Bold Bets Fuel Bitcoin ETF Growth: Over $5 Billion Invested

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Bold Bets Fuel Bitcoin ETF Growth: Over $5 Billion Invested – A New Era for Crypto?

The world of finance is buzzing. Over $5 billion has poured into Bitcoin exchange-traded funds (ETFs) since the SEC's approval of the first spot Bitcoin ETF, marking a watershed moment for cryptocurrency adoption and investment. This unprecedented influx of capital signals a significant shift in investor sentiment and opens a new chapter in the evolution of digital assets. But what's driving this surge, and what does it mean for the future of Bitcoin and the broader crypto market?

The SEC Approval: A Game Changer

The approval of the first spot Bitcoin ETF by the Securities and Exchange Commission (SEC) was the catalyst for this massive investment. For years, the regulatory uncertainty surrounding Bitcoin ETFs stifled institutional investment. The SEC's decision to finally greenlight these products broke down a major barrier, allowing institutional investors to access Bitcoin exposure through a familiar and regulated vehicle. This move legitimized Bitcoin in the eyes of many traditional investors, paving the way for wider adoption.

Why the $5 Billion Influx?

Several factors contribute to this record-breaking investment:

- Reduced Risk Perception: ETFs offer a degree of regulatory oversight and transparency, mitigating some of the risks associated with directly holding Bitcoin. This appeals to risk-averse institutional investors who previously hesitated to enter the crypto market.

- Institutional Adoption: The availability of ETFs has made it easier for large institutional investors, like pension funds and hedge funds, to allocate capital to Bitcoin without the complexities of managing private keys and navigating the intricacies of cryptocurrency exchanges.

- Diversification: Many investors see Bitcoin as a hedge against inflation and a potential diversifier within their portfolios. ETFs provide a convenient way to achieve this diversification strategy.

- Increased Accessibility: ETFs offer a simpler and more accessible entry point into the Bitcoin market for smaller investors who may not be comfortable with the technical aspects of direct cryptocurrency trading.

The Future of Bitcoin ETFs:

The success of the initial Bitcoin ETFs is likely to encourage the development and launch of more similar products. We can expect to see a wider range of Bitcoin ETFs catering to diverse investment strategies and risk tolerances. This increased competition could drive down fees and further increase accessibility for investors.

Potential Challenges and Considerations:

While the future looks bright, it's crucial to acknowledge potential challenges:

- Market Volatility: Bitcoin's price remains notoriously volatile. While ETFs provide a regulated framework, they are still subject to the inherent risks of the underlying asset.

- Regulatory Uncertainty: While the SEC's approval is a significant step, regulatory landscapes can shift. Future regulatory changes could impact the Bitcoin ETF market.

- Security Concerns: As with any investment, security is paramount. Investors should choose reputable ETF providers with robust security measures.

Conclusion:

The over $5 billion invested in Bitcoin ETFs signifies a monumental shift in the relationship between traditional finance and the cryptocurrency world. While challenges remain, the trend clearly indicates a growing acceptance and institutional adoption of Bitcoin. This surge in investment suggests a promising future for Bitcoin and underscores the increasing importance of digital assets in the global financial landscape. This is not just a story about Bitcoin; it's a story about the evolving landscape of investment and the growing mainstream acceptance of cryptocurrencies. Stay tuned for further developments in this exciting space.

Keywords: Bitcoin ETF, Bitcoin Exchange Traded Fund, SEC approval, Cryptocurrency Investment, Institutional Investment, Bitcoin Price, Crypto Market, Digital Assets, Investment Trends, Financial News, Crypto ETF, Spot Bitcoin ETF.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Bold Bets Fuel Bitcoin ETF Growth: Over $5 Billion Invested. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Ukraine Conflict Trump Pushes For Immediate Peace Talks With Russia

