Birmingham Capital Management Sells Bank Of America Shares: A Detailed Look

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Birmingham Capital Management Sells Bank of America Shares: A Detailed Look

Birmingham Capital Management's recent move to offload its Bank of America (BAC) shares has sent ripples through the financial market, prompting analysts and investors to dissect the implications of this strategic decision. The sale, disclosed in a recent 13F filing, reveals a significant shift in the investment firm's portfolio allocation and raises questions about the future outlook for Bank of America stock. This article delves into the details surrounding this transaction, examining potential motivations and analyzing its impact on both Birmingham Capital Management and the broader market.

Why the Sale? Unpacking Birmingham Capital Management's Strategy

Birmingham Capital Management, known for its value-oriented investment approach, hasn't publicly commented on the specifics behind the Bank of America share sale. However, several factors could have contributed to this decision. These include:

-

Profit-Taking: After a period of growth, realizing profits on a substantial holding like Bank of America is a standard practice for many investment firms. The timing of the sale may indicate Birmingham Capital Management identified a favorable market condition to maximize returns.

-

Portfolio Rebalancing: Investment firms regularly rebalance their portfolios to manage risk and capitalize on emerging opportunities in other sectors. The sale of Bank of America shares might signal a shift towards different asset classes or companies deemed more promising in the current economic climate.

-

Market Outlook: Birmingham Capital Management's decision could reflect a less optimistic outlook on Bank of America's future performance. Concerns about rising interest rates, a potential economic slowdown, or increasing competition within the financial sector could have influenced their strategy.

-

Investment Thesis Change: The firm's original investment thesis for Bank of America might have evolved, rendering the investment less attractive compared to other opportunities. This could be due to changes in company leadership, strategic direction, or regulatory environment.

Impact on Bank of America Stock and the Broader Market

While Birmingham Capital Management's sale represents a significant transaction, its impact on Bank of America's stock price is likely to be relatively limited. The firm's holdings likely represented a small fraction of Bank of America's total outstanding shares. However, the sale does add to the ongoing narrative surrounding the financial sector's performance and investor sentiment.

Other factors influencing Bank of America's stock price include:

- Interest rate hikes by the Federal Reserve.

- Economic growth forecasts.

- Competition from other financial institutions.

- Regulatory changes affecting the banking industry.

What's Next for Birmingham Capital Management and Bank of America?

The future remains uncertain for both Birmingham Capital Management and Bank of America. Birmingham Capital Management's future investment strategy remains to be seen, but their actions suggest a willingness to adapt to changing market conditions. For Bank of America, the performance of the stock will largely depend on broader macroeconomic factors and the company's own ability to navigate the current financial landscape. Keeping a close eye on economic indicators and Bank of America's financial reports will be crucial for investors.

Disclaimer: This article is for informational purposes only and should not be construed as financial advice. Always consult with a qualified financial advisor before making any investment decisions.

Keywords: Birmingham Capital Management, Bank of America, BAC stock, 13F filing, stock sale, portfolio rebalancing, investment strategy, financial news, market analysis, economic outlook, investment advice.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Birmingham Capital Management Sells Bank Of America Shares: A Detailed Look. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Brigitte Macron Et Emmanuel Macron Au Vietnam Simple Dispute Conjugale Selon L Entourage Presidentiel

May 27, 2025

Brigitte Macron Et Emmanuel Macron Au Vietnam Simple Dispute Conjugale Selon L Entourage Presidentiel

May 27, 2025 -

Gaza Babys Plight Bbc Highlights Hunger Amidst Blockade

May 27, 2025

Gaza Babys Plight Bbc Highlights Hunger Amidst Blockade

May 27, 2025 -

Human Touch Takes Center Stage Doctor Delivers Powerful Harvard Commencement Address

May 27, 2025

Human Touch Takes Center Stage Doctor Delivers Powerful Harvard Commencement Address

May 27, 2025 -

Political Fallout And Public Sentiment Following Andriy Portnovs Murder In Ukraine

May 27, 2025

Political Fallout And Public Sentiment Following Andriy Portnovs Murder In Ukraine

