Bitcoin ETF Investments Exceed $5 Billion: What's Driving The Growth?

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Bitcoin ETF Investments Exceed $5 Billion: What's Driving the Growth?

The floodgates have opened. Bitcoin exchange-traded fund (ETF) investments have officially surpassed the monumental $5 billion mark, signifying a significant shift in the landscape of digital asset investment. This surge represents a powerful vote of confidence in Bitcoin and highlights a growing appetite for regulated exposure to the cryptocurrency market. But what's fueling this unprecedented growth? Let's delve into the key factors driving this exciting development.

Institutional Adoption: A Major Catalyst

One of the most significant drivers behind the booming Bitcoin ETF market is the increasing acceptance of Bitcoin among institutional investors. Hedge funds, pension funds, and other large financial institutions are increasingly incorporating Bitcoin into their portfolios, seeking diversification and exposure to a potentially high-growth asset class. The availability of ETFs provides a comfortable and regulated entry point for these institutions, reducing the complexities and risks associated with direct Bitcoin ownership. This institutional interest is a powerful indicator of Bitcoin's growing maturity as an asset.

Regulatory Approvals: Paving the Way for Mainstream Adoption

The recent approvals of Bitcoin ETFs in various jurisdictions have played a pivotal role in unlocking this growth. The regulatory clarity provided by these approvals significantly reduces the perceived risk for investors, encouraging greater participation. This is a crucial step in legitimizing Bitcoin and making it more accessible to a wider range of investors who previously hesitated due to regulatory uncertainty. The path towards wider adoption is now clearer than ever.

Increased Accessibility and Simplicity:

Bitcoin ETFs offer a user-friendly and accessible way to invest in Bitcoin, eliminating the need for navigating the complexities of cryptocurrency exchanges and digital wallets. This simplicity appeals to both seasoned investors and newcomers to the crypto space, contributing to the broader adoption of Bitcoin ETFs. The ability to buy and sell Bitcoin through traditional brokerage accounts makes investment significantly more convenient.

Inflation Hedge and Portfolio Diversification:

Many investors see Bitcoin as a potential hedge against inflation, especially during times of economic uncertainty. Its limited supply and decentralized nature make it an attractive alternative investment to traditional assets. Furthermore, Bitcoin's low correlation with traditional market assets makes it a valuable tool for portfolio diversification, further boosting its appeal to risk-averse and sophisticated investors alike.

Looking Ahead: What Does the Future Hold?

The surpassing of the $5 billion mark in Bitcoin ETF investments is a significant milestone, but it's likely just the beginning. As regulatory landscapes continue to evolve and institutional adoption grows, we can expect even greater inflows into Bitcoin ETFs. The future of Bitcoin and its integration into mainstream finance is looking brighter than ever.

What are your thoughts on the future of Bitcoin ETFs? Share your predictions in the comments below!

Keywords: Bitcoin ETF, Bitcoin exchange-traded fund, Bitcoin investment, cryptocurrency investment, institutional investors, regulatory approval, inflation hedge, portfolio diversification, digital assets, cryptocurrency ETFs, Bitcoin price, crypto market.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Bitcoin ETF Investments Exceed $5 Billion: What's Driving The Growth?. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Liga Mx 2025 Posible Fecha Y Horario De La Final Toluca America

May 20, 2025

Liga Mx 2025 Posible Fecha Y Horario De La Final Toluca America

May 20, 2025 -

Breaking Point Olympic Champions Harrowing Account Of Abuse And Body Image Issues

May 20, 2025

Breaking Point Olympic Champions Harrowing Account Of Abuse And Body Image Issues

