Bitcoin Price Correction Imminent? US Investor Interest Wanes.

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Bitcoin Price Correction Imminent? US Investor Interest Wanes

Is the Bitcoin bull run over? Recent data suggests a potential price correction for Bitcoin is looming, fueled by declining US investor interest and a broader market slowdown. While Bitcoin remains a significant player in the cryptocurrency landscape, the question on everyone's mind is: how severe will the correction be?

The cryptocurrency market, known for its volatility, has seen significant swings in recent months. Bitcoin, the largest cryptocurrency by market capitalization, has been particularly susceptible to these fluctuations. While it has experienced periods of remarkable growth, signs are pointing towards a potential downturn.

Waning US Investor Enthusiasm:

One key indicator contributing to the possibility of a Bitcoin price correction is the decline in US investor interest. Several factors are at play here:

- Regulatory Uncertainty: The ongoing debate surrounding Bitcoin regulation in the US continues to create uncertainty for potential investors. This lack of clarity can lead to hesitation and a reluctance to invest heavily in the volatile market.

- Macroeconomic Factors: The current economic climate, marked by inflation and potential recessionary pressures, is impacting investment strategies across the board. Investors are becoming more risk-averse, leading to a shift away from higher-risk assets like Bitcoin.

- Alternative Investments: The emergence of alternative investment opportunities, such as other cryptocurrencies and decentralized finance (DeFi) projects, is also diverting investor attention and capital away from Bitcoin.

Technical Indicators Pointing to a Correction:

Beyond investor sentiment, several technical indicators suggest a potential Bitcoin price correction:

- Overbought Conditions: Some technical analysis tools indicate that Bitcoin is currently in overbought territory, suggesting a potential price pullback. This is often followed by a period of consolidation or correction.

- Decreased Trading Volume: A decline in trading volume can often precede a price correction. Reduced trading activity suggests waning investor confidence and a potential shift in market sentiment.

- Resistance Levels: Bitcoin has encountered strong resistance at certain price levels recently, indicating a struggle to break through and continue its upward trajectory.

What Does This Mean for Bitcoin Investors?

The possibility of a Bitcoin price correction doesn't necessarily signal the end of Bitcoin. Historically, Bitcoin has experienced periods of both significant growth and correction. These corrections, while potentially unsettling, can also present opportunities for savvy investors.

Strategies for Navigating a Potential Correction:

- Diversification: Diversifying your cryptocurrency portfolio beyond Bitcoin can help mitigate risk during periods of market volatility.

- Dollar-Cost Averaging (DCA): Investing a fixed amount of money at regular intervals, regardless of price fluctuations, can help reduce the impact of market volatility.

- Risk Management: Implementing robust risk management strategies, such as setting stop-loss orders, is crucial for protecting your investment during periods of uncertainty.

Conclusion:

While the possibility of a Bitcoin price correction is significant, it's important to remember that the cryptocurrency market is inherently volatile. While waning US investor interest and technical indicators suggest a potential downturn, Bitcoin's long-term prospects remain a subject of ongoing debate among experts. Careful analysis, risk management, and a long-term perspective are crucial for navigating this dynamic market. Stay informed and adapt your strategies accordingly. Remember to conduct thorough research before making any investment decisions.

Disclaimer: This article is for informational purposes only and should not be considered financial advice. Investing in cryptocurrencies involves significant risk, and you could lose some or all of your investment.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Bitcoin Price Correction Imminent? US Investor Interest Wanes.. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Tragedy Strikes Midtown Four Dead In Office Tower Shooting

