Birmingham Capital Management Offloads Bank Of America Shares: A Detailed Look

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Birmingham Capital Management Offloads Bank of America Shares: A Detailed Look

Birmingham Capital Management's recent move to significantly reduce its Bank of America holdings has sent ripples through the financial markets, prompting analysts and investors to scrutinize the implications. The firm, known for its shrewd investment strategies, decreased its stake in the banking giant by a substantial margin, sparking questions about their outlook on the financial sector and Bank of America's future performance. This article delves into the details of this significant divestment, examining the potential reasons behind the decision and exploring its broader impact.

The Sale: Facts and Figures

Birmingham Capital Management, a prominent investment firm with a history of successful portfolio management, recently filed a 13F report revealing a dramatic decrease in its Bank of America (BAC) holdings. While the exact figures remain subject to interpretation depending on the reporting period, preliminary reports suggest a reduction of [Insert Percentage or Share Number if available, otherwise remove this sentence and the next]. This significant reduction represents a major shift in Birmingham Capital Management's investment strategy concerning one of the nation's largest financial institutions. [If available, add a link to the official SEC filing here].

Why the Downgrade? Potential Motivations

Several factors could have contributed to Birmingham Capital Management's decision to offload its Bank of America shares. These include:

-

Market Outlook: A pessimistic outlook on the overall financial market, particularly concerning the banking sector, could have prompted the sell-off. Rising interest rates, potential economic slowdown, and increased regulatory scrutiny are all potential contributing factors. Recent economic reports showing [mention specific relevant economic indicators] may have influenced this decision.

-

Company-Specific Concerns: While Bank of America has generally performed well, specific concerns about its future profitability or strategic direction might have led Birmingham Capital Management to re-evaluate its investment. This could be related to [mention any specific news or events regarding Bank of America, such as potential lawsuits, new regulations, or changes in leadership].

-

Portfolio Diversification: The sale might simply be part of a broader portfolio diversification strategy. Birmingham Capital Management may have identified more attractive investment opportunities in other sectors, leading them to reallocate capital. This is a common practice among investment firms seeking to optimize returns and mitigate risk.

-

Profit Taking: The sale could also be a simple case of profit-taking. If Birmingham Capital Management acquired its Bank of America shares at a significantly lower price, selling at the current market price could represent a substantial profit.

Implications for Bank of America and the Broader Market

The impact of Birmingham Capital Management's decision on Bank of America's stock price and overall market sentiment remains to be seen. While a single firm's actions rarely cause dramatic market shifts, the move serves as a data point for analysts to consider. Further declines in the stock price might trigger a larger sell-off, while a stable or upward trend could indicate investor confidence remains relatively strong. The overall health of the banking sector and broader economic conditions will ultimately play a significant role in shaping the long-term consequences of this decision.

What's Next?

The financial markets are constantly evolving, and this situation is no exception. Investors and analysts will be closely monitoring Bank of America's performance, as well as the overall economic climate, to understand the full implications of Birmingham Capital Management's move. Further analysis and news reports will be crucial in interpreting this event's significance. Stay tuned for updates as this story unfolds.

Keywords: Birmingham Capital Management, Bank of America, BAC, stock sale, 13F filing, investment strategy, portfolio diversification, financial markets, economic outlook, banking sector, stock market analysis, investment news

(Note: This article uses placeholder information where specific data was not provided. Remember to replace the bracketed information with accurate and up-to-date details before publishing.)

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Birmingham Capital Management Offloads Bank Of America Shares: A Detailed Look. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Harvard Commencement Speaker To Champion Human Touch Over Tech

May 27, 2025

Harvard Commencement Speaker To Champion Human Touch Over Tech

May 27, 2025 -

Benefit Cap Future Unclear Rayner Declines To Comment On Abolition

May 27, 2025

Benefit Cap Future Unclear Rayner Declines To Comment On Abolition

May 27, 2025 -

Pda Filled Outing Sparks Romance Rumors Between Jo Jo Siwa And Chris Hughes

May 27, 2025

Pda Filled Outing Sparks Romance Rumors Between Jo Jo Siwa And Chris Hughes

May 27, 2025 -

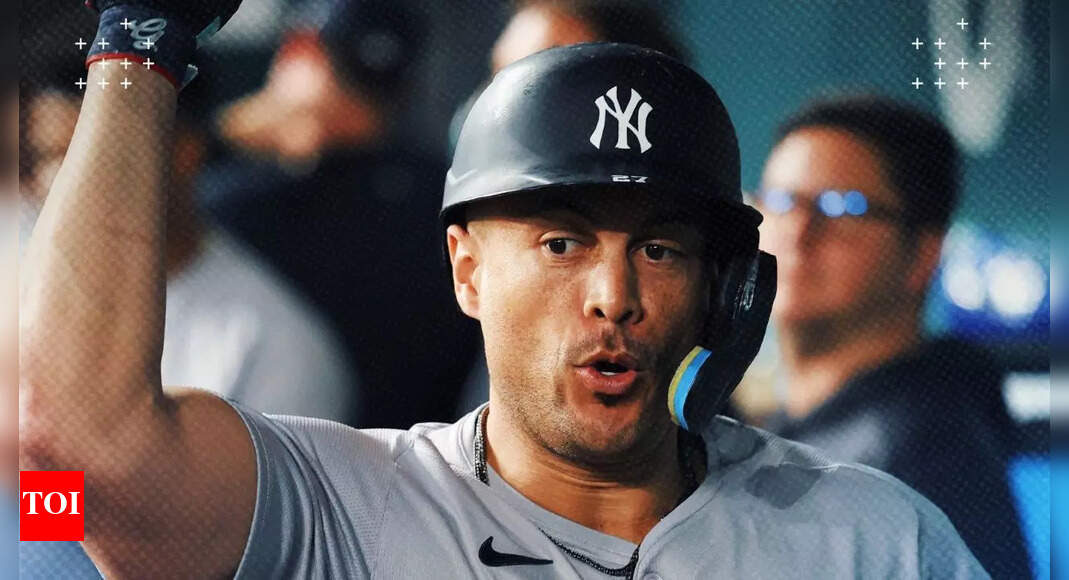

Mariners Rumors Is Giancarlo Stanton Headed To Seattle

May 27, 2025

Mariners Rumors Is Giancarlo Stanton Headed To Seattle

May 27, 2025 -

Gary Linekers Bbc Exit The End Of A Long And Successful Career

May 27, 2025

Gary Linekers Bbc Exit The End Of A Long And Successful Career

May 27, 2025

Latest Posts

-

Student Visa Delays Us Halts Appointments Increases Social Media Vetting

May 30, 2025

Student Visa Delays Us Halts Appointments Increases Social Media Vetting

May 30, 2025 -

Tearful Tribute George Strait Delivers Emotional Eulogy At Location

May 30, 2025

Tearful Tribute George Strait Delivers Emotional Eulogy At Location

May 30, 2025 -

Gaza Conflict Un Envoy In Tears After Witnessing Child Deaths Video

May 30, 2025

Gaza Conflict Un Envoy In Tears After Witnessing Child Deaths Video

May 30, 2025 -

Diddy Trial Update Ex Employees Shocking Testimony On Kid Cudi Threat

May 30, 2025

Diddy Trial Update Ex Employees Shocking Testimony On Kid Cudi Threat

May 30, 2025 -

Watch Passengers Attempt To Capture Birds Aboard A Delta Airplane

May 30, 2025

Watch Passengers Attempt To Capture Birds Aboard A Delta Airplane

May 30, 2025