May 20, 2025 -

Liga Mx 2025 Toluca Vs America Todo Sobre La Gran Final

May 20, 2025

Liga Mx 2025 Toluca Vs America Todo Sobre La Gran Final

May 20, 2025 -

Exclusive Interview The Making Of Netflixs Documentary Fall Of Favre

May 20, 2025

Exclusive Interview The Making Of Netflixs Documentary Fall Of Favre

May 20, 2025 -

Commuters Fury The Bare Beating Phenomenon On Public Transportation

May 20, 2025

Commuters Fury The Bare Beating Phenomenon On Public Transportation

May 20, 2025

Latest Posts

-

The Unexpected Friendship Jamie Lee Curtis And Lindsay Lohans Close Bond

May 20, 2025

The Unexpected Friendship Jamie Lee Curtis And Lindsay Lohans Close Bond

May 20, 2025 -

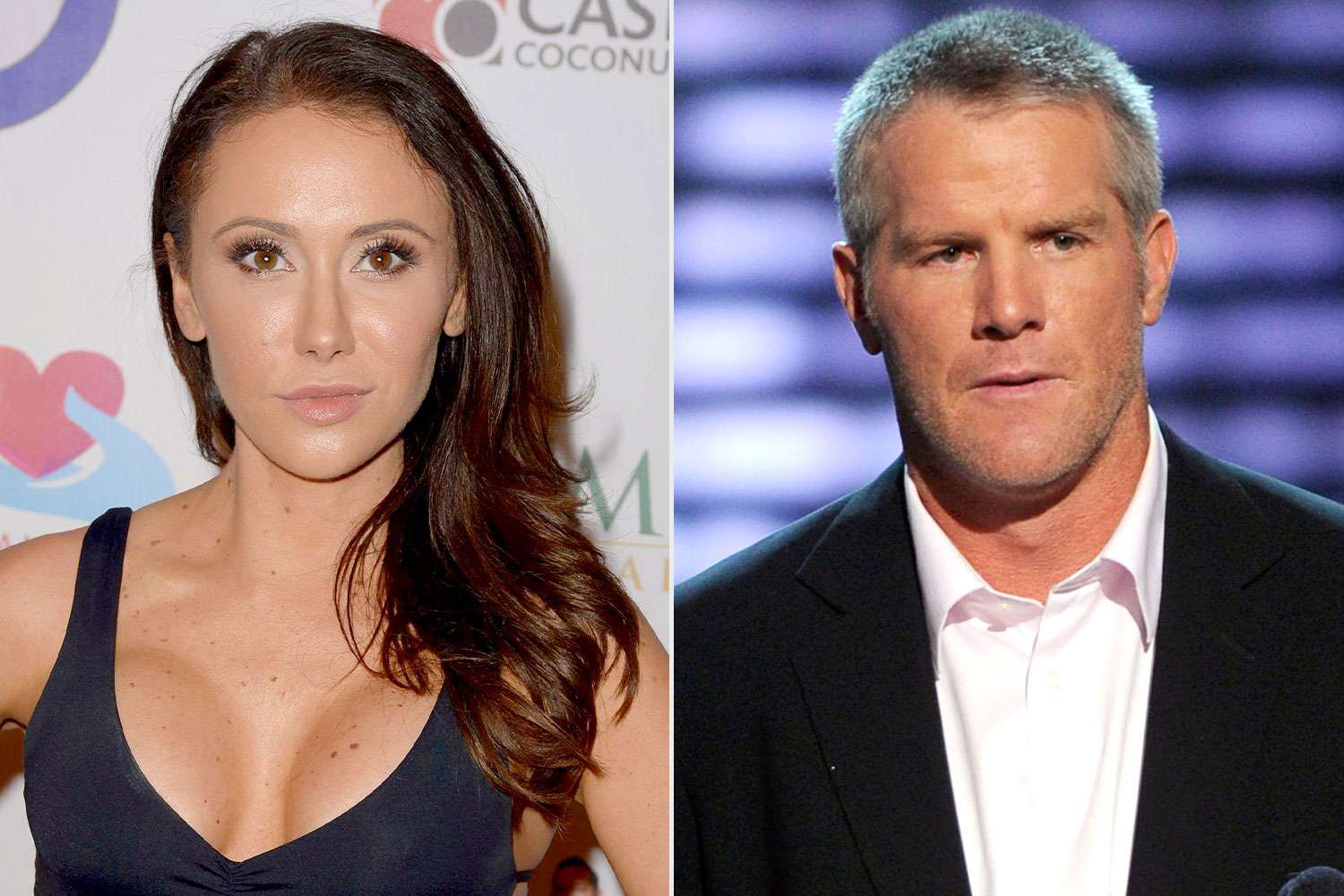

The Lasting Impact Jenn Sterger Reflects On The Brett Favre Scandal

May 20, 2025

The Lasting Impact Jenn Sterger Reflects On The Brett Favre Scandal

May 20, 2025 -

Urgent Security Breach Legal Aid Firm Suffers Data Loss Including Criminal Records

May 20, 2025

Urgent Security Breach Legal Aid Firm Suffers Data Loss Including Criminal Records

May 20, 2025 -

Tragic Railroad Accident Two Adults Killed Children Injured And Missing

May 20, 2025

Tragic Railroad Accident Two Adults Killed Children Injured And Missing

May 20, 2025 -

May 15th Helldivers 2 Master Of Ceremony Warbonds Go Live

May 20, 2025

May 15th Helldivers 2 Master Of Ceremony Warbonds Go Live

May 20, 2025