Bitcoin ETF Investment Surges Past $5 Billion: Analyzing The Influx

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Bitcoin ETF Investment Surges Past $5 Billion: Analyzing the Influx

The long-awaited arrival of Bitcoin exchange-traded funds (ETFs) in the US has unleashed a wave of investment, exceeding $5 billion in a remarkably short timeframe. This unprecedented influx signifies a major shift in the landscape of digital asset investment, attracting both institutional and retail investors. The approval of the first spot Bitcoin ETF by the Securities and Exchange Commission (SEC) opened the floodgates, creating a ripple effect across the financial world. This article delves into the reasons behind this surge, examining the implications and potential future trends.

The SEC's Green Light: A Catalyst for Growth

For years, the crypto community eagerly awaited SEC approval for a spot Bitcoin ETF. The perceived regulatory uncertainty had acted as a significant barrier to entry for many institutional investors. However, the recent approval shattered this barrier, legitimizing Bitcoin in the eyes of many traditional finance players. This landmark decision instantly boosted investor confidence, paving the way for significant capital inflows. The approval, however, didn't come without its challenges and continued scrutiny. Many other ETF applications are still under review, highlighting the complexities of navigating the regulatory environment.

Why the Rush to Bitcoin ETFs?

The surge in investment can be attributed to several key factors:

- Increased Accessibility: ETFs offer a regulated and convenient way to invest in Bitcoin, eliminating the need for navigating complex cryptocurrency exchanges. This simplified access is particularly appealing to institutional investors and those new to the crypto market.

- Diversification: Many investors see Bitcoin ETFs as a means to diversify their portfolios, adding exposure to a burgeoning asset class with the added security and regulation provided by the ETF structure.

- Regulatory Clarity: The SEC's approval provided a much-needed stamp of legitimacy, reducing the regulatory uncertainty that previously deterred many investors.

- Growing Institutional Adoption: The influx is not solely driven by retail investors. Institutional investors, such as pension funds and hedge funds, are increasingly allocating funds to Bitcoin, viewing it as a potential hedge against inflation and a store of value.

Analyzing the $5 Billion Influx: A Deep Dive

The sheer volume of investment pouring into Bitcoin ETFs surpasses initial projections. While precise figures remain dynamic, the rapid accumulation of assets highlights the immense potential of this market segment. This significant capital injection is fueling further development and innovation within the crypto ecosystem, creating a positive feedback loop.

What's Next for Bitcoin ETFs?

The future of Bitcoin ETFs remains promising, but not without its challenges. The ongoing regulatory landscape continues to evolve, and potential future amendments or stricter rules could impact investor confidence. Furthermore, the inherent volatility of Bitcoin remains a considerable risk factor.

However, several positive factors suggest continued growth:

- Further ETF Approvals: More Bitcoin ETF applications are pending before the SEC, indicating potential for further investment growth in the near future.

- Technological Advancements: Innovations within the blockchain space continue to enhance Bitcoin's efficiency and scalability.

- Growing Global Adoption: Bitcoin's adoption is steadily increasing globally, further solidifying its position as a significant digital asset.

Conclusion: A Turning Point in Crypto Investment

The surge past $5 billion in Bitcoin ETF investments marks a pivotal moment for the crypto market. This unprecedented influx reflects a growing acceptance of Bitcoin as a legitimate investment asset, driven by increased accessibility, regulatory clarity, and institutional adoption. While risks remain, the future of Bitcoin ETFs appears bright, promising further growth and potentially reshaping the financial landscape as we know it. Stay informed and conduct thorough research before making any investment decisions.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. Investing in cryptocurrencies carries significant risk.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Bitcoin ETF Investment Surges Past $5 Billion: Analyzing The Influx. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

