Bitcoin ETF Investments Surpass $5 Billion: What's Driving The Surge?

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Bitcoin ETF Investments Surpass $5 Billion: What's Driving the Surge?

The world of finance is buzzing! Bitcoin exchange-traded funds (ETFs) have just crossed a monumental threshold, surpassing a collective $5 billion in investments. This significant milestone marks a pivotal moment for Bitcoin's mainstream adoption and signals a growing confidence in the cryptocurrency's long-term potential. But what's fueling this incredible surge in investment? Let's delve into the key factors driving this exciting development.

The Rise of Institutional Investment:

One of the most significant contributors to the $5 billion figure is the increasing involvement of institutional investors. Hedge funds, pension funds, and other large financial institutions are increasingly allocating a portion of their portfolios to Bitcoin, recognizing its potential as a hedge against inflation and a diversification tool. The approval of Bitcoin futures ETFs paved the way for this institutional influx, providing a more regulated and accessible entry point for these larger players. This trend signifies a shift away from the perception of Bitcoin as solely a speculative asset to its recognition as a legitimate asset class.

Increased Regulatory Clarity (and the Anticipation of More):

While regulatory uncertainty still surrounds cryptocurrencies globally, recent developments in some key markets have fostered a more positive environment for Bitcoin ETFs. The approval of the first Bitcoin futures ETF in the US in 2021, for example, marked a significant step towards legitimizing Bitcoin investment. Further anticipated regulatory approvals, particularly for spot Bitcoin ETFs, are expected to further fuel the surge in investment. This increased clarity reduces risk and attracts a broader range of investors.

Growing Retail Investor Interest:

It's not just institutional investors who are showing interest. Retail investors are also increasingly embracing Bitcoin ETFs as a convenient and regulated way to gain exposure to the cryptocurrency market. The ease of access through brokerage accounts, coupled with the perceived lower risk compared to directly investing in Bitcoin, makes ETFs an attractive option for a wider audience. This democratization of Bitcoin investment is a key driver of the current growth.

Inflationary Pressures and Diversification Strategies:

The persistent inflationary pressures in global economies are also contributing to the rise in Bitcoin ETF investments. Many investors view Bitcoin as a potential hedge against inflation, believing its limited supply and decentralized nature could protect against currency devaluation. Furthermore, the growing demand for portfolio diversification, especially in uncertain economic times, has led to increased allocation towards alternative assets like Bitcoin.

Looking Ahead: What Does the Future Hold?

The surpassing of $5 billion in Bitcoin ETF investments is a significant achievement, but it's likely just the beginning. As regulatory clarity improves, institutional interest grows, and retail investors continue to embrace this asset class, the future of Bitcoin ETFs looks incredibly bright. Further approval of spot Bitcoin ETFs could trigger another massive wave of investment, solidifying Bitcoin's position as a mainstream asset.

Key Takeaways:

- Institutional adoption is key: Large financial institutions are increasingly embracing Bitcoin ETFs.

- Regulatory clarity is crucial: Clearer regulations are attracting more investors.

- Retail investors are joining the party: Bitcoin ETFs offer ease of access and perceived lower risk.

- Inflation and diversification are driving forces: Investors are seeking hedges against inflation and portfolio diversification.

The journey of Bitcoin ETFs is far from over. This $5 billion milestone is a strong testament to the growing acceptance and legitimacy of Bitcoin within the broader financial landscape. Stay tuned for more developments in this exciting and rapidly evolving space!

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Bitcoin ETF Investments Surpass $5 Billion: What's Driving The Surge?. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Liga Mx Asi Jugaran Toluca Y America La Final Del Clausura 2025

May 20, 2025

Liga Mx Asi Jugaran Toluca Y America La Final Del Clausura 2025

May 20, 2025 -

M And S And Co Op Hacking Bbc Interview With The Hackers Target

May 20, 2025

M And S And Co Op Hacking Bbc Interview With The Hackers Target

May 20, 2025 -

Lufthansa Pilotless Flight 10 Minutes Of Unattended Operation After Co Pilot Faint

May 20, 2025

Lufthansa Pilotless Flight 10 Minutes Of Unattended Operation After Co Pilot Faint