Jul 31, 2025

Tragedy Strikes Midtown Four Dead In Office Tower Shooting

Jul 31, 2025 -

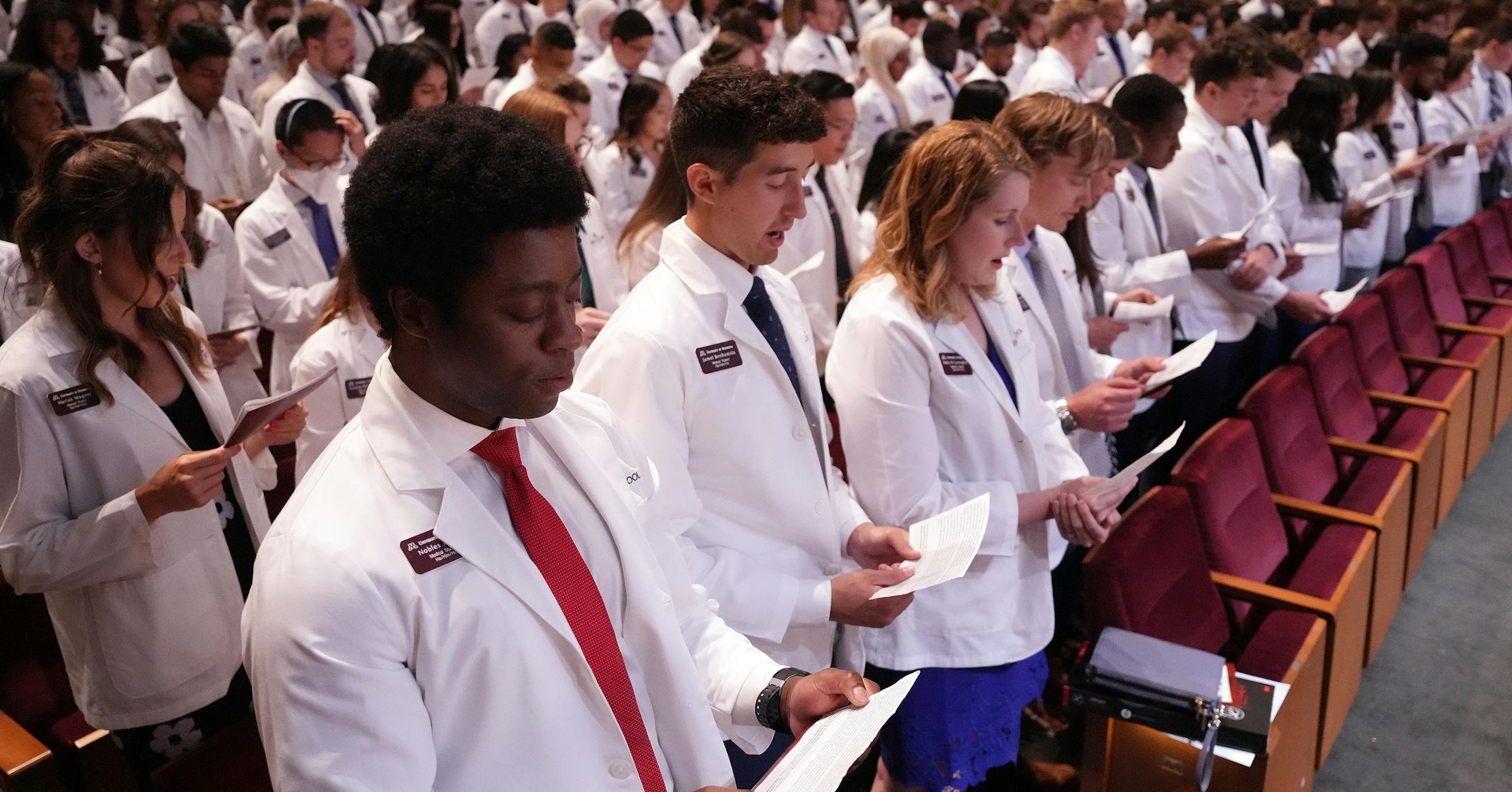

Federal Student Loan Changes Impact On Law And Medical School Aspirations

Jul 31, 2025

Federal Student Loan Changes Impact On Law And Medical School Aspirations

Jul 31, 2025 -

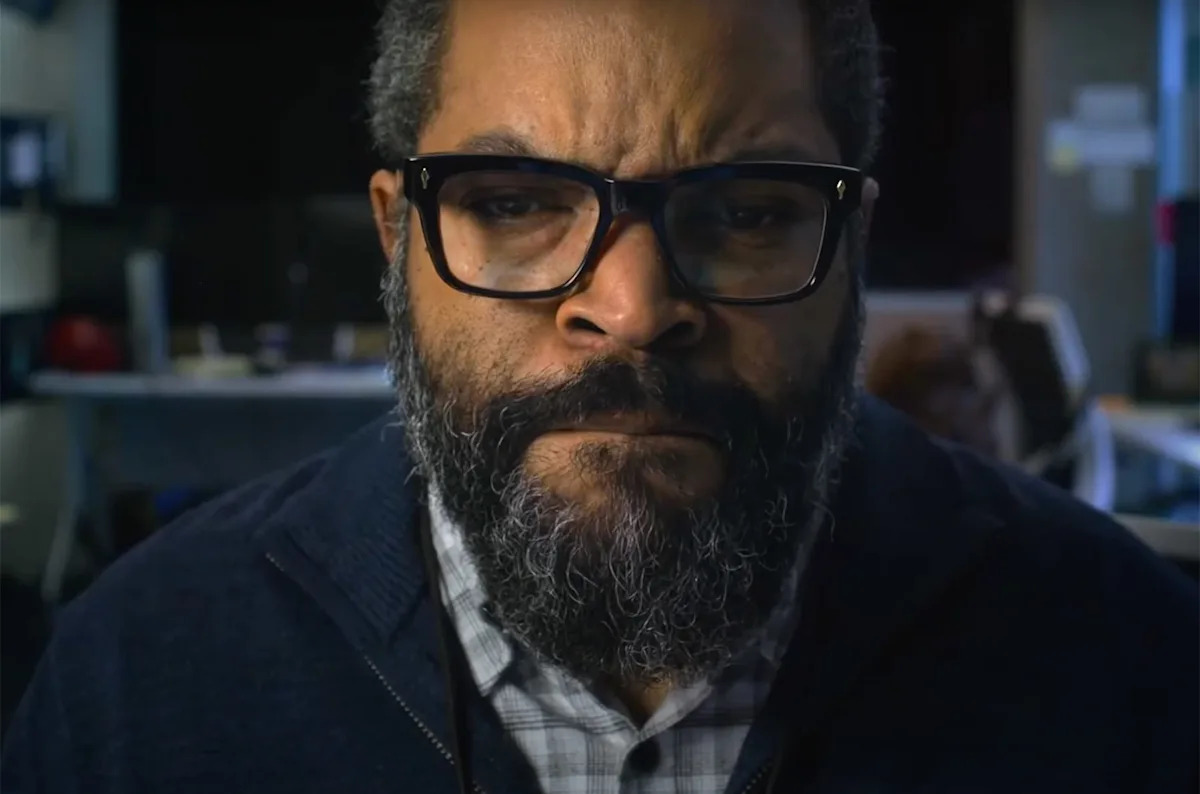

Ice Cube Faces Alien Invasion War Of The Worlds Trailer Breakdown

Jul 31, 2025

Ice Cube Faces Alien Invasion War Of The Worlds Trailer Breakdown

Jul 31, 2025 -

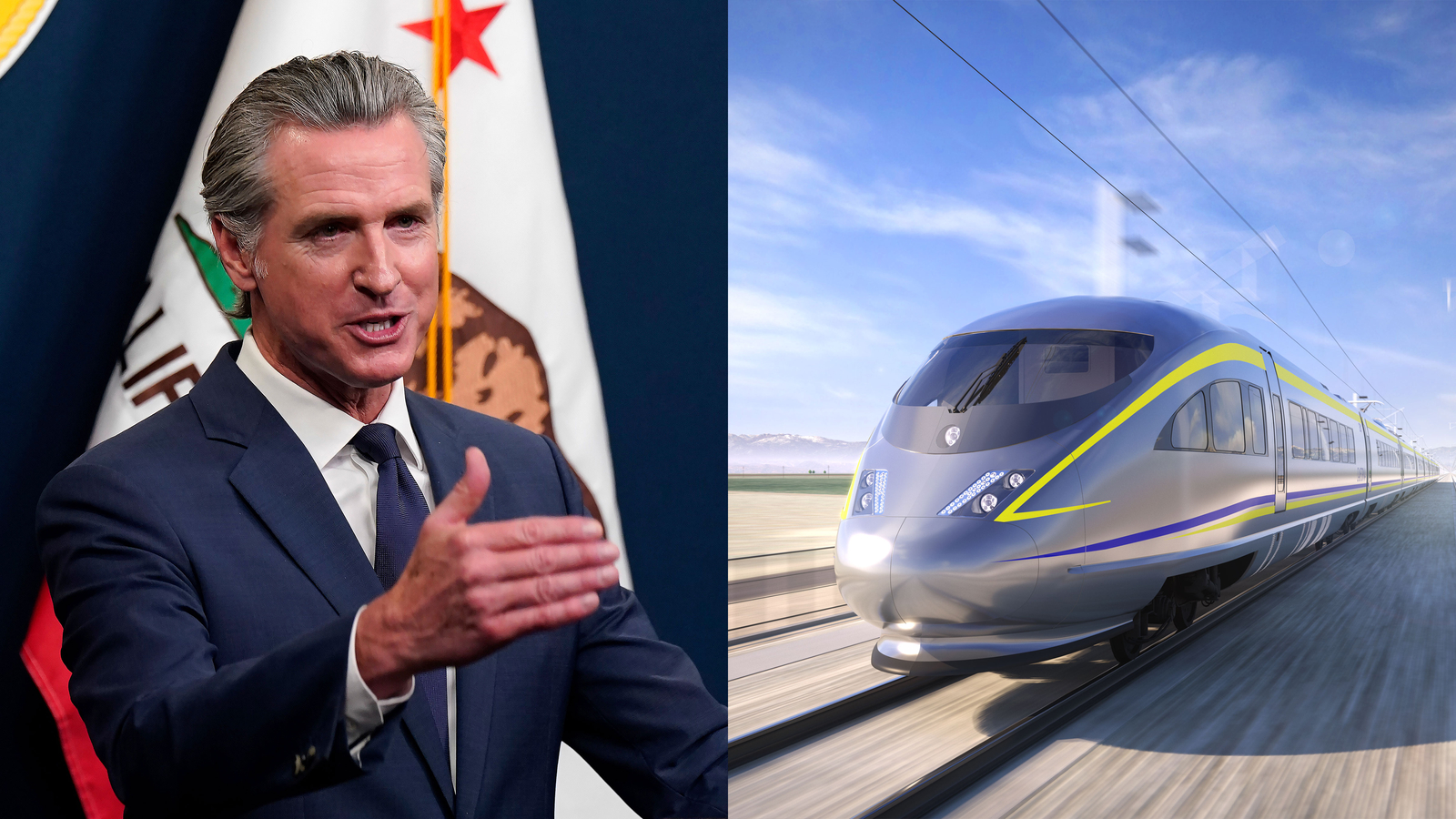

Newsom Signs Bill Mandating Funding Plan For California High Speed Rail

