Birmingham Capital Management Offloads Bank Of America Shares: A 20,850 Share Sale

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Birmingham Capital Management Sheds Bank of America Shares: A 20,850 Share Sale Signals Shifting Market Sentiment?

Birmingham, AL – October 26, 2023 – Birmingham Capital Management, a prominent investment firm, recently reduced its holdings in Bank of America Corporation (BAC), selling off 20,850 shares according to recently filed SEC documents. This move has sparked speculation about potential shifts in market sentiment towards the financial giant and broader economic expectations. The sale, while representing a relatively small portion of Birmingham Capital Management's overall portfolio, has raised eyebrows amongst financial analysts.

This isn't the first time institutional investors have adjusted their Bank of America positions this year. Fluctuations in the stock price, driven by factors like interest rate hikes and economic uncertainty, have undoubtedly influenced investment strategies. Understanding the reasoning behind Birmingham Capital Management's decision requires a deeper dive into current market conditions and the firm's overall investment philosophy.

Analyzing the Implications: Why the Sale?

Several factors could contribute to Birmingham Capital Management's decision to offload its Bank of America shares:

-

Profit-Taking: The most straightforward explanation is simple profit-taking. If the firm purchased the shares at a lower price, selling them now could generate a healthy return on investment. This is a common strategy employed by many investment firms to secure gains and reallocate capital.

-

Diversification: Another possible reason is portfolio diversification. Investment firms constantly rebalance their holdings to manage risk and optimize returns. Selling some Bank of America shares might allow Birmingham Capital Management to invest in other sectors they deem more promising for future growth. This is a key element of risk management in the investment world.

-

Market Outlook: The broader economic climate plays a significant role in investment decisions. Concerns about a potential recession, inflation, or changes in regulatory environments could have prompted Birmingham Capital Management to reassess its position in Bank of America. Uncertainty in the financial sector often leads to adjustments in investment portfolios.

Bank of America's Current Performance and Future Outlook

Bank of America, a key player in the US financial landscape, has experienced its share of ups and downs this year. provides detailed information on the company's financial performance. While recent earnings reports may have been positive, ongoing macroeconomic factors continue to pose challenges. Analysts are closely watching key indicators like loan growth, net interest margins, and credit quality to gauge the bank's future prospects.

The Bigger Picture: Institutional Investor Activity and Market Sentiment

The actions of large institutional investors like Birmingham Capital Management often serve as indicators of broader market sentiment. Their decisions are closely scrutinized by other investors and analysts who look for patterns and clues about future market movements. While this single sale doesn't necessarily signal a major market shift, it does contribute to the overall narrative surrounding Bank of America and the financial sector. It's important to remember that individual investment decisions shouldn't be taken as definitive market predictions.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. Investment decisions should be made based on individual circumstances and after consulting with a qualified financial advisor.

Keywords: Birmingham Capital Management, Bank of America, BAC, stock sale, SEC filings, institutional investors, market sentiment, investment strategy, portfolio diversification, financial news, economic outlook, recession, inflation, financial sector.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Birmingham Capital Management Offloads Bank Of America Shares: A 20,850 Share Sale. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Government Cuts Threaten Black Lung Prevention Coal Miners Health At Risk

