Bitcoin Demand Shift Threatens Coinbase's 60-Day BTC Premium

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Bitcoin Demand Shift Threatens Coinbase's 60-Day BTC Premium: A Market Analysis

Coinbase's significant premium over the spot price of Bitcoin (BTC), a hallmark of its trading platform for much of the past two years, is showing signs of significant erosion. This dwindling premium, which has consistently hovered around 2% to 5% for over 60 days, threatens the exchange's revenue stream and reflects a broader shift in market dynamics. Analysts point to several contributing factors, indicating a potential paradigm shift in the cryptocurrency landscape.

The Crumbling Premium: A Sign of Changing Times?

For a considerable period, Coinbase enjoyed a substantial premium on its Bitcoin offerings. This was largely attributed to its reputation as a reliable and regulated platform, particularly appealing to institutional investors and those new to the crypto space. However, recent data suggests this premium has dramatically decreased, even falling below 1% in certain periods. This decline raises crucial questions about the future of Coinbase's trading volume and profitability.

Factors Contributing to the Decline:

Several interconnected factors have contributed to the weakening of Coinbase's Bitcoin premium:

-

Increased Competition: The cryptocurrency exchange landscape has become increasingly crowded. New entrants and the growth of decentralized exchanges (DEXs) offer users more options, intensifying competition and forcing platforms like Coinbase to be more price-competitive.

-

Regulatory Uncertainty: While Coinbase operates under a relatively well-defined regulatory framework compared to many competitors, ongoing regulatory uncertainty within the broader cryptocurrency market continues to impact investor sentiment and potentially drive demand towards less regulated platforms.

-

Shifting Investor Sentiment: The recent market downturn, coupled with ongoing macroeconomic headwinds, has led to a more cautious approach amongst investors. This may have reduced the premium investors are willing to pay for the perceived security and regulatory compliance offered by Coinbase.

-

Improved On-Ramp/Off-Ramp Solutions: The availability of more user-friendly and cost-effective on-ramps and off-ramps for cryptocurrency has made it easier for users to access and trade Bitcoin on various exchanges, reducing the reliance on platforms like Coinbase.

Implications for Coinbase and the Broader Market:

The shrinking Bitcoin premium on Coinbase has significant implications for both the exchange itself and the wider cryptocurrency market. For Coinbase, the reduced premium directly translates to lower trading fees and potentially reduced profitability. This necessitates a strategic response, possibly involving adjustments to its fee structure, enhanced product offerings, or a greater focus on institutional clients.

The broader market implications are equally noteworthy. The decline signifies a potential shift away from centralized exchanges towards decentralized alternatives or more competitive centralized players. It underscores the evolving dynamics within the cryptocurrency ecosystem and highlights the need for exchanges to constantly adapt to changing market conditions and investor preferences.

What Lies Ahead?

The future trajectory of Coinbase's Bitcoin premium remains uncertain. While the recent decline is significant, it's too early to declare its complete disappearance. The exchange's ability to adapt to the evolving market landscape, maintain its regulatory compliance, and offer competitive services will ultimately determine its future success in navigating this new phase.

Keywords: Coinbase, Bitcoin, BTC, Cryptocurrency, Exchange, Premium, Trading, Market Analysis, Regulatory Uncertainty, Decentralized Exchanges (DEXs), Competition, Investor Sentiment, On-Ramp, Off-Ramp.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Bitcoin Demand Shift Threatens Coinbase's 60-Day BTC Premium. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Labours Handling Of Hamas Criticism Mounts Over Partys Response