Jul 31, 2025

Newsom Signs Bill Mandating Funding Plan For California High Speed Rail

Jul 31, 2025 -

Trump Officials Slip Unintentional Disclosure Of Budget Program Details

Jul 31, 2025

Trump Officials Slip Unintentional Disclosure Of Budget Program Details

Jul 31, 2025

Latest Posts

-

Brazilian Government Actions Potential Threats To Us National Interests

Aug 01, 2025

Brazilian Government Actions Potential Threats To Us National Interests

Aug 01, 2025 -

Oyster Bay Womans 30 Million Fraud Scheme A Guilty Plea And Political Connections

Aug 01, 2025

Oyster Bay Womans 30 Million Fraud Scheme A Guilty Plea And Political Connections

Aug 01, 2025 -

Cnn Politics Examining The Maga Medias Rally Around Trump On Epstein Allegations

Aug 01, 2025

Cnn Politics Examining The Maga Medias Rally Around Trump On Epstein Allegations

Aug 01, 2025 -

Market Movers Apples Earnings Surprise Amazons Stock Slip Reddits Rally

Aug 01, 2025

Market Movers Apples Earnings Surprise Amazons Stock Slip Reddits Rally

Aug 01, 2025 -

Pop Cap Reimagines Plants Vs Zombies Replanted As Franchise Cornerstone

Aug 01, 2025

Pop Cap Reimagines Plants Vs Zombies Replanted As Franchise Cornerstone

Aug 01, 2025