events that can significantly impact the performance of financial institutions. Analyzing recent financial reports and industry forecasts is crucial to understanding the future outlook for BAC. [Link to Bank of America's investor relations page]

The sale by Birmingham Capital Management doesn't necessarily signal a negative outlook for Bank of America. It's important to remember that this is a single firm's decision and shouldn't be interpreted as a broad market indicator. However, it does underscore the dynamic nature of the investment landscape and the constant adjustments made by investment managers to maximize returns and mitigate risk.

Implications for Investors

This news highlights the importance of staying informed about the movements of key players in the market. Investors should conduct their own thorough research and consult with financial advisors before making any investment decisions. Regularly monitoring your portfolio and adapting your investment strategy based on market changes is crucial for long-term success.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. Investing involves risk, including the potential loss of principal. Consult with a qualified financial advisor before making any investment decisions.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Birmingham Capital Management Offloads Bank Of America Shares: 20,850 Shares Sold. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

No More Downgrades Apple Stops Signing I Os 18 4 1 Firmware

May 27, 2025

No More Downgrades Apple Stops Signing I Os 18 4 1 Firmware

May 27, 2025 -

Before And After The Breakout The Alleged Assistance Network For Escaped New Orleans Inmates

May 27, 2025

Before And After The Breakout The Alleged Assistance Network For Escaped New Orleans Inmates

May 27, 2025 -

Stricter Rules For Developers Action On Uncompleted Housing Projects

May 27, 2025

Stricter Rules For Developers Action On Uncompleted Housing Projects

May 27, 2025 -

Social Security Recipients Expect Checks Up To 5 108 This Week

May 27, 2025

Social Security Recipients Expect Checks Up To 5 108 This Week

May 27, 2025 -

T J Maxx Memorial Day 2025 Hours Sales And More

May 27, 2025

T J Maxx Memorial Day 2025 Hours Sales And More

May 27, 2025

Latest Posts

-

Glacier Collapse In Switzerland Significant Portion Of Blatten Destroyed

May 30, 2025

Glacier Collapse In Switzerland Significant Portion Of Blatten Destroyed

May 30, 2025 -

Controversy Erupts Californias New Track Rules Following Transgender Athlete Victory

May 30, 2025

Controversy Erupts Californias New Track Rules Following Transgender Athlete Victory

May 30, 2025 -

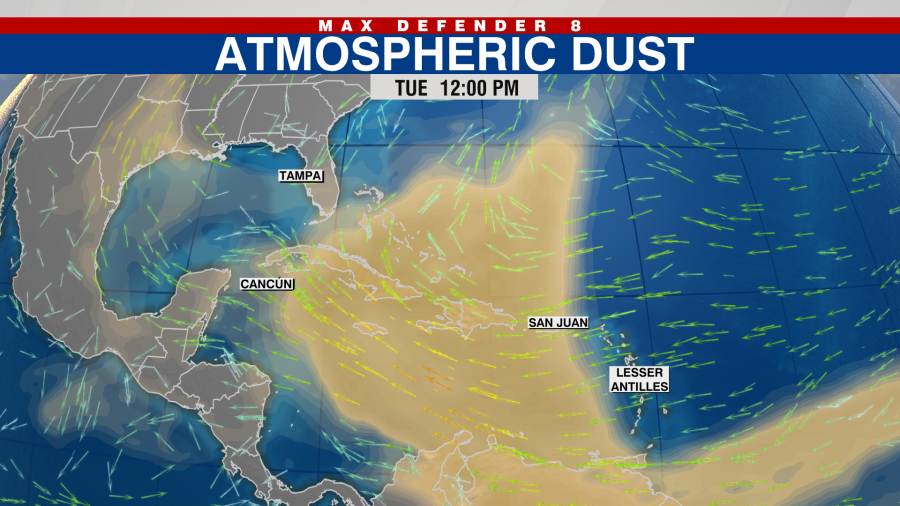

Saharan Dust Storm Approaching Florida Air Quality Alert Issued

May 30, 2025

Saharan Dust Storm Approaching Florida Air Quality Alert Issued

May 30, 2025 -

Saharan Dust Impacts North Texas Air Quality And Health Concerns

May 30, 2025

Saharan Dust Impacts North Texas Air Quality And Health Concerns

May 30, 2025 -

Under The Lights Former Junior Athletes Stellar Day 4

May 30, 2025

Under The Lights Former Junior Athletes Stellar Day 4

May 30, 2025