Bitcoin Demand Dips: US Investor Sentiment And Price Predictions

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Bitcoin Demand Dips: US Investor Sentiment and Price Predictions

Bitcoin's price has seen a recent downturn, sparking concerns about the future of the cryptocurrency. While Bitcoin remains a prominent player in the digital asset landscape, waning US investor sentiment and fluctuating predictions are causing ripples throughout the market. This article delves into the factors contributing to this dip, analyzes current investor sentiment, and explores various price predictions for the leading cryptocurrency.

The Cooling of US Investor Enthusiasm:

The recent decline in Bitcoin demand is largely attributed to a shift in US investor sentiment. Several factors are at play:

- Inflation Concerns: The ongoing battle against inflation continues to impact investment decisions. With traditional asset classes like bonds and stocks offering (relatively) safer returns, investors are becoming more risk-averse, leading to a decrease in appetite for volatile assets like Bitcoin.

- Regulatory Uncertainty: The regulatory landscape surrounding cryptocurrencies in the US remains unclear. The lack of a comprehensive regulatory framework creates uncertainty, deterring some institutional investors and potentially hindering broader adoption. This uncertainty is further fueled by ongoing regulatory probes and enforcement actions against various crypto firms.

- Macroeconomic Headwinds: Global economic instability, including rising interest rates and potential recessionary fears, further dampens investor enthusiasm for speculative assets like Bitcoin. This macroeconomic environment makes investors more cautious about their investments, including cryptocurrencies.

Expert Price Predictions – A Divergent Landscape:

Predicting Bitcoin's price is notoriously difficult, and analysts offer a wide range of forecasts. While some maintain a bullish outlook citing long-term growth potential and technological advancements, others express caution given the current market conditions.

- Bearish Predictions: Some analysts predict further price drops, pointing to the current bearish sentiment and potential for further regulatory crackdowns. These predictions often cite technical indicators and historical price patterns to support their outlook. They suggest that Bitcoin could test lower support levels before finding a bottom.

- Bullish Predictions: Conversely, others remain optimistic about Bitcoin's long-term prospects. They emphasize the growing adoption of Bitcoin as a store of value and a hedge against inflation. These analysts highlight the potential for institutional adoption to drive future price increases. They often point to factors like increasing network activity and ongoing development as signs of future growth.

Navigating the Uncertainty:

The current dip in Bitcoin demand presents both challenges and opportunities for investors. It's crucial to approach the market with caution and conduct thorough research before making any investment decisions. Here are some key considerations:

- Risk Tolerance: Investing in Bitcoin carries significant risk. It's crucial to only invest what you can afford to lose.

- Diversification: Diversifying your investment portfolio across different asset classes is essential to mitigate risk. Don't put all your eggs in one basket.

- Long-Term Vision: Many believe Bitcoin's long-term potential remains strong, despite short-term volatility. A long-term investment strategy might be suitable for those with a higher risk tolerance.

Conclusion:

The recent dip in Bitcoin demand reflects a confluence of factors, including shifting US investor sentiment and macroeconomic uncertainties. While price predictions vary widely, it’s clear that navigating this market requires careful consideration of risk and a well-informed investment strategy. Stay informed about the latest developments and consult with a financial advisor before making any investment decisions. The future of Bitcoin remains uncertain, but its journey continues to be a fascinating one to follow.

Keywords: Bitcoin price, Bitcoin demand, US investor sentiment, Bitcoin price prediction, cryptocurrency, Bitcoin investment, regulatory uncertainty, macroeconomic headwinds, Bitcoin future, crypto market, Bitcoin volatility.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Bitcoin Demand Dips: US Investor Sentiment And Price Predictions. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