Aug 01, 2025

Labours Handling Of Hamas Criticism Mounts Over Partys Response

Aug 01, 2025 -

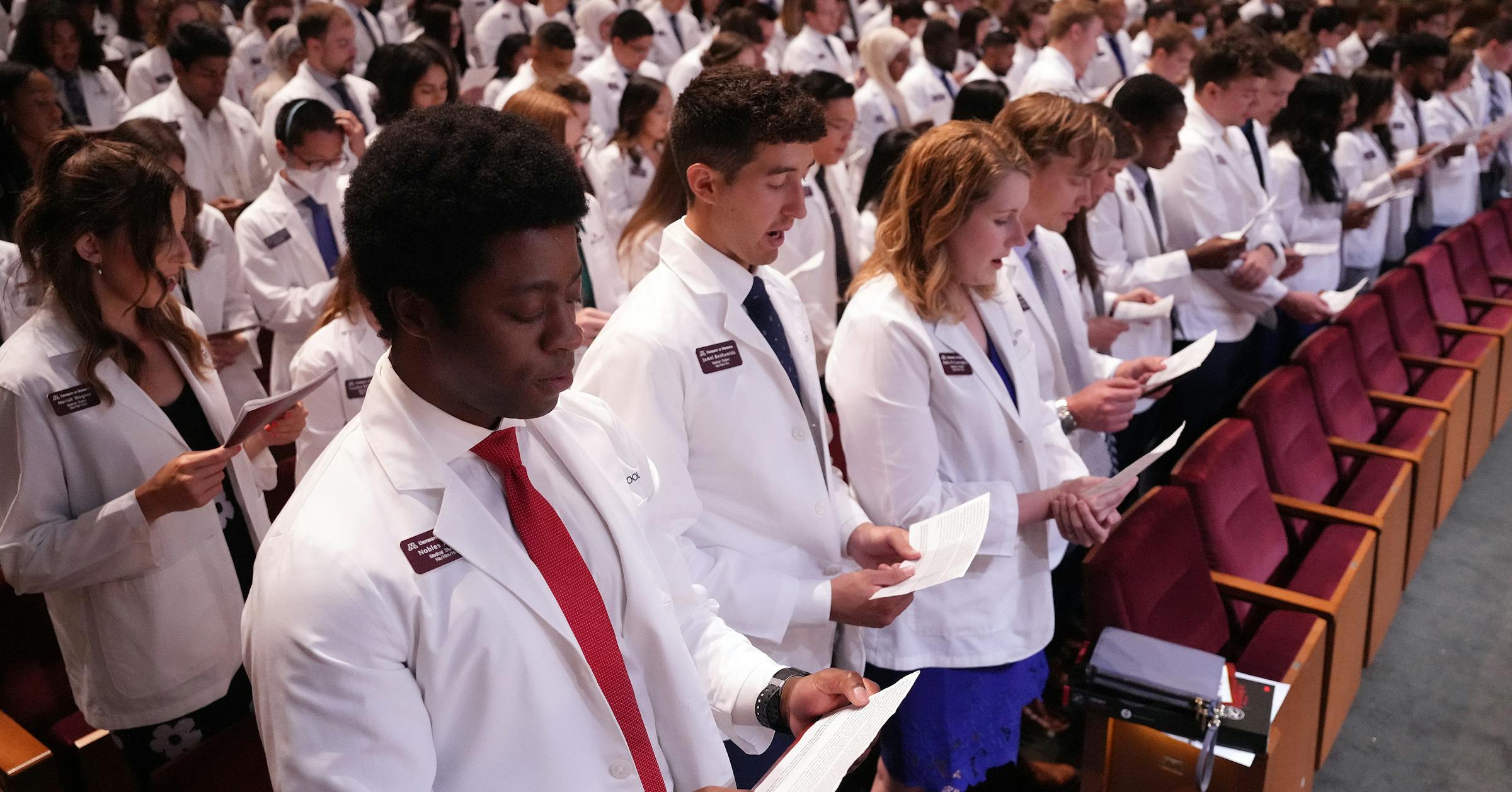

Rising Tuition And Shrinking Loan Limits The Future Of Law And Medical School

Aug 01, 2025

Rising Tuition And Shrinking Loan Limits The Future Of Law And Medical School

Aug 01, 2025 -

Declining Bitcoin Demand In The Us A Market Analysis

Aug 01, 2025

Declining Bitcoin Demand In The Us A Market Analysis

Aug 01, 2025 -

Reagan National Airport Collision Spurs Familys Campaign For Enhanced Aviation Safety

Aug 01, 2025

Reagan National Airport Collision Spurs Familys Campaign For Enhanced Aviation Safety

Aug 01, 2025 -

Air Traffic Control Failure Airlines Demand Urgent Action

Aug 01, 2025

Air Traffic Control Failure Airlines Demand Urgent Action

Aug 01, 2025

Latest Posts

-

Pattinsons Batman And Corenswets Superman A Gunn Sequel

Aug 02, 2025

Pattinsons Batman And Corenswets Superman A Gunn Sequel

Aug 02, 2025 -

Mega Millions Jackpot 8 1 25 Winning Numbers And Results

Aug 02, 2025

Mega Millions Jackpot 8 1 25 Winning Numbers And Results

Aug 02, 2025 -

Mr Beasts Team Trees Successor 40 Million Clean Water Initiative

Aug 02, 2025

Mr Beasts Team Trees Successor 40 Million Clean Water Initiative

Aug 02, 2025 -

No Pattinson As Batman James Gunn Clarifies Dcu Casting Rumors

Aug 02, 2025

No Pattinson As Batman James Gunn Clarifies Dcu Casting Rumors

Aug 02, 2025 -

Quentin Tarantino Breaks Silence On Michael Madsens Passing

Aug 02, 2025

Quentin Tarantino Breaks Silence On Michael Madsens Passing

Aug 02, 2025