Bitcoin ETF Investments Surge Past $5 Billion: What Does This Mean?

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Bitcoin ETF Investments Surge Past $5 Billion: What Does This Mean?

The floodgates have opened. Bitcoin exchange-traded fund (ETF) investments have officially surpassed $5 billion, marking a monumental shift in the cryptocurrency landscape. This surge represents a significant vote of confidence in Bitcoin's legitimacy and potential, but what does this truly mean for investors, the market, and the future of digital assets?

The recent approval of the first spot Bitcoin ETF in the US, after years of regulatory hurdles, triggered this dramatic increase. This landmark decision has legitimized Bitcoin in the eyes of many mainstream investors, previously hesitant due to the asset's perceived volatility and regulatory uncertainty. The accessibility of Bitcoin through traditional brokerage accounts, rather than navigating the complexities of cryptocurrency exchanges, has proven to be a game-changer.

What Fueled This Massive Investment Surge?

Several factors contributed to this unprecedented growth in Bitcoin ETF investments:

- Regulatory Approval: The SEC's approval of the first spot Bitcoin ETF was the catalyst. This signaled a significant shift in regulatory sentiment towards cryptocurrencies, paving the way for increased institutional adoption.

- Increased Accessibility: Investing in Bitcoin through an ETF drastically simplifies the process for average investors, removing the technical barriers associated with directly purchasing and storing Bitcoin.

- Growing Institutional Interest: Large institutional investors, including pension funds and hedge funds, are increasingly allocating a portion of their portfolios to Bitcoin, viewing it as a potential hedge against inflation and a diversifying asset.

- Mainstream Media Attention: The increased media coverage surrounding Bitcoin ETFs has further fueled public interest and driven investment.

What Does This Mean for the Future?

This $5 billion milestone signifies more than just a fleeting trend. It suggests a potential paradigm shift in how institutional and retail investors perceive Bitcoin. Several key implications arise from this surge:

- Increased Market Stability (Potentially): The influx of institutional money can contribute to greater price stability in the Bitcoin market, reducing extreme volatility.

- Further Regulatory Scrutiny: The increased mainstream adoption may lead to even stricter regulatory oversight of the cryptocurrency market.

- Competition and Innovation: The success of Bitcoin ETFs will likely encourage the development of similar products for other cryptocurrencies, fostering innovation within the broader digital asset space.

- Increased Mainstream Adoption: The ease of access offered by ETFs is likely to accelerate Bitcoin's adoption among a wider range of investors.

Potential Risks and Considerations

While the growth is impressive, it's crucial to acknowledge potential risks:

- Market Volatility: Bitcoin remains a volatile asset, and despite the influx of institutional investment, price fluctuations are still expected.

- Regulatory Uncertainty: The regulatory landscape for cryptocurrencies is constantly evolving, and future regulatory changes could impact the performance of Bitcoin ETFs.

- Security Risks: While ETFs offer a degree of security compared to direct Bitcoin ownership, risks associated with the custodian and the exchange remain.

Conclusion: A New Era for Bitcoin?

The surge in Bitcoin ETF investments beyond $5 billion marks a significant turning point for Bitcoin and the broader cryptocurrency market. While challenges and risks remain, this milestone undeniably demonstrates a growing acceptance of Bitcoin as a legitimate asset class. The long-term implications are yet to be fully realized, but this unprecedented growth signals a potentially transformative era for the world of digital finance. Further monitoring of market trends and regulatory developments is crucial for understanding the full impact of this investment boom. Are you ready to explore the world of Bitcoin ETFs? .

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Bitcoin ETF Investments Surge Past $5 Billion: What Does This Mean?. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Colombian Models Murder Follows Mexican Influencers Killing Femicide Condemnation Mounts

May 20, 2025

Colombian Models Murder Follows Mexican Influencers Killing Femicide Condemnation Mounts

May 20, 2025 -

Jon Jones Retirement Rumors Intensify Aspinall Negotiations Breakdown Sparks Fan Outrage

May 20, 2025

Jon Jones Retirement Rumors Intensify Aspinall Negotiations Breakdown Sparks Fan Outrage

May 20, 2025 -

Presidential Travel Reimagined A Tour Of The Next Generation Air Force One

May 20, 2025

Presidential Travel Reimagined A Tour Of The Next Generation Air Force One

May 20, 2025 -

Analysis Why The Tight Nl West Contributed To Dodgers Decision On Taylor And Barnes

May 20, 2025

Analysis Why The Tight Nl West Contributed To Dodgers Decision On Taylor And Barnes