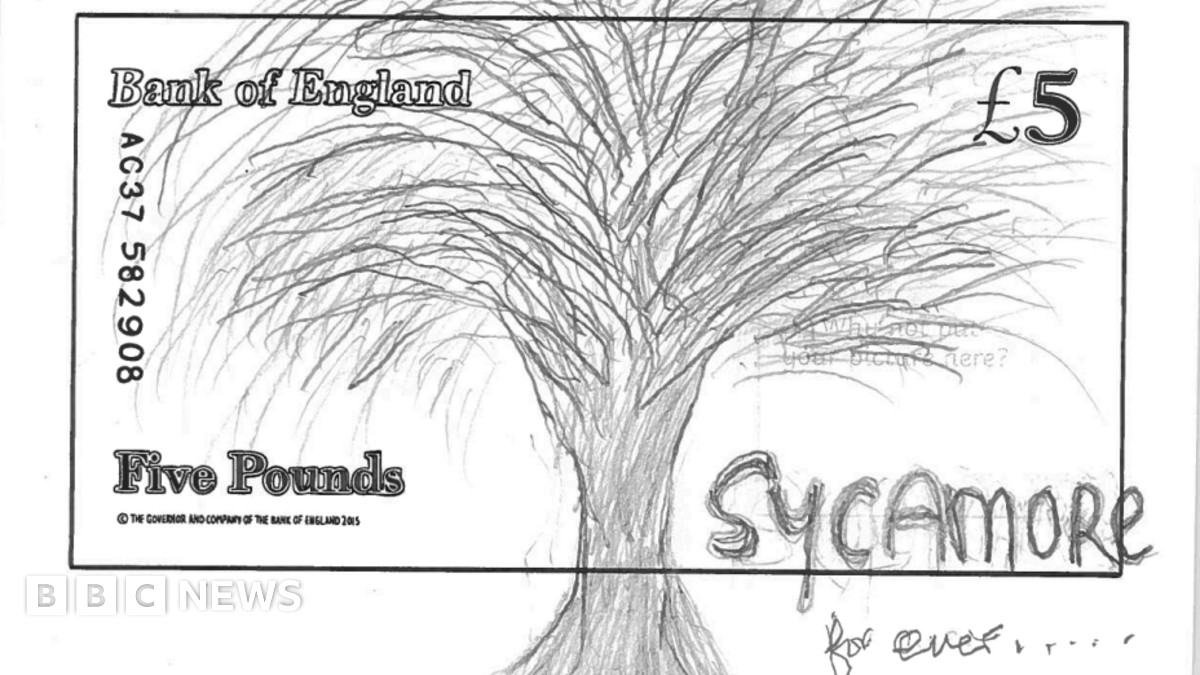

Bank Of England Flooded With Thousands Of Banknote Redesign Proposals

Aug 01, 2025

Bank Of England Flooded With Thousands Of Banknote Redesign Proposals

Aug 01, 2025 -

Palestinian State Recognition Implications And Consequences

Aug 01, 2025

Palestinian State Recognition Implications And Consequences

Aug 01, 2025 -

New Sba Advocate A Lifeline For Small Businesses In Automation And Manufacturing

Aug 01, 2025

New Sba Advocate A Lifeline For Small Businesses In Automation And Manufacturing

Aug 01, 2025 -

Navigating Student Loan Options Why Federal Loans Are Still The Preferred Choice

Aug 01, 2025

Navigating Student Loan Options Why Federal Loans Are Still The Preferred Choice

Aug 01, 2025 -

Midair Collision At Reagan National A Familys Fight For Safer Skies

Aug 01, 2025

Midair Collision At Reagan National A Familys Fight For Safer Skies

Aug 01, 2025

Latest Posts

-

Trump And Epstein How Maga Media Is Responding To The Renewed Scrutiny

Aug 02, 2025

Trump And Epstein How Maga Media Is Responding To The Renewed Scrutiny

Aug 02, 2025 -

Marathon Dreams Vs Gaza Reality One Athletes Heartbreaking Dilemma

Aug 02, 2025

Marathon Dreams Vs Gaza Reality One Athletes Heartbreaking Dilemma

Aug 02, 2025 -

Us National Security Evaluating Risks Posed By Brazils Policies

Aug 02, 2025

Us National Security Evaluating Risks Posed By Brazils Policies

Aug 02, 2025 -

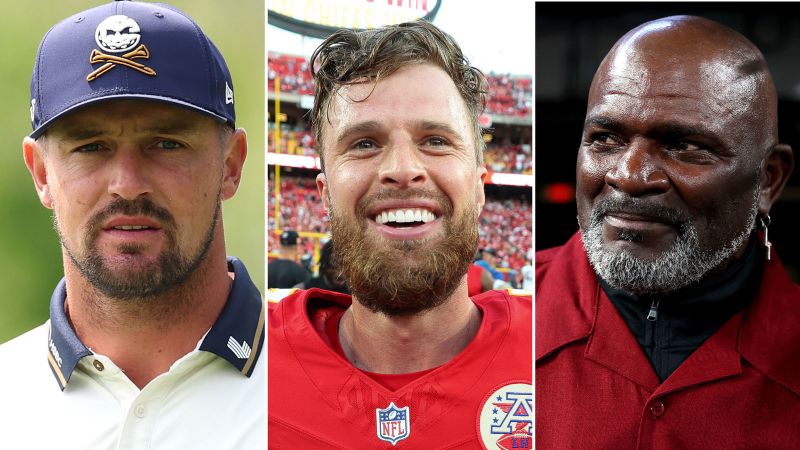

Professional Athletes To Join Trumps Expanded Presidential Sports Council

Aug 02, 2025

Professional Athletes To Join Trumps Expanded Presidential Sports Council

Aug 02, 2025 -

Wifes Death Leads To Life Sentence For Colorado Dentist

Aug 02, 2025

Wifes Death Leads To Life Sentence For Colorado Dentist

Aug 02, 2025