May 27, 2025

Government Cuts Threaten Black Lung Prevention Coal Miners Health At Risk

May 27, 2025 -

Dealing With Bicycle Theft My Experience In The Hague

May 27, 2025

Dealing With Bicycle Theft My Experience In The Hague

May 27, 2025 -

New York Yankees Face Setback With Stantons Latest Injury News

May 27, 2025

New York Yankees Face Setback With Stantons Latest Injury News

May 27, 2025 -

Wwii Plane Crash Eleven Dead Four Airmen Identified After Decades

May 27, 2025

Wwii Plane Crash Eleven Dead Four Airmen Identified After Decades

May 27, 2025 -

American Life Vs German Life An Expats Honest Account Of Relocation Regret

May 27, 2025

American Life Vs German Life An Expats Honest Account Of Relocation Regret

May 27, 2025

Latest Posts

-

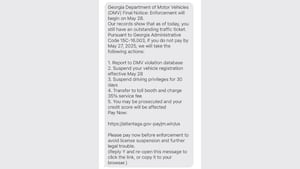

Fake Text Message From Ga Department Of Driver Services Is It A Scam

May 28, 2025

Fake Text Message From Ga Department Of Driver Services Is It A Scam

May 28, 2025 -

Thames Valley Police Man Charged In Crash That Injured Officer

May 28, 2025

Thames Valley Police Man Charged In Crash That Injured Officer

May 28, 2025 -

See Through Style Alexandra Daddarios Daring Dress Choice

May 28, 2025

See Through Style Alexandra Daddarios Daring Dress Choice

May 28, 2025 -

Are Americans Still Welcome In Canada Canadians Weigh In

May 28, 2025

Are Americans Still Welcome In Canada Canadians Weigh In

May 28, 2025 -

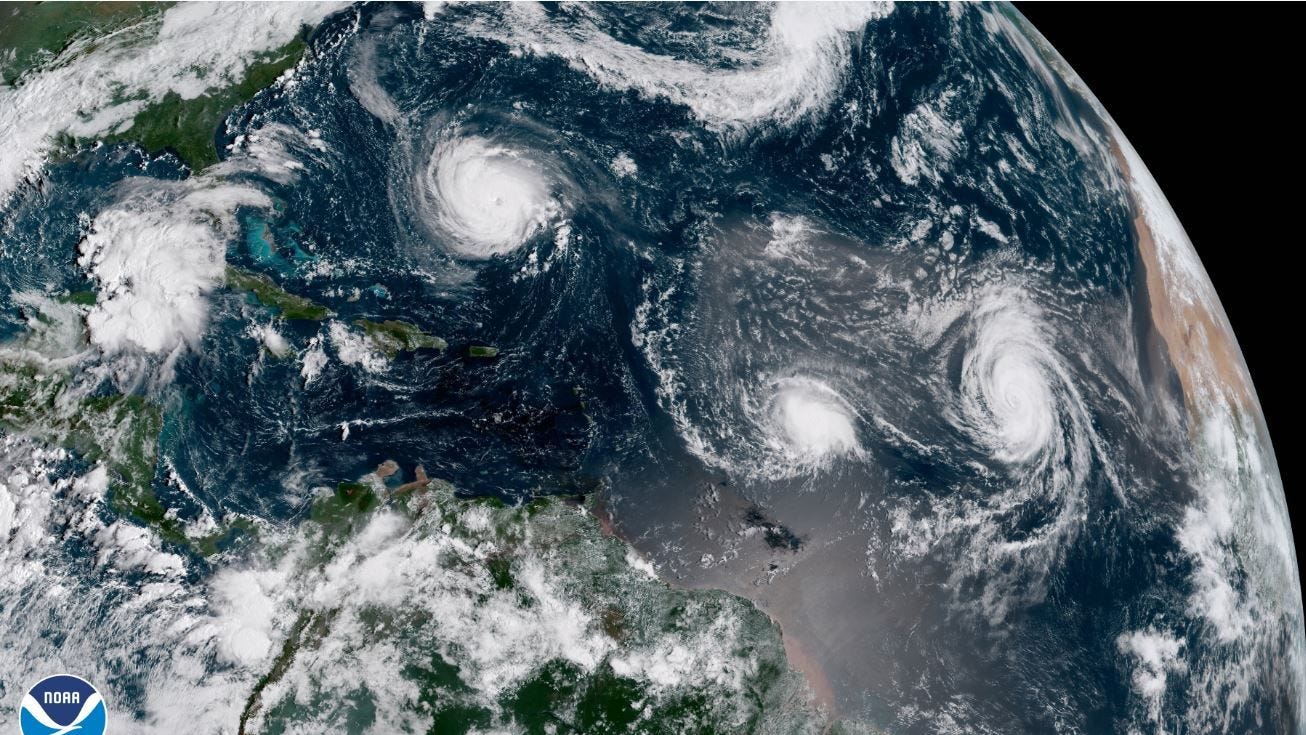

Preparing For The 2025 Hurricane Season Answers To Key Questions

May 28, 2025

Preparing For The 2025 Hurricane Season Answers To Key Questions

May 28, 2025