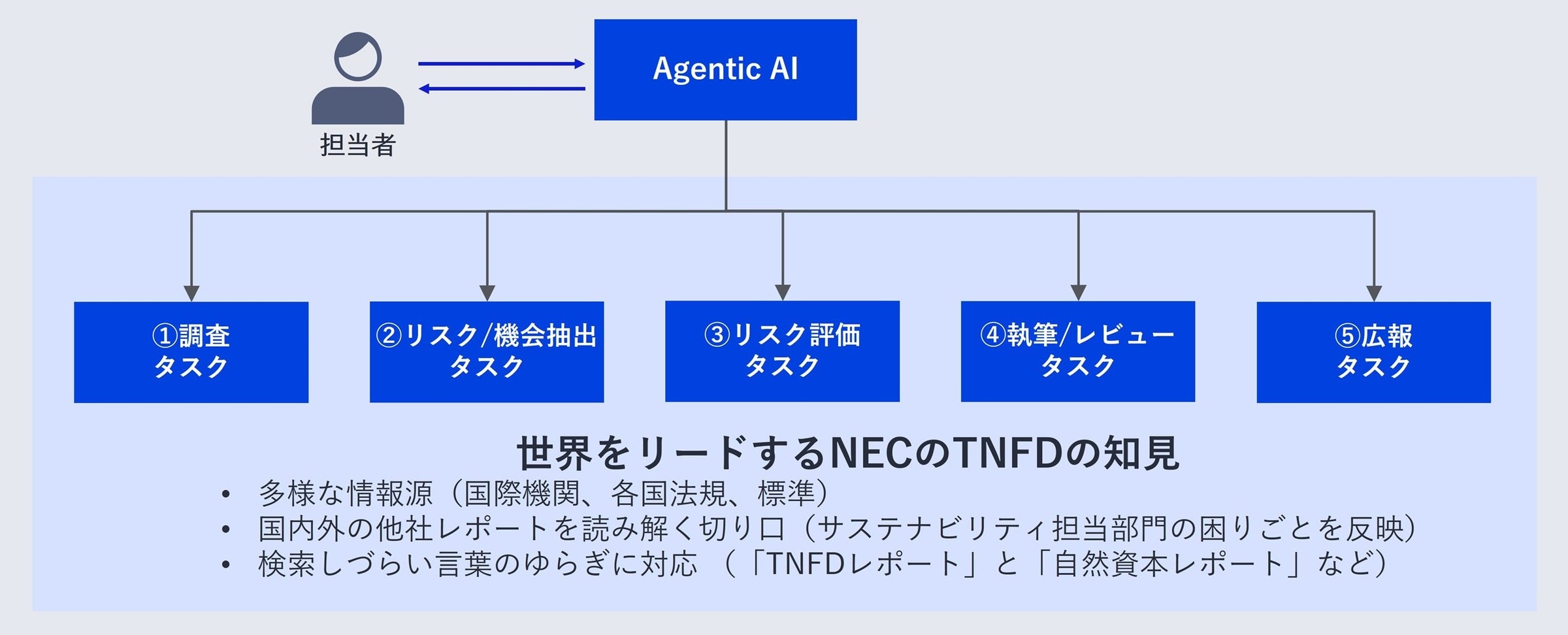

Nec Tnfd Ai Agentic Ai

May 21, 2025

Nec Tnfd Ai Agentic Ai

May 21, 2025 -

Bali Seeks International Help To Improve Tourist Conduct And Safety

May 21, 2025

Bali Seeks International Help To Improve Tourist Conduct And Safety

May 21, 2025 -

Helldivers 2 Warbond Program Update Masters Of Ceremony May 15th Launch

May 21, 2025

Helldivers 2 Warbond Program Update Masters Of Ceremony May 15th Launch

May 21, 2025 -

Abandoned Chicks In Usps Truck Delaware Shelter Seeks Urgent Help

May 21, 2025

Abandoned Chicks In Usps Truck Delaware Shelter Seeks Urgent Help

May 21, 2025 -

Hostages Release A Familys Journey To Reunification And Healing

May 21, 2025

Hostages Release A Familys Journey To Reunification And Healing

May 21, 2025

Latest Posts

-

Prime Ministers Home Fire Second Individual Charged

May 21, 2025

Prime Ministers Home Fire Second Individual Charged

May 21, 2025 -

Urgent Update Fourth Escaped New Orleans Inmate Apprehended Heightened Security Measures Implemented

May 21, 2025

Urgent Update Fourth Escaped New Orleans Inmate Apprehended Heightened Security Measures Implemented

May 21, 2025 -

Ny Ag James Trumps Legal Troubles Vs Dojs Real Estate Fraud Investigation

May 21, 2025

Ny Ag James Trumps Legal Troubles Vs Dojs Real Estate Fraud Investigation

May 21, 2025 -

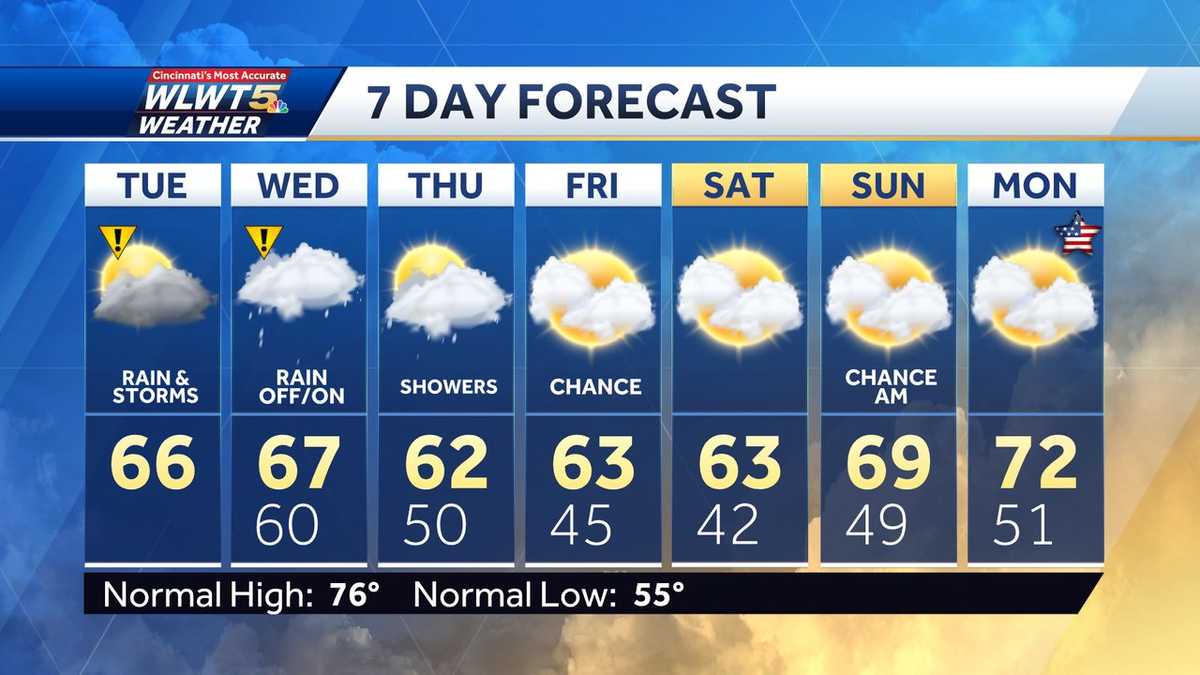

Temperature Drop And Continued Rain Expected This Week

May 21, 2025

Temperature Drop And Continued Rain Expected This Week

May 21, 2025 -

Data Breach Settlement Post Office To Compensate Hundreds Of Victims

May 21, 2025

Data Breach Settlement Post Office To Compensate Hundreds Of Victims

May 21, 2025