Boeing Stock Outperforms Market In 2025: Long-Term Investment Analysis

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Boeing Stock Outperforms Market in 2025: A Long-Term Investment Analysis

Introduction:

The aviation industry is notoriously cyclical, but Boeing (BA) stock defied expectations in 2025, significantly outperforming the broader market. This surprising surge offers valuable insights into the potential for long-term investments in aerospace giants and prompts a closer look at the factors contributing to Boeing's success. This in-depth analysis explores the key drivers behind Boeing's stock performance and assesses its prospects for continued growth.

Boeing's 2025 Triumph: A Deep Dive into Performance Drivers:

Several interconnected factors contributed to Boeing's impressive performance in 2025. These include:

-

Strong 737 MAX Recovery: The grounding and subsequent recertification of the 737 MAX, a significant hurdle in previous years, finally reached a turning point. Increased deliveries and renewed customer confidence played a crucial role in boosting revenue and investor sentiment. This recovery solidified Boeing's position in the crucial narrow-body aircraft market.

-

Increased Demand for Commercial Aircraft: Global air travel witnessed a robust recovery in 2025, exceeding pre-pandemic levels. This surge in demand fueled a significant increase in orders for both Boeing's narrow-body and wide-body aircraft, providing a solid foundation for future growth. Airlines, eager to expand their fleets, drove up Boeing's order backlog, creating a positive outlook for years to come.

-

Defense Sector Strength: Boeing's defense, space, and security segment also contributed significantly to its overall success. Government contracts for military aircraft, satellites, and other defense systems provided stable revenue streams and reduced reliance on the often volatile commercial aviation market. This diversification proved crucial for mitigating risk and bolstering investor confidence.

-

Improved Operational Efficiency: Internal restructuring and a focus on streamlining operations resulted in significant cost savings. This improved efficiency directly translated into higher profit margins and stronger financial performance, ultimately attracting investors seeking robust returns.

-

Technological Advancements: Boeing's continuous investment in research and development (R&D) yielded innovative technologies and more fuel-efficient aircraft designs. These advancements not only improved the competitiveness of its products but also appealed to environmentally conscious airlines.

Long-Term Investment Prospects: Is Boeing a Buy?

While Boeing's 2025 performance is impressive, potential investors should consider both the upside and downside risks before making any investment decisions.

Potential Upside:

- Continued Growth in Air Travel: The long-term outlook for air travel remains positive, suggesting continued demand for new aircraft.

- Innovation in Aerospace Technology: Boeing's commitment to R&D positions it for future market leadership.

- Diversified Revenue Streams: The combination of commercial and defense contracts reduces overall risk.

Potential Downside:

- Geopolitical Uncertainty: Global events can significantly impact air travel and defense spending.

- Supply Chain Disruptions: Supply chain issues remain a potential threat to production and delivery schedules.

- Competition: Intense competition from Airbus remains a factor to consider.

Conclusion:

Boeing's strong performance in 2025 highlights the potential for long-term growth in the aerospace industry. However, investors should conduct thorough due diligence and carefully assess the potential risks before making investment decisions. Considering the factors discussed above, Boeing’s stock, while exhibiting promising signs, should be approached with a balanced perspective, considering the inherent volatility of the sector. Further research into market trends and competitor analysis is recommended before any investment commitments are made.

Disclaimer: This article provides general information and does not constitute financial advice. Conduct thorough research and consult a qualified financial advisor before making any investment decisions.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Boeing Stock Outperforms Market In 2025: Long-Term Investment Analysis. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Breaking Mystery Witness Testimony In Karen Read Murder Trial

Jun 03, 2025

Breaking Mystery Witness Testimony In Karen Read Murder Trial

Jun 03, 2025 -

Protests And Political Pressure A Transgender Athletes California Finals Journey

Jun 03, 2025

Protests And Political Pressure A Transgender Athletes California Finals Journey

Jun 03, 2025 -

New Photos Aaron Taylor Johnson And Jodie Comers Intense On Screen Dynamic

Jun 03, 2025

New Photos Aaron Taylor Johnson And Jodie Comers Intense On Screen Dynamic

Jun 03, 2025 -

Debunking The Mc Migraine Tik Tok Trend Does It Help With Headaches

Jun 03, 2025

Debunking The Mc Migraine Tik Tok Trend Does It Help With Headaches

Jun 03, 2025 -

Fever Address Point Guard Shortage With Emergency Addition

Jun 03, 2025

Fever Address Point Guard Shortage With Emergency Addition

Jun 03, 2025

Latest Posts

-

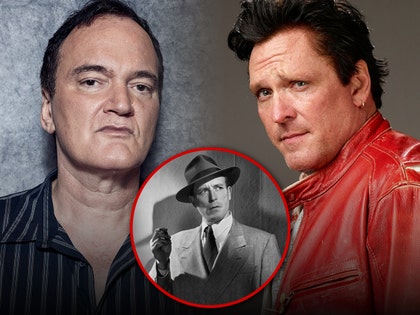

Actor Michael Madsen On Lawrence Tierneys Dismissal From Tarantino Film

Aug 02, 2025

Actor Michael Madsen On Lawrence Tierneys Dismissal From Tarantino Film

Aug 02, 2025 -

Michael Madsen Remembered Tarantino Speaks Out At Star Studded Funeral

Aug 02, 2025

Michael Madsen Remembered Tarantino Speaks Out At Star Studded Funeral

Aug 02, 2025 -

Cornwall Mums Death Could Older Driver Rule Changes Have Saved Her Life

Aug 02, 2025

Cornwall Mums Death Could Older Driver Rule Changes Have Saved Her Life

Aug 02, 2025 -

Ukraine Zelensky Concedes To Youth Demands Averts Crisis

Aug 02, 2025

Ukraine Zelensky Concedes To Youth Demands Averts Crisis

Aug 02, 2025 -

Golden Dome Missile Defense First Major Pentagon Test Planned Before 2028

Aug 02, 2025

Golden Dome Missile Defense First Major Pentagon Test Planned Before 2028

Aug 02, 2025