Bitcoin ETF Investments Surge Past $5 Billion: What's Driving The Growth?

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Bitcoin ETF Investments Surge Past $5 Billion: What's Driving the Growth?

The world of finance is buzzing. Bitcoin exchange-traded funds (ETFs) have just surpassed a monumental milestone: over $5 billion in total assets under management (AUM). This explosive growth marks a significant shift in investor sentiment towards Bitcoin and digital assets, raising the question: what's fueling this incredible surge?

The rapid increase in Bitcoin ETF investments isn't a sudden phenomenon; it's the culmination of several converging factors creating a perfect storm for crypto adoption within traditional financial markets.

H2: The Rise of Regulated Bitcoin Exposure

One of the primary drivers is the increasing availability of regulated Bitcoin ETFs. Previously, many investors were hesitant to directly invest in Bitcoin due to concerns about security, volatility, and regulatory uncertainty. The emergence of ETFs, which are traded on major stock exchanges and subject to regulatory oversight, offers a more accessible and arguably safer entry point for institutional and retail investors alike. This regulated exposure significantly lowers the barrier to entry for those seeking Bitcoin exposure without the complexities of directly managing cryptocurrency holdings.

H2: Institutional Adoption and Growing Acceptance

Institutional investors, including pension funds and hedge funds, are increasingly allocating a portion of their portfolios to Bitcoin. This is partly driven by the perceived potential of Bitcoin as a hedge against inflation and a diversification tool. BlackRock's recent application for a spot Bitcoin ETF, arguably the world's largest asset manager, further underscores this growing institutional acceptance and confidence in the future of Bitcoin. Their move alone sent ripples throughout the market, signaling a potential paradigm shift in how traditional finance views digital assets.

H2: The Search for Yield in a Low-Interest-Rate Environment

With interest rates remaining relatively low in many parts of the world, investors are constantly searching for higher-yielding assets. Bitcoin, despite its volatility, has shown substantial growth potential over the years, making it an attractive option for those seeking to potentially outperform traditional investments. This search for yield is further amplified by persistent inflation concerns, driving investors towards assets considered to be inflation hedges.

H3: Spot vs. Futures Bitcoin ETFs:

It's important to note the distinction between spot Bitcoin ETFs, which directly track the price of Bitcoin, and futures-based ETFs, which track Bitcoin futures contracts. The approval of a spot Bitcoin ETF is considered a more significant milestone, as it provides investors with more direct exposure to the underlying asset. The ongoing applications and potential approvals of spot Bitcoin ETFs are a major catalyst for the current surge in investment.

H2: Increased Regulatory Clarity (Slowly but Surely)

While regulatory uncertainty still exists in some jurisdictions, there's a growing trend towards greater clarity and potentially more favorable regulations for cryptocurrencies. This increasing regulatory certainty, albeit slow, is gradually reducing the risk perception associated with Bitcoin investment, encouraging greater participation from risk-averse investors.

H2: The Future of Bitcoin ETF Investments

The $5 billion milestone is a significant achievement, but it likely represents only the beginning of a much larger trend. As more regulated Bitcoin ETFs become available and institutional adoption continues to grow, we can expect further substantial growth in AUM. However, it's crucial to remember that Bitcoin remains a volatile asset, and investors should proceed with caution and conduct thorough research before investing. Diversification within a well-balanced portfolio is always recommended.

Call to Action: Stay informed about the latest developments in the Bitcoin ETF market by subscribing to our newsletter (link to newsletter signup). We'll keep you updated on all the key trends and developments in the world of cryptocurrency investment.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Bitcoin ETF Investments Surge Past $5 Billion: What's Driving The Growth?. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Toledo Mud Hens 20 Run Win Mendoza Lee And Liranzos Impact

May 20, 2025

Toledo Mud Hens 20 Run Win Mendoza Lee And Liranzos Impact

May 20, 2025 -

10 Minutes Of Unpiloted Flight Lufthansa Investigates Co Pilot Medical Emergency

May 20, 2025

10 Minutes Of Unpiloted Flight Lufthansa Investigates Co Pilot Medical Emergency

May 20, 2025 -

Cassie Venturas Gripping Testimony Could Convict Sean Diddy Combs

May 20, 2025

Cassie Venturas Gripping Testimony Could Convict Sean Diddy Combs

May 20, 2025 -

Ufc News Jon Joness Cryptic I M Done Message And Aspinall Contract Stalemate

May 20, 2025

Ufc News Jon Joness Cryptic I M Done Message And Aspinall Contract Stalemate

May 20, 2025 -

Ufc Accused Of Concealing Aspinall Injury Information Jon Jones Speaks Out

May 20, 2025

Ufc Accused Of Concealing Aspinall Injury Information Jon Jones Speaks Out

May 20, 2025

Latest Posts

-

Deadline Looms Brexit Talks Reach Critical Point With Claims Of Broken Promises

May 20, 2025

Deadline Looms Brexit Talks Reach Critical Point With Claims Of Broken Promises

May 20, 2025 -

Olympic Gold The High Cost Of A Coachs Demanding Methods

May 20, 2025

Olympic Gold The High Cost Of A Coachs Demanding Methods

May 20, 2025 -

Ufc News Jon Jones Future In Jeopardy Aspinall Negotiations At Impasse

May 20, 2025

Ufc News Jon Jones Future In Jeopardy Aspinall Negotiations At Impasse

May 20, 2025 -

Enhancing Tourist Safety And Behavior In Bali A Call For International Assistance

May 20, 2025

Enhancing Tourist Safety And Behavior In Bali A Call For International Assistance

May 20, 2025 -

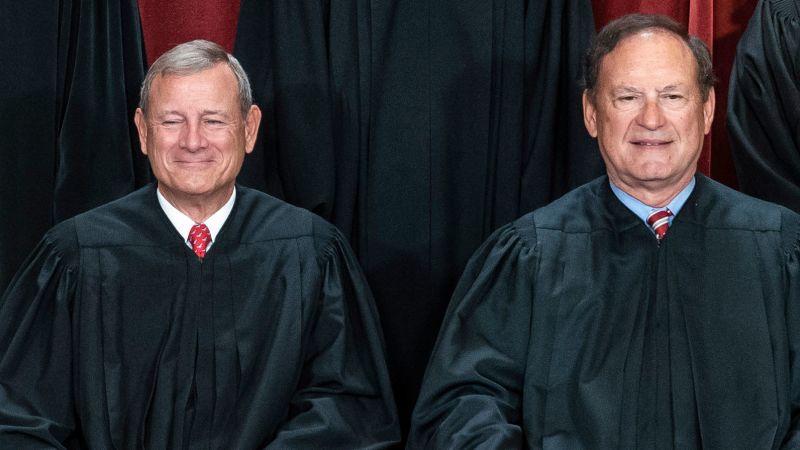

The Alito And Roberts Era A Retrospective On Two Supreme Court Justices

May 20, 2025

The Alito And Roberts Era A Retrospective On Two Supreme Court Justices

May 20, 2025