May 21, 2025

Ukraine Conflict Trump Pushes For Immediate Peace Talks With Russia

May 21, 2025 -

Brit William Goodge Shatters Australian Cross Country Running Record

May 21, 2025

Brit William Goodge Shatters Australian Cross Country Running Record

May 21, 2025 -

Olympic Gold Medalist Alleges Coachs Emotional And Physical Abuse

May 21, 2025

Olympic Gold Medalist Alleges Coachs Emotional And Physical Abuse

May 21, 2025 -

Luxury Gift Uzi League Of Legends Player Awarded Electric G Wagon By Mercedes Benz

May 21, 2025

Luxury Gift Uzi League Of Legends Player Awarded Electric G Wagon By Mercedes Benz

May 21, 2025 -

Australian Ultramarathon Conquered William Goodges Record Breaking Run

May 21, 2025

Australian Ultramarathon Conquered William Goodges Record Breaking Run

May 21, 2025

Latest Posts

-

Intolerable Suffering In Gaza Humanitarian Crisis Deepens Amidst Brexit Uncertainty

May 21, 2025

Intolerable Suffering In Gaza Humanitarian Crisis Deepens Amidst Brexit Uncertainty

May 21, 2025 -

Chris Mason On The Eu Deal A Sign Of Continued Tensions

May 21, 2025

Chris Mason On The Eu Deal A Sign Of Continued Tensions

May 21, 2025 -

William Goodges Epic Australian Run A New Benchmark

May 21, 2025

William Goodges Epic Australian Run A New Benchmark

May 21, 2025 -

Australian Ultramarathon William Goodge Sets New Record

May 21, 2025

Australian Ultramarathon William Goodge Sets New Record

May 21, 2025 -

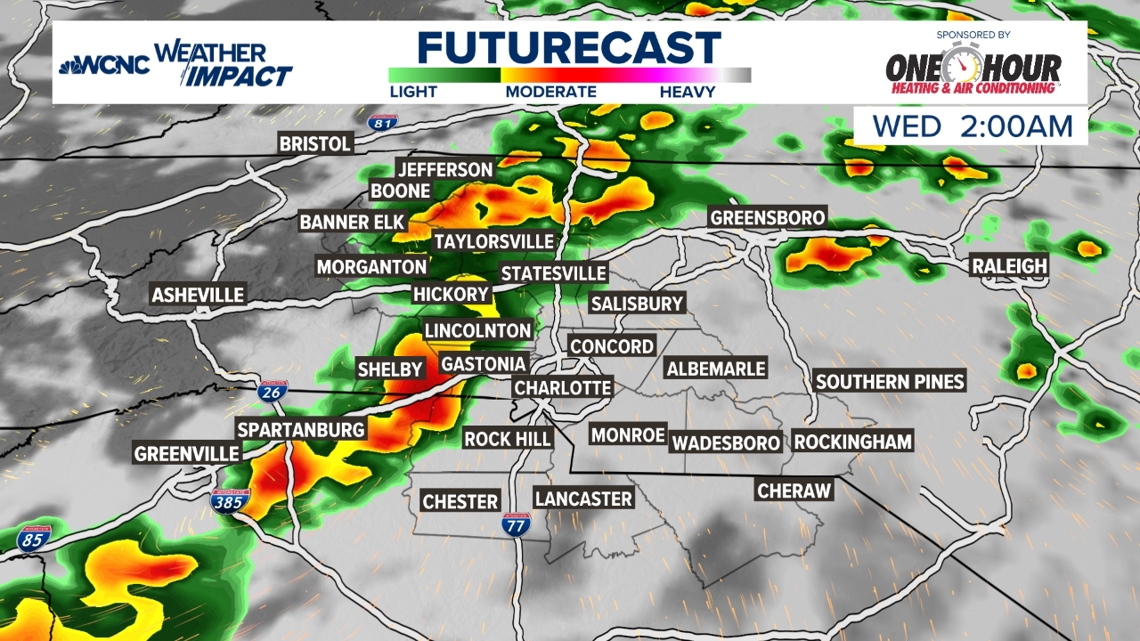

Isolated Severe Storms Possible Late Tuesday What To Expect

May 21, 2025

Isolated Severe Storms Possible Late Tuesday What To Expect

May 21, 2025