May 20, 2025 -

The Right Time To Wean Your Child From A Pacifier Or Thumb

May 20, 2025

The Right Time To Wean Your Child From A Pacifier Or Thumb

May 20, 2025

Latest Posts

-

Putins Snub Demonstrating Independence From Trumps Influence

May 21, 2025

Putins Snub Demonstrating Independence From Trumps Influence

May 21, 2025 -

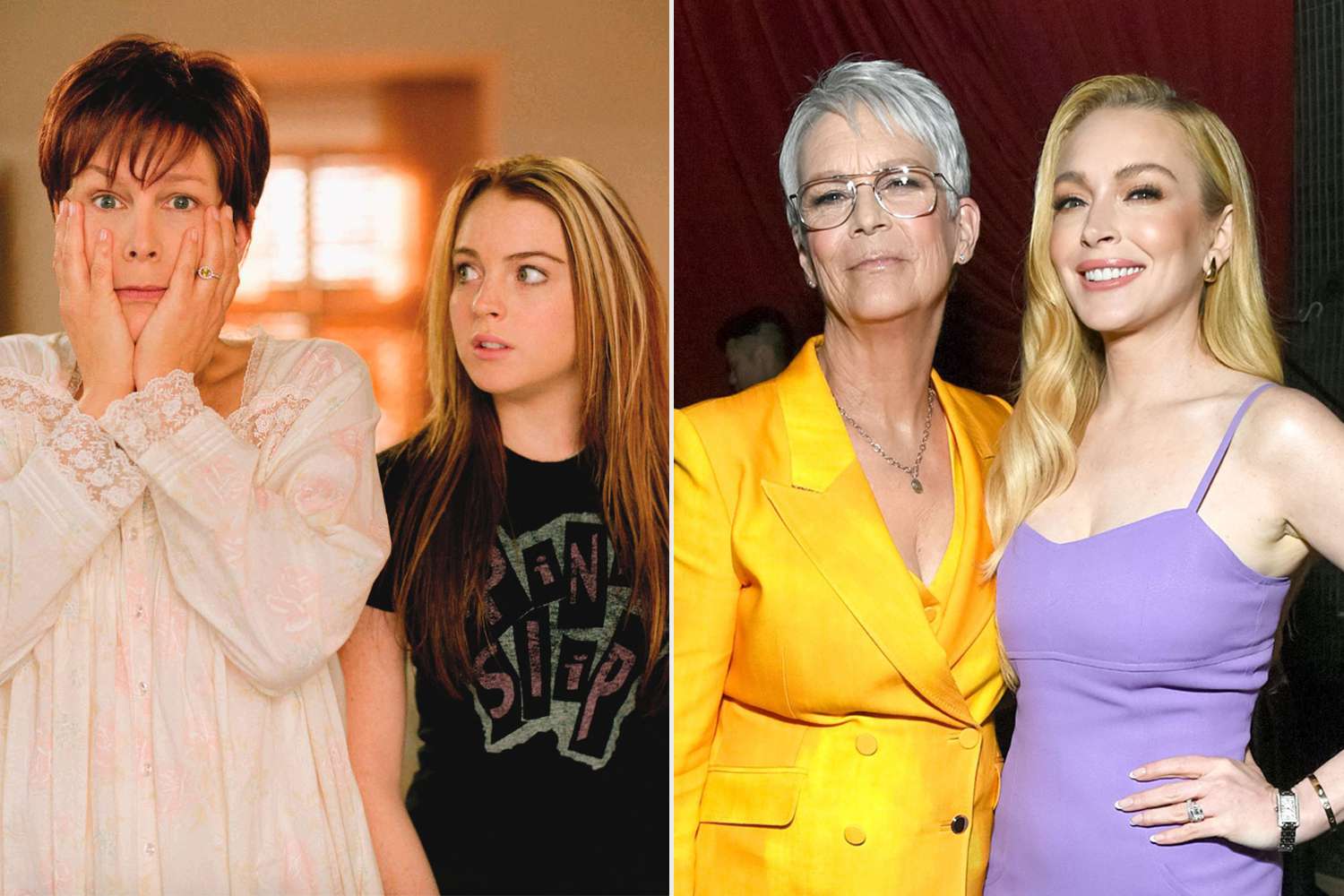

Jamie Lee Curtis Talks Lindsay Lohan An Exclusive Update On Their Post Freaky Friday Friendship

May 21, 2025

Jamie Lee Curtis Talks Lindsay Lohan An Exclusive Update On Their Post Freaky Friday Friendship

May 21, 2025 -

Bali Targets Poor Tourist Behavior With New Enforcement Measures

May 21, 2025

Bali Targets Poor Tourist Behavior With New Enforcement Measures

May 21, 2025 -

Bitcoin Etf Investment Booms 5 Billion And Counting

May 21, 2025

Bitcoin Etf Investment Booms 5 Billion And Counting

May 21, 2025 -

200 Million In Ethereum Funds Investor Confidence Soars After Pectra

May 21, 2025

200 Million In Ethereum Funds Investor Confidence Soars After Pectra

May 21, 2025