Bitcoin Price Update: 0.59% Gain, CME Gap And Institutional Pressure Test $118K-$120K

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Bitcoin Price Update: 0.59% Gain, CME Gap and Institutional Pressure Test $118K-$120K

Bitcoin (BTC) experienced a modest 0.59% price increase in the past 24 hours, currently trading at approximately $[Insert Current Price]*. This small gain follows weeks of fluctuating prices, leaving many investors wondering about the future trajectory of the leading cryptocurrency. While the increase might seem insignificant, several factors point to a potential significant shift in the market, particularly the looming CME gap and the ongoing test of institutional buying pressure around the $118,000 - $120,000 mark.

CME Gap: A Potential Catalyst for Price Movement?

The Chicago Mercantile Exchange (CME) gap, a persistent feature in Bitcoin's price chart, remains a significant point of discussion among analysts. This gap, representing a period where the price of Bitcoin on the CME futures market deviated significantly from the spot market, often acts as a magnet for price action. Historically, these gaps tend to be filled, meaning Bitcoin's price often retraces to cover the price discrepancy. The current gap sits around $[Insert CME Gap Price Range], and its potential filling could trigger a noticeable price surge or drop, depending on market sentiment.

Institutional Investors Eyeing $120,000:

The recent price action has seen Bitcoin repeatedly test the $118,000 to $120,000 resistance level. This level is seen by many as a crucial psychological barrier and a key test for institutional investor confidence. A decisive break above this resistance could signal a renewed bull market, potentially leading to a significant price rally. Conversely, a failure to break through could result in a period of consolidation or even a price correction.

Factors Influencing Bitcoin's Price:

Several factors contribute to Bitcoin's current price fluctuations. These include:

- Macroeconomic Conditions: Global economic uncertainty, inflation, and interest rate hikes continue to impact investor sentiment towards risk assets, including Bitcoin.

- Regulatory Landscape: Ongoing regulatory developments worldwide, particularly concerning cryptocurrency trading and taxation, significantly influence market confidence.

- Technological Advancements: Developments in the Bitcoin network, such as the Lightning Network's scaling solutions, impact Bitcoin's usability and long-term potential.

- Adoption Rates: Increased adoption by businesses and institutional investors plays a crucial role in driving Bitcoin's price upwards.

What's Next for Bitcoin?

Predicting Bitcoin's price is notoriously difficult. However, considering the CME gap, the resistance level around $120,000, and the various macroeconomic factors, the short-term outlook remains uncertain. While a further price increase is possible, a period of consolidation or even a minor correction could also occur. Investors should carefully consider their risk tolerance and diversify their portfolios accordingly. Staying informed about market developments and consulting financial advisors is essential for navigating the complexities of the cryptocurrency market.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. Investing in cryptocurrencies involves significant risk, and you could lose some or all of your investment.

Please replace "[Insert Current Price]" and "[Insert CME Gap Price Range]" with the actual current price of Bitcoin and the relevant CME gap price range at the time of publishing.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Bitcoin Price Update: 0.59% Gain, CME Gap And Institutional Pressure Test $118K-$120K. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