May 27, 2025 -

Memorial Day Weekend Violence 73 Arrested In Beach Town

May 27, 2025

Memorial Day Weekend Violence 73 Arrested In Beach Town

May 27, 2025

Latest Posts

-

600 Billion Pledge The Future Of Billionaire Philanthropy After Gates And Buffett

May 28, 2025

600 Billion Pledge The Future Of Billionaire Philanthropy After Gates And Buffett

May 28, 2025 -

The Truth Behind Trumps Outburst At Harvard A Maga Scandal Revealed

May 28, 2025

The Truth Behind Trumps Outburst At Harvard A Maga Scandal Revealed

May 28, 2025 -

Royal Visit And Political Tensions King Charles In Canada As Trump Pushes Statehood

May 28, 2025

Royal Visit And Political Tensions King Charles In Canada As Trump Pushes Statehood

May 28, 2025 -

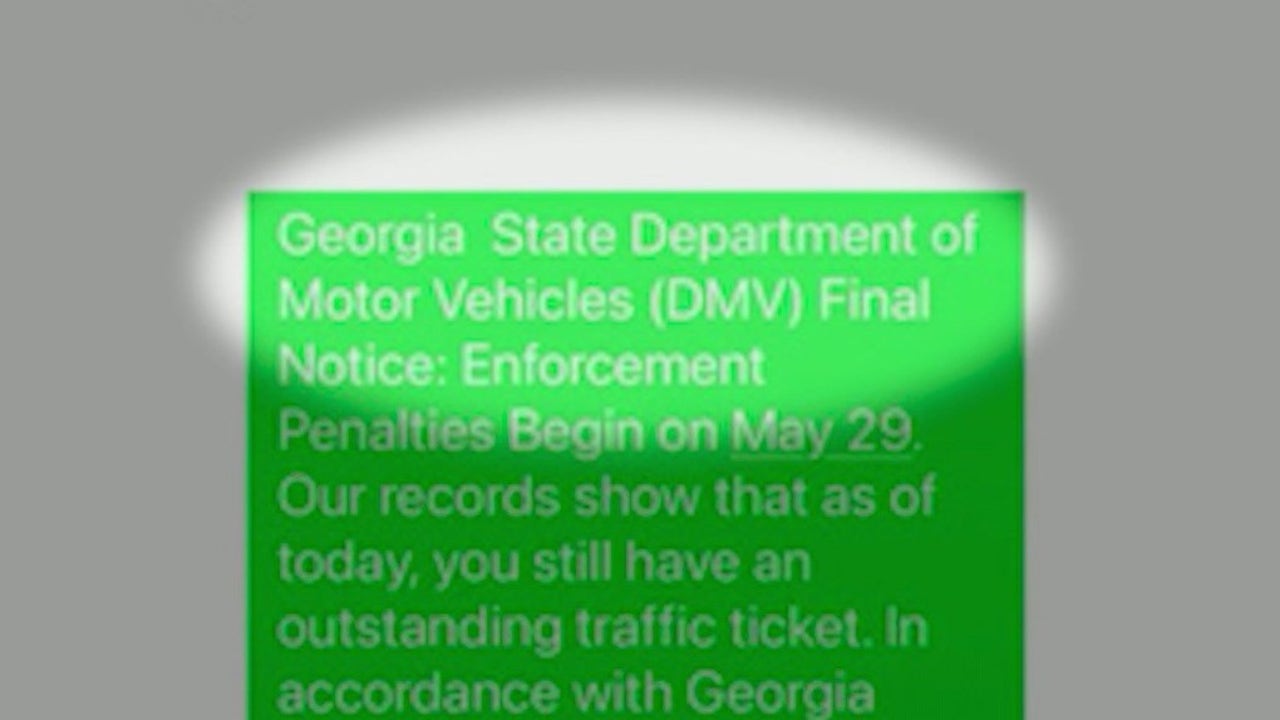

How To Spot A Fake Traffic Ticket Text Scam In Georgia

May 28, 2025

How To Spot A Fake Traffic Ticket Text Scam In Georgia

May 28, 2025 -

Could Giannis Be Traded Top Nba Teams Likely To Make A Push

May 28, 2025

Could Giannis Be Traded Top Nba Teams Likely To Make A Push

May 28, 2025