Bitcoin Market Shift: Coinbase's 60-Day Premium Under Pressure

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Bitcoin Market Shift: Coinbase's 60-Day Premium Under Pressure

The cryptocurrency market is a volatile beast, and recent shifts are putting pressure on even the largest players. Coinbase, a leading cryptocurrency exchange, is feeling the heat as its historically significant 60-day premium shrinks, signaling a potential change in market dynamics. This development raises important questions about the future of Bitcoin pricing and the role of major exchanges in shaping market sentiment.

Coinbase Premium: A Historical Indicator

For a considerable time, Coinbase's Bitcoin price has consistently traded at a premium compared to other exchanges. This "Coinbase Premium," often lasting around 60 days, was seen as a reliable indicator of strong buyer demand and overall market bullishness. Traders often viewed this premium as a sign of confidence in the platform and the broader Bitcoin market. A higher premium suggested increased demand, potentially driving further price increases. However, the recent erosion of this premium indicates a potential shift in market sentiment.

The Shrinking Premium: What's Driving the Change?

Several factors contribute to the shrinking Coinbase premium:

-

Increased Regulatory Scrutiny: The intensified regulatory scrutiny surrounding the cryptocurrency industry globally is impacting investor confidence and trading activity. Increased compliance costs and uncertainty regarding future regulations might be deterring some investors.

-

Increased Competition: The cryptocurrency exchange landscape is fiercely competitive. The rise of decentralized exchanges (DEXs) and other centralized exchanges offering lower fees is eroding Coinbase's market share and its ability to maintain a significant premium.

-

Macroeconomic Factors: Broader macroeconomic conditions, including inflation and interest rate hikes, are impacting investor risk appetite. This is leading to a decrease in overall trading volume across the cryptocurrency market, affecting even major players like Coinbase.

-

Reduced Demand: A decrease in overall demand for Bitcoin, reflected in lower trading volumes across various platforms, contributes directly to the narrowing premium. This could indicate a shift towards a more bearish market outlook.

Implications for Bitcoin and the Broader Market

The decline in Coinbase's 60-day premium is not an isolated incident. It reflects broader trends in the cryptocurrency market, potentially signaling a period of consolidation or even a bearish correction. While a shrinking premium doesn't automatically predict a Bitcoin price crash, it suggests a weakening of bullish sentiment and increased market uncertainty.

What to Watch For:

Investors and traders should closely monitor the following factors:

- Regulatory developments: Keep an eye on regulatory announcements and their potential impact on the cryptocurrency market.

- Trading volume: Observe changes in trading volume across different exchanges to gauge overall market sentiment.

- Bitcoin price action: Pay close attention to Bitcoin's price movements and any correlation with the Coinbase premium.

- Competitive landscape: Monitor the emergence of new competitors and their impact on market share.

Conclusion:

The shrinking Coinbase 60-day premium serves as a crucial warning sign for Bitcoin investors. It's a clear indication of shifting market dynamics and increased uncertainty. While it's impossible to predict the future with certainty, staying informed about these market shifts and adapting your investment strategy accordingly is crucial for navigating the complexities of the cryptocurrency market. This warrants careful consideration and a thorough understanding of the risks involved before making any investment decisions. Remember to always do your own research (DYOR) before investing in cryptocurrencies.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Bitcoin Market Shift: Coinbase's 60-Day Premium Under Pressure. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Historic First Uk Welcomes Its First Female Astronomer Royal

Jul 31, 2025

Historic First Uk Welcomes Its First Female Astronomer Royal

Jul 31, 2025 -

Small Business Relief New Sba Advocate Targets Manufacturing And Automation Growth

Jul 31, 2025

Small Business Relief New Sba Advocate Targets Manufacturing And Automation Growth

Jul 31, 2025 -

July August 2025 Clash Royale Meta 5 Best Goblin Party Decks

Jul 31, 2025

July August 2025 Clash Royale Meta 5 Best Goblin Party Decks

Jul 31, 2025 -

Major Housing Project 40 000 Homes On Ex Railway Sites

Jul 31, 2025

Major Housing Project 40 000 Homes On Ex Railway Sites

Jul 31, 2025 -

Federal Government Seeks Input On Regulations Impacting Knoxville Businesses

Jul 31, 2025

Federal Government Seeks Input On Regulations Impacting Knoxville Businesses

Jul 31, 2025

Latest Posts

-

The Devastating Effect Of Dine And Dash Scams On Restaurant Workers Well Being

Aug 02, 2025

The Devastating Effect Of Dine And Dash Scams On Restaurant Workers Well Being

Aug 02, 2025 -

Understanding The Threats Brazils Actions And Their Impact On The United States

Aug 02, 2025

Understanding The Threats Brazils Actions And Their Impact On The United States

Aug 02, 2025 -

Australian Childcare Worker Faces Charges Over Abuse Video Production

Aug 02, 2025

Australian Childcare Worker Faces Charges Over Abuse Video Production

Aug 02, 2025 -

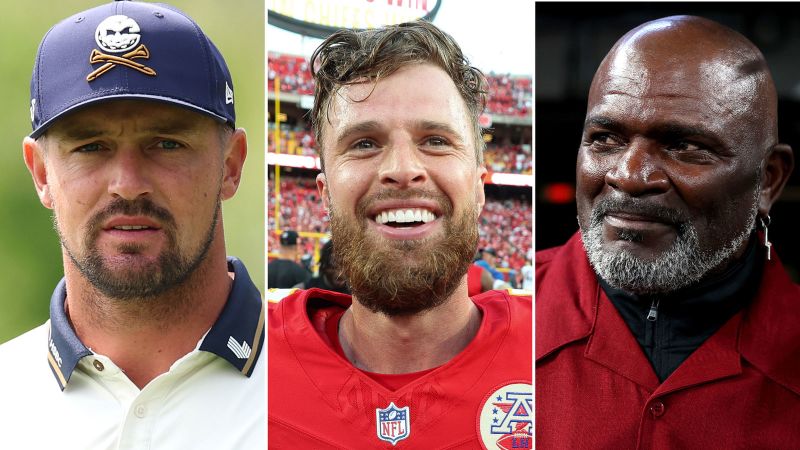

Trumps Presidential Sports Council Gets A Boost With Addition Of Professional Athletes

Aug 02, 2025

Trumps Presidential Sports Council Gets A Boost With Addition Of Professional Athletes

Aug 02, 2025 -

Behind The Scenes Of Marvels Eyes Of Wakanda With Showrunner Todd Harris

Aug 02, 2025

Behind The Scenes Of Marvels Eyes Of Wakanda With Showrunner Todd Harris

Aug 02, 2025