Boeing's 2025 Stock Performance: A Deeper Dive

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Boeing's 2025 Stock Performance: A Deeper Dive

Boeing (BA), a titan of the aerospace industry, has experienced a rollercoaster ride in recent years. From the 737 MAX crisis to the impact of the pandemic, the company's stock performance has been anything but predictable. But what does the future hold? This in-depth analysis explores potential factors influencing Boeing's stock performance in 2025 and beyond, offering insights for investors and aviation enthusiasts alike.

Navigating the Turbulence: Boeing's Recent Challenges

Before predicting future performance, understanding the past is crucial. Boeing's stock price has been significantly impacted by several key events:

-

The 737 MAX Grounding: The grounding of the 737 MAX aircraft following two fatal crashes dealt a devastating blow to Boeing's reputation and finances. The subsequent production delays and regulatory hurdles significantly impacted the company's bottom line and investor confidence. Learn more about the 737 MAX crisis and its lasting effects [link to relevant news article or Boeing's official statement].

-

The COVID-19 Pandemic: The pandemic further exacerbated Boeing's challenges. Reduced air travel led to a significant drop in demand for new aircraft, impacting production and sales. The ripple effect throughout the supply chain also presented further obstacles.

-

Supply Chain Disruptions: Beyond the pandemic, broader global supply chain issues continue to pose significant challenges for Boeing's manufacturing and delivery timelines. Securing crucial components and managing logistics remains a critical factor influencing the company's operational efficiency.

Factors Shaping Boeing's 2025 Outlook

Predicting stock performance is inherently complex, but several key factors will likely influence Boeing's trajectory in 2025:

1. 737 MAX Recovery and Demand: The recovery of the 737 MAX program is paramount. Stronger demand for this crucial aircraft will be essential for boosting Boeing's revenue and profitability. The global resurgence of air travel will be a key driver here.

2. 787 Dreamliner Production and Deliveries: Addressing production issues and ensuring timely deliveries of the 787 Dreamliner will be vital. This program is another significant revenue stream for Boeing, and any hiccups can significantly impact its financial health.

3. Defense Contracts and Government Spending: Boeing's substantial defense business segment plays a crucial role in its overall financial stability. Securing lucrative government contracts and maintaining a strong presence in the defense sector will be critical for long-term growth.

4. Competition and Innovation: Competition from Airbus remains fierce. Boeing's ability to innovate and develop new technologies, such as sustainable aviation fuels and next-generation aircraft designs, will be crucial for maintaining its market share and attracting investors.

5. Global Economic Conditions: The global economic climate will undoubtedly play a significant role. Recessions or economic downturns can severely impact air travel demand and, consequently, Boeing's financial performance.

Investing in Boeing: A Calculated Risk?

Investing in Boeing's stock involves inherent risks. While the company is a major player in the aerospace industry, external factors and operational challenges can significantly impact its share price. Investors should carefully weigh the potential rewards against the risks before making any investment decisions. Consulting a financial advisor is always recommended before investing in the stock market.

Conclusion:

Boeing's 2025 stock performance will depend on a complex interplay of factors. Successful navigation of current challenges, strong demand for its aircraft, securing government contracts, and continued innovation will be crucial for the company's future success. While predicting the future is impossible, a careful assessment of these factors can help investors make informed decisions. Stay informed by following reputable financial news sources and Boeing's official announcements for the latest updates.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. Investing in the stock market involves inherent risks, and you should consult a financial advisor before making any investment decisions.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Boeing's 2025 Stock Performance: A Deeper Dive. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

The Art Of Sustainable Furniture A Look At Its 10 Year Growth Cycle And Premium Price

Jun 03, 2025

The Art Of Sustainable Furniture A Look At Its 10 Year Growth Cycle And Premium Price

Jun 03, 2025 -

Indiana Fever Announces Emergency Hardship Signing

Jun 03, 2025

Indiana Fever Announces Emergency Hardship Signing

Jun 03, 2025 -

Exploring The Link Between Faith And Relationships In The United Kingdom

Jun 03, 2025

Exploring The Link Between Faith And Relationships In The United Kingdom

Jun 03, 2025 -

Boeing Stock On The Rise Bank Of America Cites Trumps Trade Influence

Jun 03, 2025

Boeing Stock On The Rise Bank Of America Cites Trumps Trade Influence

Jun 03, 2025 -

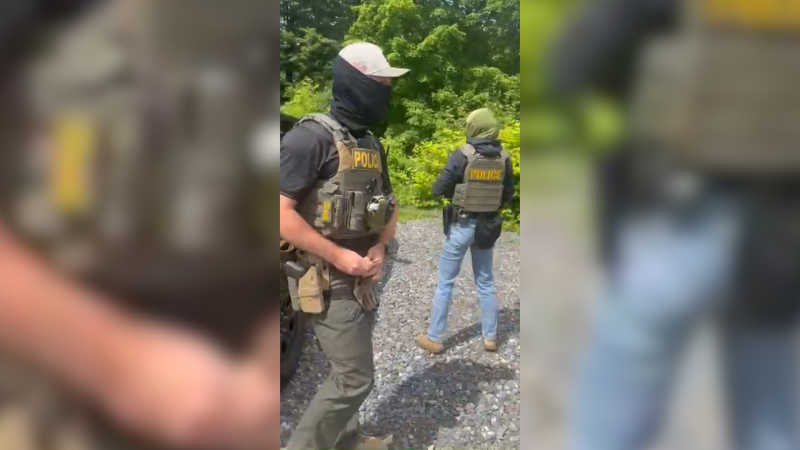

Gardener Detained By Unidentified Agents Business Owners Demand Answers

Jun 03, 2025

Gardener Detained By Unidentified Agents Business Owners Demand Answers

Jun 03, 2025

Latest Posts

-

September Start Date Announced For Trumps 200 Million White House Ballroom

Aug 03, 2025

September Start Date Announced For Trumps 200 Million White House Ballroom

Aug 03, 2025 -

Pattinson Out James Gunn Clarifies Dcu Batman Casting Speculation

Aug 03, 2025

Pattinson Out James Gunn Clarifies Dcu Batman Casting Speculation

Aug 03, 2025 -

Norris Fastest In Hungarian Gp Practice A Strong Start For Mc Laren

Aug 03, 2025

Norris Fastest In Hungarian Gp Practice A Strong Start For Mc Laren

Aug 03, 2025 -

White House Ballroom Renovation 200 Million Project Begins This September

Aug 03, 2025

White House Ballroom Renovation 200 Million Project Begins This September

Aug 03, 2025 -

X Qc Vs Kai Cenat Who Reigns Supreme In Streaming Net Worth

Aug 03, 2025

X Qc Vs Kai Cenat Who Reigns Supreme In Streaming Net Worth

Aug 03, 2025