May 20, 2025 -

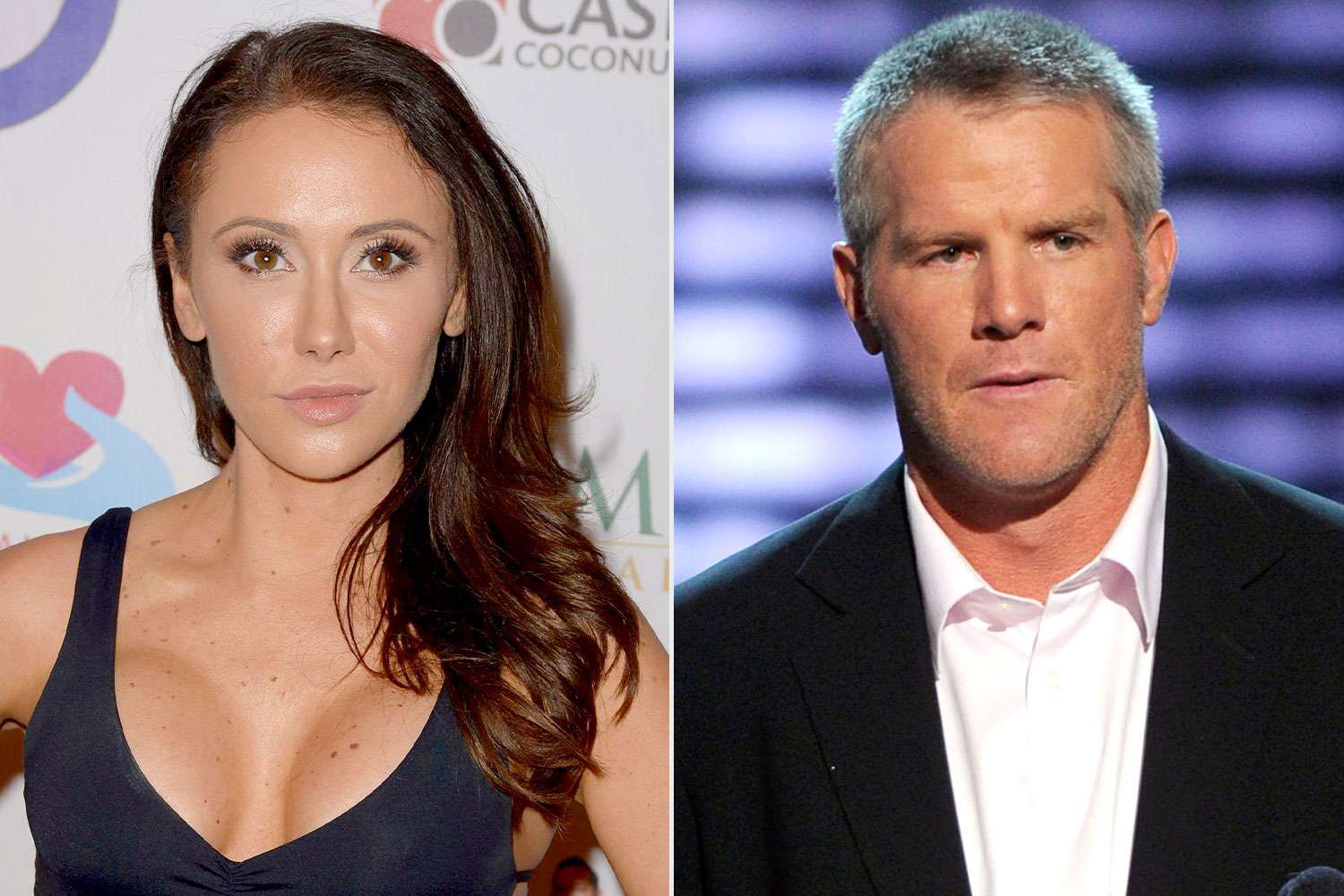

Brett Favres Fall A J Perez Discusses Threats And The Untold Story

May 20, 2025

Brett Favres Fall A J Perez Discusses Threats And The Untold Story

May 20, 2025 -

S And P 500 Dow Nasdaq Rise Stock Market Rebounds Despite Moodys Action

May 20, 2025

S And P 500 Dow Nasdaq Rise Stock Market Rebounds Despite Moodys Action

May 20, 2025

Latest Posts

-

Assessing The Damage St Louis Rebuilds After Unprecedented Tornado

May 20, 2025

Assessing The Damage St Louis Rebuilds After Unprecedented Tornado

May 20, 2025 -

Crunch Time For Brexit Accusations Of Betrayal Shadow Eu Negotiations

May 20, 2025

Crunch Time For Brexit Accusations Of Betrayal Shadow Eu Negotiations

May 20, 2025 -

Gaza Healthcare Crisis Deepens Following Israeli Hospital Attack

May 20, 2025

Gaza Healthcare Crisis Deepens Following Israeli Hospital Attack

May 20, 2025 -

The Unexpected Friendship Jamie Lee Curtis And Lindsay Lohans Close Bond

May 20, 2025

The Unexpected Friendship Jamie Lee Curtis And Lindsay Lohans Close Bond

May 20, 2025 -

The Lasting Impact Jenn Sterger Reflects On The Brett Favre Scandal

May 20, 2025

The Lasting Impact Jenn Sterger Reflects On The Brett Favre Scandal

May 20, 2025