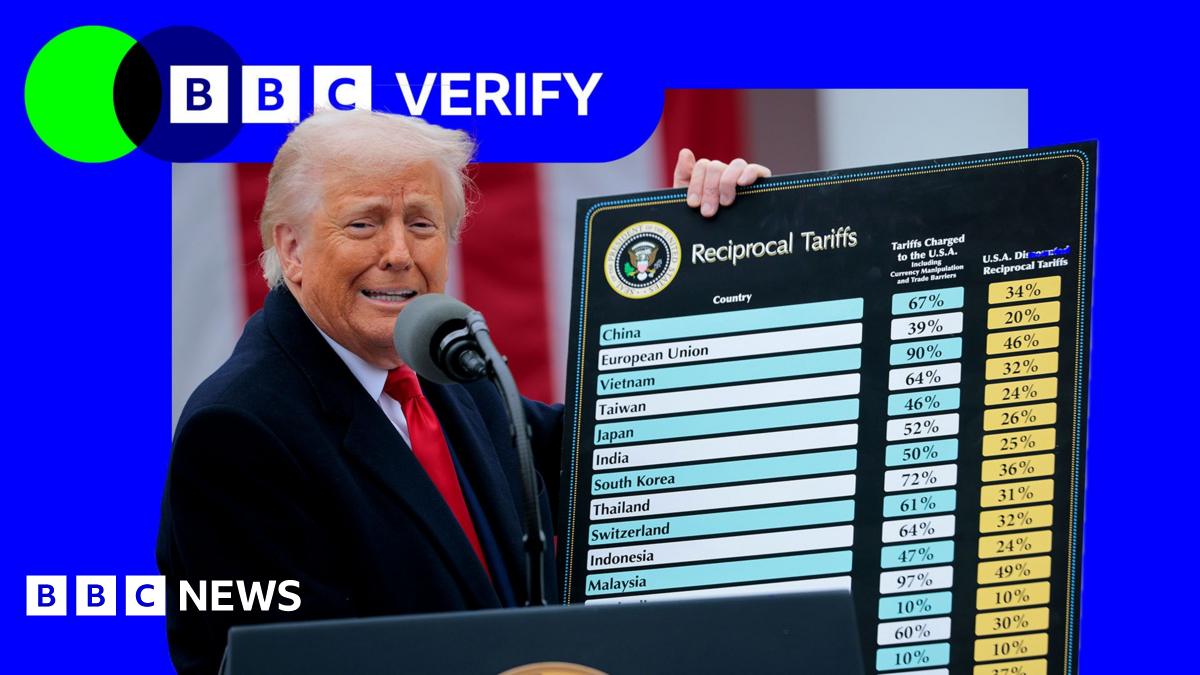

Trump Tariffs And The American Economy Winners And Losers

Aug 01, 2025

Trump Tariffs And The American Economy Winners And Losers

Aug 01, 2025 -

Trump Administration Freezes 108 Million In Duke Health Funding Over Alleged Systemic Racism

Aug 01, 2025

Trump Administration Freezes 108 Million In Duke Health Funding Over Alleged Systemic Racism

Aug 01, 2025 -

Canada U S Border Crossing Project Progress On New Bridge Hampered By Delays

Aug 01, 2025

Canada U S Border Crossing Project Progress On New Bridge Hampered By Delays

Aug 01, 2025 -

Brazilian Government Actions Potential Threats To Us National Interests

Aug 01, 2025

Brazilian Government Actions Potential Threats To Us National Interests

Aug 01, 2025 -

After Public Disputes Dr Vinay Prasad Leaves His Post At The Fda

Aug 01, 2025

After Public Disputes Dr Vinay Prasad Leaves His Post At The Fda

Aug 01, 2025

Latest Posts

-

Community Grieves Remembering The Service Of Officer Didarul Islam

Aug 02, 2025

Community Grieves Remembering The Service Of Officer Didarul Islam

Aug 02, 2025 -

Illegal House Shares A Breeding Ground For Rats Mold And Overcrowding

Aug 02, 2025

Illegal House Shares A Breeding Ground For Rats Mold And Overcrowding

Aug 02, 2025 -

2028 Election Looms Pentagon Schedules Crucial Golden Dome Missile Defense Test

Aug 02, 2025

2028 Election Looms Pentagon Schedules Crucial Golden Dome Missile Defense Test

Aug 02, 2025 -

Zelenskys Law Reversal A Victory For Young Ukrainians

Aug 02, 2025

Zelenskys Law Reversal A Victory For Young Ukrainians

Aug 02, 2025 -

Michael Madsen Defends Tarantinos Firing Of Lawrence Tierney

Aug 02, 2025

Michael Madsen Defends Tarantinos Firing Of Lawrence Tierney

Aug 02, 2025